The views of central banks are changing – the preferences of investors are changing. If earlier, FOMC members were divided into those who want to raise rates and those who believe that they need to be kept at the same level, now the picture is different.

There are two groups within the Fed: the first expects monetary policy tightening, the second expects that this process will proceed quickly. Such a "hawkish" shift could not but affect the positions of the U.S. dollar, which finished 2021 as the best performer among the G10 currencies and intends to continue what it started in 2022.

The minutes of the December FOMC meeting, which returned investors' interest in the U.S. dollar and brought down U.S. stock indexes, showed that the Fed is confident in the strength of the U.S. economy. It believes that high inflation and the rapid return of the labor market to full employment may require an increase in the federal funds rate sooner or faster than participants expected.

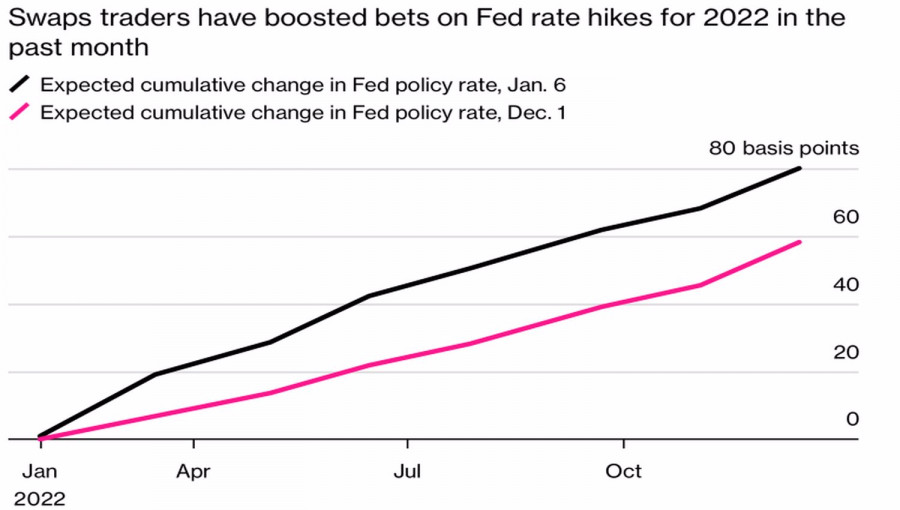

Some argue that the $8.8 trillion reduction in the balance sheet could begin immediately after the first act of monetary restriction. This has become the new trump card of the U.S. dollar, and the futures market has increased the chances of tightening monetary policy in March and three rate hikes in 2022.

Dynamics of the futures market expectations at the Fed rate

Even if inflation in the United States soon reaches a peak and begins to slow down, the Fed seems confident that consumer prices will remain at elevated levels for longer than initially expected. And this circumstance dictates the fashion for monetary restriction.

Unlike the Fed, the ECB is dominated by completely different sentiments. It seems to have frozen in the past and is a copy of yesterday's Fed. That is, within the Governing Council there are "hawks" who want to raise rates, and "doves" who do not want it. Looking at the acceleration of inflation, the immutability of the ECB's views is surprising, but its inaction has its own logic.

ECB President Christine Lagarde and her colleagues believe that the risks of political consequences from monetary restriction may outweigh the risks of economic consequences from inaction. Due to the enormous incentives, the ratio of public debt to GDP in France jumped to 118%, in Spain to 120%, in Portugal to 135%, in Italy to 155%, and in Greece to 206%. Rising European bond yields will increase the cost of debt servicing and will be a serious blow to governments.

If the current views of the Fed and the ECB persist, EURUSD may well continue to decline in the direction of 1.1. What can break the downtrend? It is unlikely that the ECB will change its outlook. Especially given the gradual slowdown in inflation in the eurozone. Washington is another matter. Omicron, a decline in GDP growth or consumer prices, may make the Fed less aggressive.

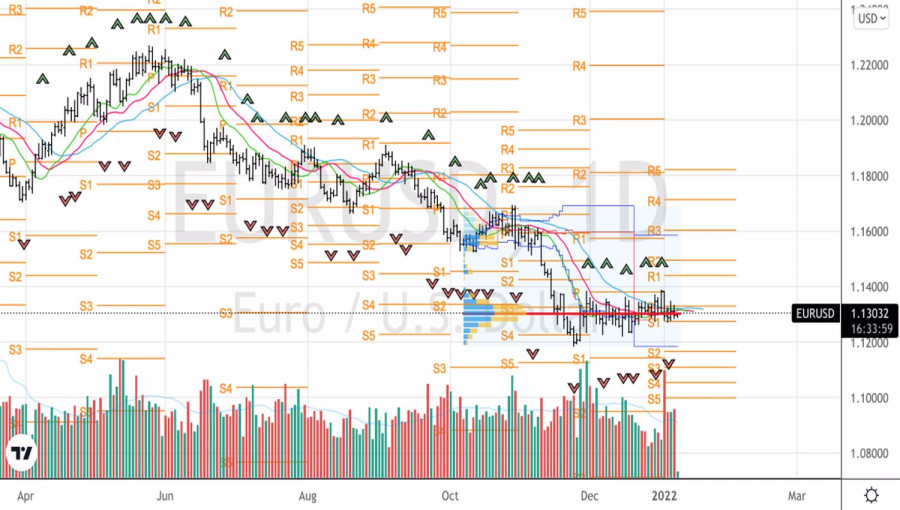

Technically, without EURUSD breaking out of the 1.123–1.138 trading range, it is not possible to talk about a recovery in the bearish trend or a pullback that could lead to its breakdown. A break of the support at 1.123 will create preconditions for selling the euro against the U.S. dollar in the direction of 1.113 and 1.100.

EURUSD, Daily chart