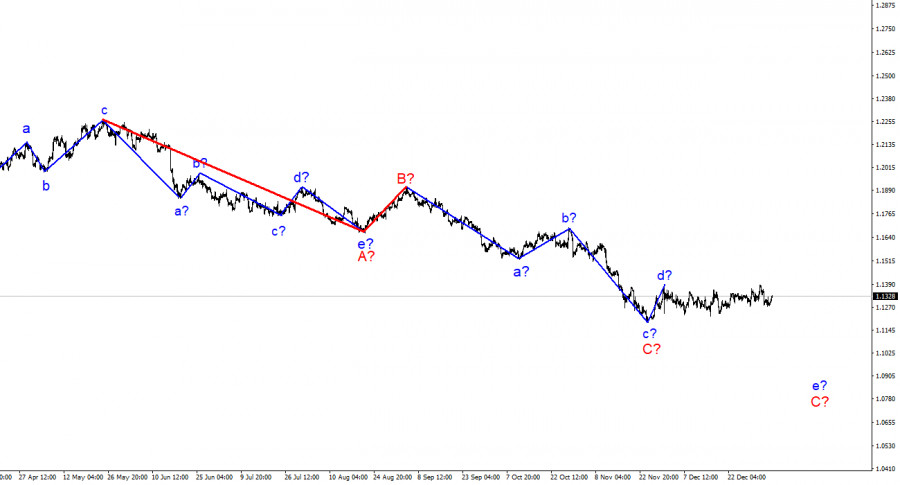

The wave pattern of the 4-hourly chart for the EUR/USD pair has not changed for over a month. During this period of time, the horizontal movement continues. At the moment, it is impossible to say whether the supposed d wave is completed or not. On the one hand, on the last day of the previous year, the instrument broke its high of November 30. Thus, the whole trend segment starting on November 24 should be considered as one wave. On the other hand, this is the problem of all corrective structures. They can constantly change and take almost any length. Therefore, the wave of November 24 may be wave d after which the building of wave e in C and the first wave of a new uptrend section starts. I assume that the downward trend will continue as too much uncertainty in rising the quotes is observed in the recent weeks. However, in this case the anticipated wave d may become even more extended and complicated.

US business activity declines slightly in December

The EUR/USD pair moved with an amplitude of about 25 basis points on Wednesday. During the day, the European currency managed to rise by 50 basis points. However, this movement is irrelevant as a horizontal wave is still forming for the instrument. News background also remains quite weak. Last night, the index of business activity ISM in the sphere of US manufacturing was released. The significant index showed the decline by 2.4 points. However, the value of 58.7 is still quite high, so the US dollar only experienced pressure for a short period of time. Today, on Wednesday, Germany released its services business activity report with a value of 48.7. The composite PMI was 49.9 points. These values are already negative. However, the demand for the euro has increased since the morning. So, I believe that the news background was weak today. The business activity in the eurozone service sector is also weak. It fell in December to 53.1 points and the composite PMI declined to 53.3 points. These are still positive values, however they are close to entering negative territory. The separator is the level of 50.0.The ADP report on the change in the number of the employed in the USA was insignificant for the market. In December the number of employed people grew by 807,000 against expectations of 405,000. Thus, the demand for the US currency should have increased, but it failed. Therefore, I conclude that the whole statistics is irrelevant. Consequently, there is no reason to expect the completion of the construction of the horizontal wave yet. Besides, the US dollar may be under little pressure due to the growing number of coronavirus cases. A million new cases were reported on Tuesday. It is pessimistic news for dollar buyers. However, it is also not enough now to complete the horizontal movement of the instrument.

Conclusions

Based on the analysis, I conclude that the construction of the descending wave C may be completed. However, the internal wave structure of this wave still allows for the construction of one more downward internal wave. Thus, I advise selling the instrument with targets near the level of 1.1152 on each MACD downward signal, until a successful attempt to break the peak of wave d occurs. A limit order can be placed above the peak of wave d.