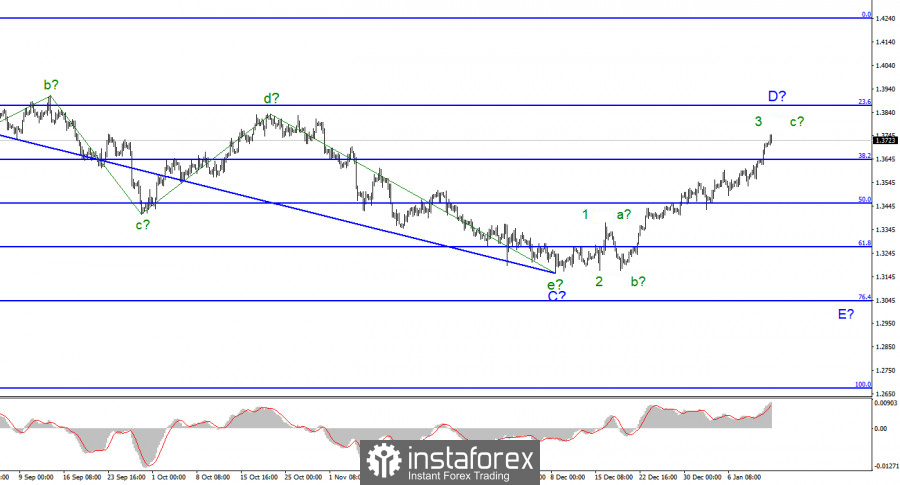

For the pound/dollar instrument, the wave markup continues to look quite convincing and is becoming more and more structured. In the last few weeks, the instrument has continued to build an upward wave, which is currently interpreted as wave D of the downward trend segment. If the current wave marking is correct, then the decline in quotes will resume after the completion of this wave, which may happen in the near future. Thus, the entire downward section of the trend can take on an even more extended form. However, if wave D takes a five-wave form, then it will need to be recognized as an impulse, and in this case, it will no longer be able to be a corrective wave D, and the entire wave pattern will require additions. At the moment, only three waves are visible inside it, which can be a-b-c series. However, a successful attempt to break through the 1.3644 mark, which corresponds to 38.2% Fibonacci, indicates the readiness of the markets for further purchases of the British.

Let's move away from politics. The Fed has a delicate job to do with PEPP.

The exchange rate of the pound/dollar instrument increased by another 35 basis points during January 13. The news background in the UK and the US was practically absent today, however, the market continued to increase demand for the British. The pound sterling has continued to rise for several weeks, which so far fully fits into the current wave markup. But at the same time, it is growing at a time when no news or news should support demand for the dollar, not for it. Meanwhile, in the United States, several Fed members gave interviews in which they spoke about the future of monetary policy. Most of them also noted, like Powell, the highest inflation and reported that they expect the end of the stimulus program in March. Also, most of the interview participants noted that they are waiting for three rate increases. However, there were also those (James Bullard and Rafael Bostic) who announced four rate increases this year. I would like to note that any rate increase is a measure that slows down economic growth. Because investors are starting to transfer their capital into less risky assets, inflation is decreasing. At the same time, the Fed still faces the task of stimulating economic growth and restoring the labor market. And if the interest rate rises, the economy will cool down and the labor market will recover more slowly. In the last two months, it has shown a much weaker growth rate than expected. However, according to Jerome Powell, the labor market and the economy are in good condition, which means you can focus on inflation. Therefore, I believe that the choice has already been made in favor of reducing inflation, which has accelerated to 7%, and now it will take a lot of effort to reduce it to the target 2%. If this assumption is correct, then the US currency will be under market pressure throughout 2022, because the tightening of the PEPP does not contribute to economic growth.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the completion of the construction of the proposed wave D in the near future. Since this wave has not yet taken a five-wave form, I expect that a new descending wave E will be built. And it should begin in the very near future. However, a successful attempt to break through the 1.3644 mark does not make it possible to sell the pound right now. I advise you to wait for signals that will announce the beginning of the construction of a new downward wave.