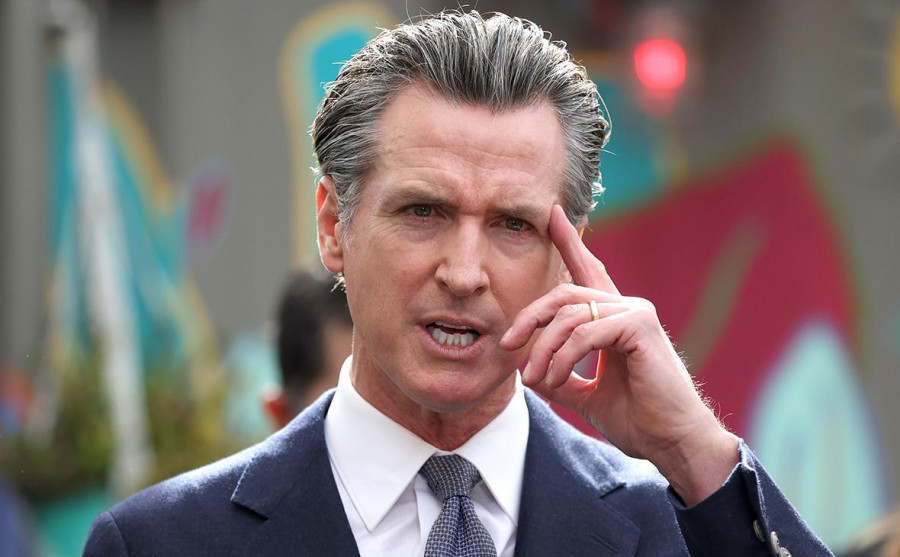

In the United States, an active fight against cryptocurrencies continues on the part of those who are not their supporters. Recently, it became known that the Governor of California, Gavin Newsom, vetoed a bill to regulate cryptocurrencies in his state. He stressed that a more flexible approach is needed to keep up with the rapidly developing technologies in the crypto sector.

The governor is not against the development of the crypto industry, but, like all politicians, he needs to know and understand how this will affect his staff and what it will lead to. He made several statements about this during Friday's speech.

Assembly Bill 2269, entitled "Digital Financial Assets: Regulation," was introduced earlier this year by California Assemblyman Timothy Grayson. It was then passed by the California State Senate on August 29 and the California State Assembly.

The state government believes that digital assets are becoming more and more popular in the financial system, and every year, more consumers buy and sell cryptocurrencies. "That is why it is so important to properly treat the bill, AB 2269, which will establish a licensing and regulatory framework for digital financial assets," Newsom said.

He also recalled the initiative he proposed on May 4 to create a transparent business environment for companies working with blockchain, including crypto assets and related financial technologies. In his opinion, the development of this decree harmonizes federal and California laws, balances benefits and risks for consumers, and includes California values such as fairness, inclusivity, and environmental protection. However, Gavin Newsom explained that since the decree was issued, his administration has conducted extensive research and explanatory work and has come to the conclusion that it is premature to consolidate the licensing structure at the legislative level without a deeper study of this issue.

Some defenders of the industry also opposed this bill. The Blockchain Association, for example, stated that the bill creates short-sighted and useless restrictions that hinder the work of innovators in the field of cryptocurrencies. The organization noted that the provisions of the licensing bill are intended to establish the same burdensome licensing and reporting regime that stopped the growth of the crypto industry and restricted access to safe and reliable crypto products and services in New York. A more flexible approach is needed so that regulatory oversight can keep pace with rapidly evolving technologies and use appropriate accounting tools.

As for today's technical picture of bitcoin, then, as I noted above, nothing much has changed after the weekend. The focus is now on the near resistance of $19,000, the return of which is "like air" needed in the near future. In the case of a breakout from this area, you can see a dash up to $19,520 and then to $20,000. To build a larger upward trend, you must break above the resistance levels of $20,540 and $21,140. If the pressure on bitcoin returns, and most likely it will, the bulls should make every effort to protect the support of $18,600, which has been tested recently. Its breakdown will quickly push the trading instrument back to $18,100 and pave the way for an update of the $17,580 level.

Ether remains above $1,270 after the recent collapse immediately after switching to PoS. The most important task of buyers in the current conditions is to return to control of the resistance at $ 1,350, which will be quite difficult to get above. Its breakdown will stabilize the market's direction and a small correction in the $ 1,440. The more distant targets will be the $1,504 and $1,550 areas. While maintaining pressure on the trading instrument and breaking through the rather important support of $1,270, this will push the ether to $1,210 and $1,150, where major players will once again manifest themselves in the market.