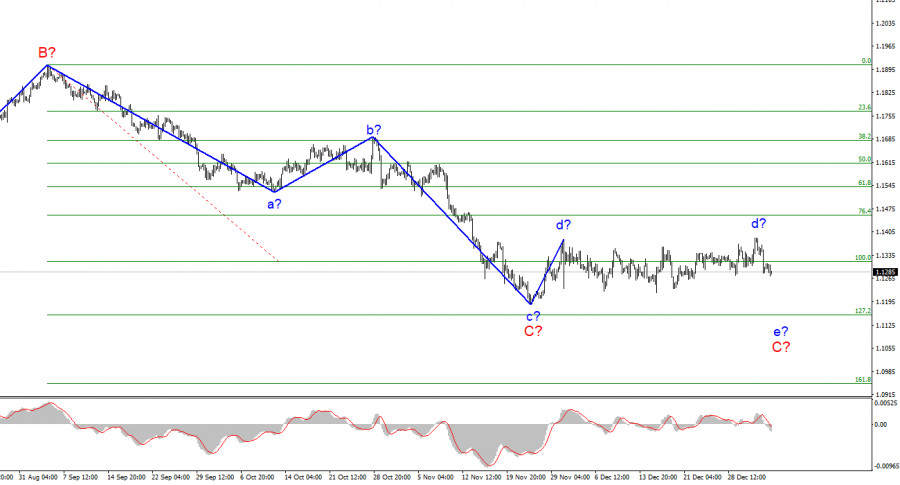

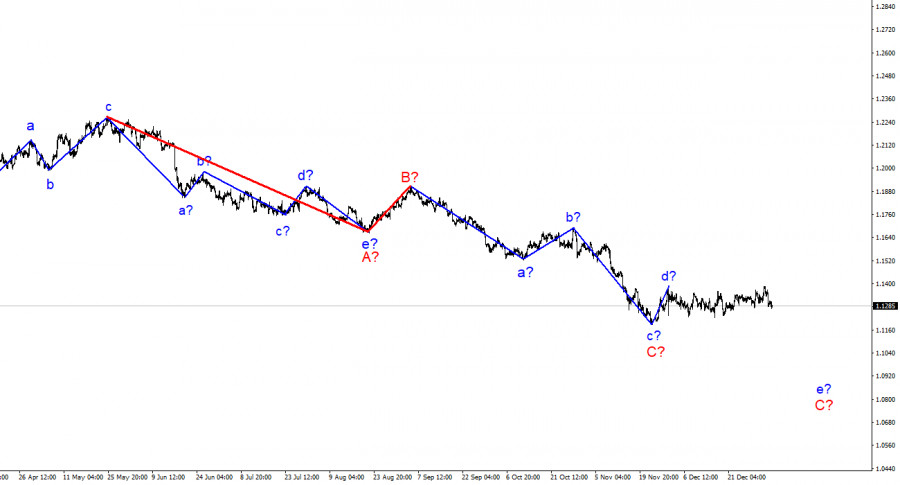

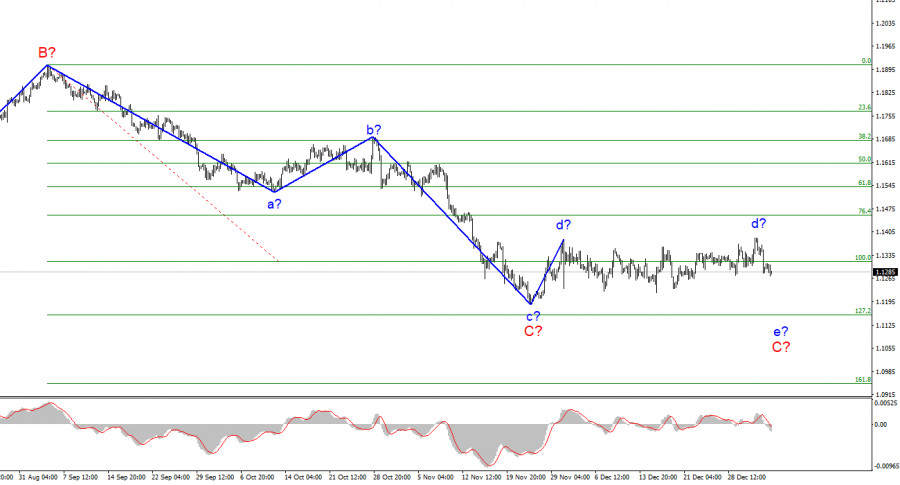

The wave marking of the 4-hour chart for the euro/dollar instrument has not changed for more than a month. The horizontal movement continues throughout this period and at the moment it is not even possible to say for sure whether the construction of the proposed wave d has been completed or not. On the one hand, on the last day of last year, the instrument broke the peak of November 30. Thus, the entire section of the trend, originating on November 24, should be considered one wave. On the other hand, this is the problem of all correctional structures: they can constantly change and take almost any length. Therefore, the wave of November 24 may be both wave d, after which the construction of wave e-C will begin, and the first wave of a new upward trend segment. I am inclined to think that the construction of the downward trend section will continue – we have been seeing too uncertain an increase in quotes in recent weeks. However, in this case, the proposed wave d may take on an even more extended and complex form.

The holidays are over, but the markets are still resting.

The euro/dollar instrument moved with an amplitude of about 20 basis points on Tuesday. If yesterday, after all, the instrument dropped by 100 basis points, today there were no movements as such. The news background of today also left much to be desired. In Germany, a report on the change in retail trade volume in November was released, which increased by 0.6% m/m and decreased by 2.9% y/y. The unemployment rate also came out, which fell to 5.2% in December. In addition, the number of unemployed decreased by 23 thousand. Thus, in general, all three reports turned out to be quite good. At the same time, the market was not too interested in German statistics. Over the past month, there have been news and reports much more important, which did not attract any market attention. Therefore, I believe that the wave marking now remains in the first place in importance in the analysis. Tomorrow evening in America, the minutes of the FOMC meeting in December will be released. It may contain important information, for example, how many members support a rate increase in the next six months. And what is the general mood of the Fed members? However, this information will in any case be available only in the evening. But there will be little news again during the day. And I strongly doubt that the report from ADP or the report on applications for unemployment benefits will be able to contribute to the completion of the horizontal movement, which has lasted for a month. Thus, the main hope is for the Nonfarm Payrolls report, which will be available this Friday. This crucial report can affect the instrument so that wave d can be considered complete. Option number 2 – at some point the market itself will complete the construction of a horizontal section of the trend without a strong news background. But this moment cannot be predicted in advance.

General conclusions.

Based on the analysis, I conclude that the construction of the descending wave C can be completed. However, the internal wave structure of this wave still allows the construction of another downward, internal wave. Thus, I advise selling the instrument with targets located around the 1.1152 mark, for each MACD signal "down", until there is a successful attempt to break the peak of wave d. A restrictive order can be placed above the peak of wave d.