Bitcoin and the cryptocurrency market are living through one of the most pessimistic months in history. The major cryptocurrencies have hit new swing lows, the UST Stablecoin has crashed, and Bitcoin's eight red weekly candlesticks took place exactly in May. The major crypto-asset is stabilizing near $29,000-$30,000. However, there is every reason to believe that June 2022 will be no less painful month for the crypto market.

The main reason for the likely decline and increase in volatility is the start of the quantitative easing program. According to the Fed's reports, the balance sheet reduction will start on June 1. However, there are several alarming signals which can provoke a negative market reaction even without any objective negative consequences. So, let's start with the announced plans, according to which the Fed will reduce the balance sheet of Treasuries and mortgage-backed securities by at least $100 billion every month.

This is a significant amount, which will affect the liquidity of the stock and cryptocurrency markets. However, the main problem is that investors do not know what to expect from the Fed's new policy. The head of the regulator said that the Fed did not know how the economy may react to the balance sheet reduction. There is some speculation, such as that a balance sheet reduction equals a 25 basis point increase in the key rate. However, investors and officials do not have enough information to predict the state of the economy, especially after the first and most shocking phase of the reduction.

With this in mind, there is every reason to believe that negative and impulsive decisions will occur in the markets, including the cryptocurrency market. It is likely that we should expect manipulation as in the situation with Terra and the UST Stablecoin. That said, Fed officials say that portfolio reduction is a quick, albeit painful, transition to stable monetary policy regulation. This is a positive signal from Fed members, but it is important to understand that digital assets will face a difficult period and another phase of decline before that happens.

This is primarily due to Bitcoin's increased correlation with stock indices. During the period of significant portfolio bloat of the Fed in 2020-2021, the largest share of investments was directed precisely to the stock market. As a result, the capitalization of the industry surpassed US GDP by 200%, a colossal result, indicating large investments in high-risk assets. The capital flight began a month ago in preparation for a tightening of monetary policy. Correlation-wise, Bitcoin and the crypto market have also reached capitalization lows estimated at nearly $1.2 trillion.

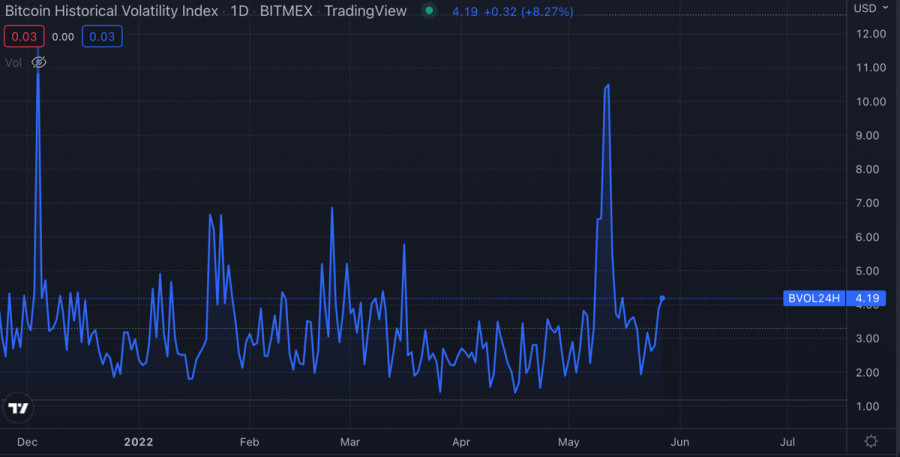

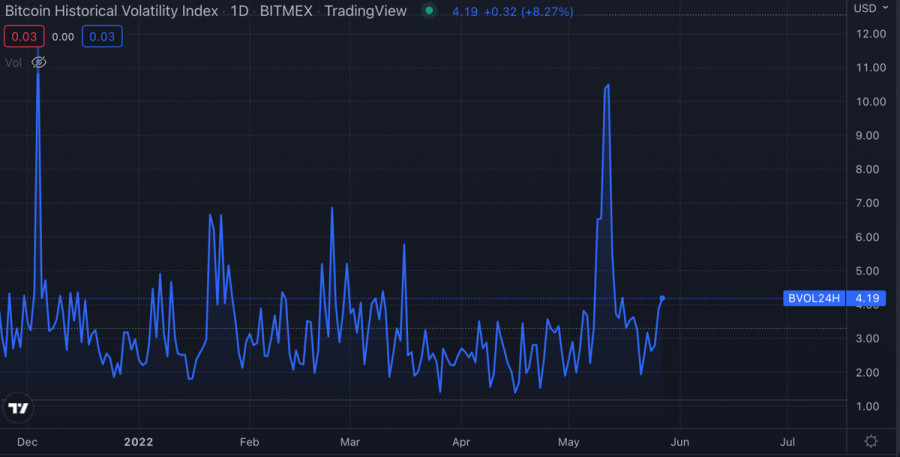

The crypto market and Bitcoin are approaching a defining juncture where the paths of the stock market and cryptocurrency market should diverge. JPMorgan predicts that the SPX index could fall to $3,400, and it may come with a new reality for the index. This is most likely where institutional investors should step in and break the BTC-SPX correlation. Regardless, the unknown suggests an escalation of the situation and a likely increase in volatility amid impulsive decisions to protect capital.

Bitcoin is approaching the final stage of consolidation. BTC is trading within a narrowing range of $29,000-$30,000. Dodge candles are beginning to form on the daily time frame, indicating the probability of a move in either direction.

Judging by the 4-hour time frame, where the squeeze looks clearer, we can assume that the price will break the trading channel to the downside. Technical indicators are beginning to decline, showing increased sellers' pressure and weakening of buyers' positions. However, it will be possible to state the beginning of the downward movement and the breakout of $29,000-$30,000 after the price reaches below $28,000.

Otherwise, the price has all chances to return back due to big volumes of purchases in the area of $28,000-$29,000, and also the active opening of positions by investors. Taking into account the correlation with the growing stock indices, the price may increase to $33,000-$35,000.