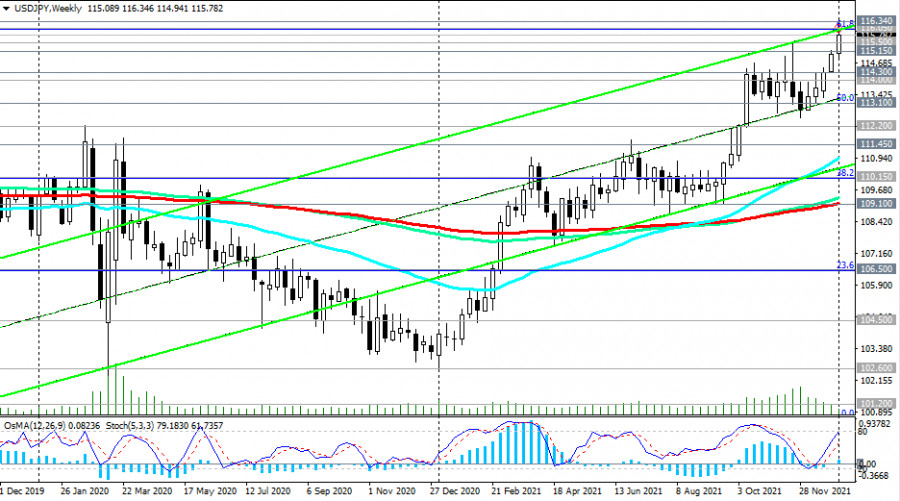

Even though the New Year holidays for some investors and market participants are probably still going on, the tension in the financial market is growing. Yesterday the tone in the market was set by the Japanese yen, which was actively weakening throughout the trading day. And the USD/JPY pair reached an intraday high of 116.34 at the beginning of yesterday's U.S. trading session, corresponding to the levels of January 2017.

Despite rising cases of coronavirus infection, investors seem to have decided to abstract from the risks associated with the coronavirus and sold the protective yen. The results of a survey of companies in the U.S. manufacturing sector, published on Monday, showed that the situation with disruptions in supply chains could begin to improve.

However, another report published on Tuesday by the Institute for Supply Management (ISM) showed that the growth rate of activity in the U.S. manufacturing sector declined to the lowest level in the last 11 months: the PMI index for the U.S. manufacturing sector in December was 58.7 versus 61.1 in November with a forecast of 60.0 points.

At the same time, the number of Americans quitting in November reached a new high, while the number of vacancies remained near record levels. The November data on the number of open vacancies in the labor market from JOLTS, published Tuesday at 12:00 UTC, turned out to be significantly worse than economists' expectations and the previous indicator (10.562 million vacancies versus 11.091 million in October).

This data somewhat tempered investor optimism. Although the data published by the ISM and the U.S. Bureau of Labor Statistics remain strong, they turned out to be below forecasts, which forced market participants to stop selling protective assets. The yen began to strengthen again in the second half of yesterday's U.S. trading session, and gold quotes crept up, reaching the level of $1,814.00 per ounce by the end of yesterday's trading day. Also, the U.S. 10-year Treasury yields decreased from an intraday and 6-week high of 1.686% to 1.649%.

Investors again prefer the protective yen, gold and government bonds to the dollar. The dollar declined during the Asian session and remains under pressure at the beginning of today's European session.

At the time of this posting, DXY dollar futures are trading near 96.16, just below the midpoint of the range between local highs near 96.94 and local lows near 95.54 in late November.

Nevertheless, if we abstract a little from the emergence of the omicron strain, which in the last few weeks has led to an increase in the number of infections in Europe and the United States to record highs, forcing workers to leave offices, and customers to refrain from visiting stores and restrict movement, then economists are more optimistic about the prospects of the U.S. economy in comparison with other major economies of the world.

Very positive macro data continues to come from the USA. At the end of December, the U.S. Bureau of Economic Analysis published the final estimate of the country's GDP dynamics for the 3rd quarter of 2021. It reflected the growth of the national economy by 2.3%, which is 0.2% better than previous preliminary estimates.

At the same time, the recently published weekly reports of the U.S. Department of Labor with statistics on the number of unemployed indicate that the number of initial applications for unemployment benefits in the U.S. remains at the lowest level in several decades - about 200,000. U.S. consumer sentiment improved in December despite rising coronavirus infections and high inflation. Thus, the final consumer sentiment index in December was 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4.

Despite the currently observed correction, in general, the dollar retains positive dynamics and potential for further growth. The markets believe that the Fed will raise the interest rate at least three times in 2022. The Fed will be ahead of other major banks in the world in this process, and this will be the main driver of the strengthening of the dollar against its main competitors in the foreign exchange market.

Minneapolis Federal Reserve Bank President Neel Kashkari said Tuesday that inflation in the United States had exceeded forecasts and that the acceleration in price growth was longer than expected. Economists predict that the Fed will start raising rates this spring after the completion of the asset purchase program.

Therefore, looking at the DXY chart, DXY futures traders would likely place a buy stop just above the recent local high of 96.67 with a restrictive stop loss below the local low of 95.73. The nearest take-profit is 96.94, 97.00. The more distant DXY upside target is the 100.00 mark.

In an alternative scenario, the first signal to sell DXY futures would be a breakout of the important support level at 96.00, and a confirmatory signal would be a breakdown of the lower end of the range passing through the 95.54 mark.

Regarding today's economic calendar, market volatility, primarily in dollar quotes, will rise again at 10:15 UTC when the ADP report on private sector employment is released, which suggests an increase of 400,000 new workers in December (against an increase of 534,000 in November, 571,000 in October, 568,000 in September, 374,000 in August, 330,000 in July). Despite the relative decline in the indicator, this is strong data, indicating the continued recovery in the U.S. labor market after falling in spring 2020.

Although the ADP report does not have a direct correlation with the official report of the U.S. Department of Labor, it is considered a harbinger of it. According to the monthly report of the U.S. Department of Labor, expected on Friday, the average hourly wages rose by another +0.4% in December (after an increase in November by + 0.3%), the number of new jobs created outside the agricultural sector amounted to 400,000 (after rising 200,000 in November and 531,000 in October), while the unemployment rate fell to a new pandemic low of 4.1%.

These are still strong indicators, indicating a continuing improvement in the situation in the U.S. labor market after its landslide in the first half of 2020 (data on the labor market, along with data on inflation and GDP, are key for the Fed when deciding on monetary policy).

And so far, the Fed's leaders still have reasons to start a cycle of interest rate hikes this spring. We will probably find out more about their opinions on this issue today when the minutes from the December Fed meeting will be published at 16:00 UTC.

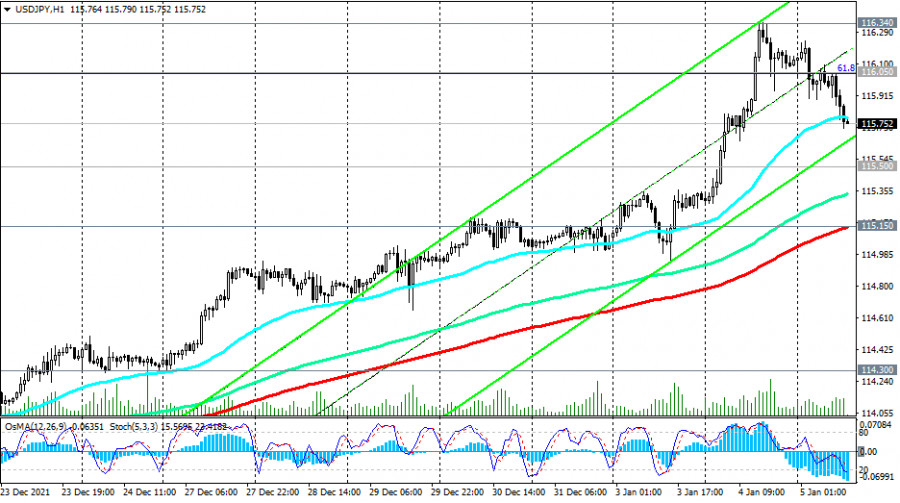

Going back to the dynamics of the yen and the USD/JPY pair: if growth resumes, then we would put a stop order to buy just above the local maximum of 116.10 with a restrictive stop just below the local support level of 115.50 (November highs).

In an alternative scenario, the first sell signal will be a breakdown of the local support level of 115.50, and the confirmation will be an important short-term support level of 115.15 (200 EMA on the 1-hour chart).

Support levels: 115.50, 115.15, 114.30, 114.00, 113.10, 112.20, 111.45, 110.15, 109.10, 109.25, 109.12, 108.86, 108.55, 108.00, 107.00, 106.75, 106.50, 106.00

Resistance levels: 116.05, 116.24, 116.34, 117.00

Trading scenarios

Buy Stop 116.15. Stop Loss 115.40. Take-Profit 116.24, 116.34, 117.00, 118.00, 120.00

Sell Stop 115.40. Stop Loss 116.15. Take-Profit 115.15, 114.30, 114.00, 113.10, 112.20, 111.45, 110.15, 109.10