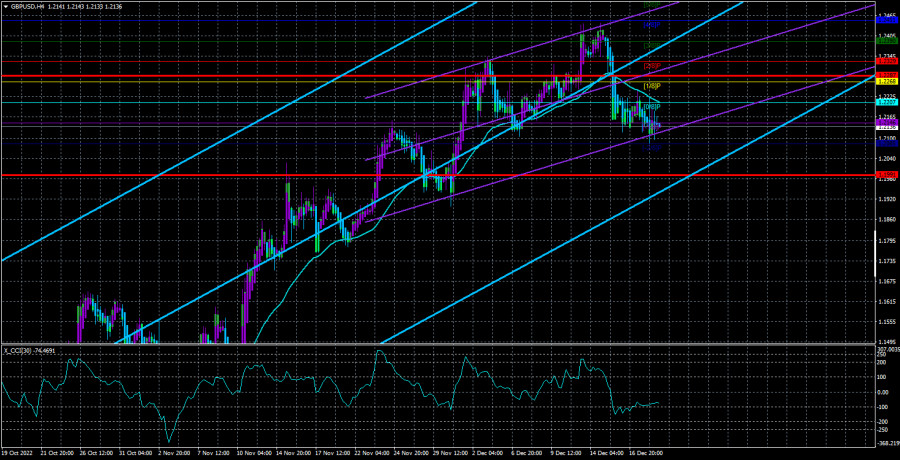

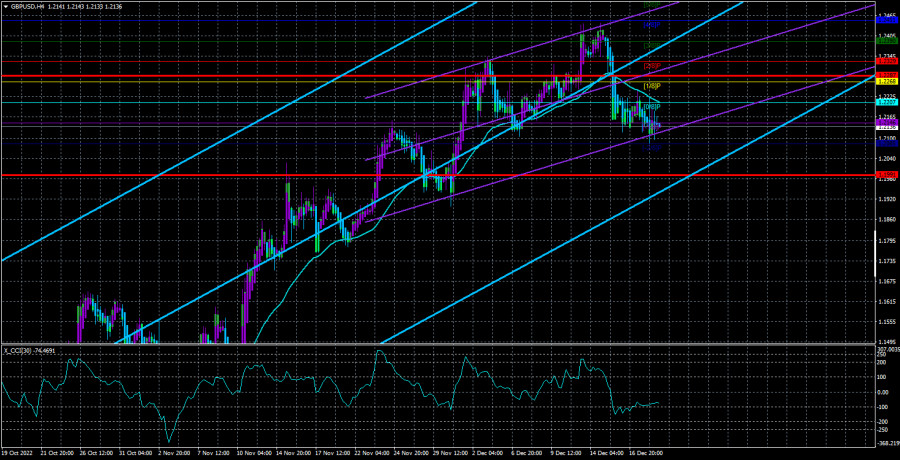

In contrast to the EUR/USD currency pair, the GBP/USD pair exhibits at least some signs of movement. In theory, the fall continues after the price has fixed below the moving average line. We can therefore conclude how a scenario with a downward correction would be implemented. To put it mildly, the fall is not significant, the pair's volatility has recently decreased, and there are many uncertainties regarding the pair's potential future trend movement. The trend movement, if there is one, is very weak on the lower TF, as is quite obvious. The pair is currently traveling south, which is good. However, you should keep in mind that a flat or "swing" has a high likelihood of occurring in the final days of the previous year. Not to mention the possibility that the market will unexpectedly recall purchasing British currency. After all, as the past month has demonstrated, they do not at all require a sound fundamental or macroeconomic background. A pound may be purchased at any time. As a result, we are placing our money on the possibility of a downward correction. But action should be taken as soon as a flat is detected.

The pair has now dropped to the critical line on the 24-hour TF, which is significant because it has grown closer to the price than it has fallen to the line. However, a rebound is possible either way. In actuality, the price must be fixed below the moving average line to constitute a sell signal. It is evident from the illustration above that there have been plenty of these fixations recently, but almost none of them have resulted in a significant movement to the South. It should be understood that the moving is frequently found close to the price; therefore, for the price to remain above it, it must constantly increase, which is essentially impossible. Fixing below the moving average line is, therefore, undoubtedly a strong signal, but confirmation is necessary if traders anticipate a movement of more than 100 points.

How should we interpret the UK GDP report?

Tomorrow in the UK, the final report on the third quarter's GDP will be released. Even though a lot of high-ranking officials have already said that the British economy has entered a recession and that it could last a while, things aren't too bad right now. A 0.2% decline is not a particularly significant decline, even though the third quarter may only be the first of many "negative" quarters. Undoubtedly, a recession is a recession, but in the United States, people wouldn't even notice a 0.2% decline. They focus primarily on the unemployment rate and the state of the labor market. To be fair, it should be mentioned that unemployment in the United Kingdom is essentially stable. By the way, the American economy declined significantly more in the first two quarters of this year. As a result, we don't think the GDP report will have any kind of market impact. The uncertain future that traders fear is now very clearly defined, especially in matters about the UK.

In the UK, nothing else intriguing is scheduled for this week. There is nothing comparable on the horizon, although we would like to write right now about a global event that might influence the market's mood in the near future. We can say that there was an information calm after the epic with Brexit and the pandemic came to an end, as well as after the subsequent change of government. This is neither good nor bad; there is simply not enough news at the moment to warrant discussion and analysis. Additionally, we don't want to focus on completely irrelevant and trivial information because this will only confuse us.

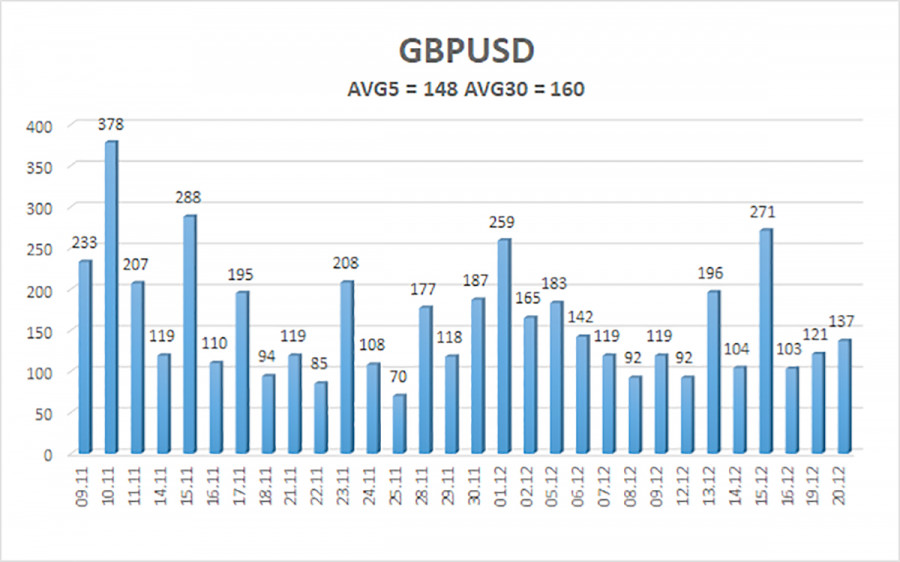

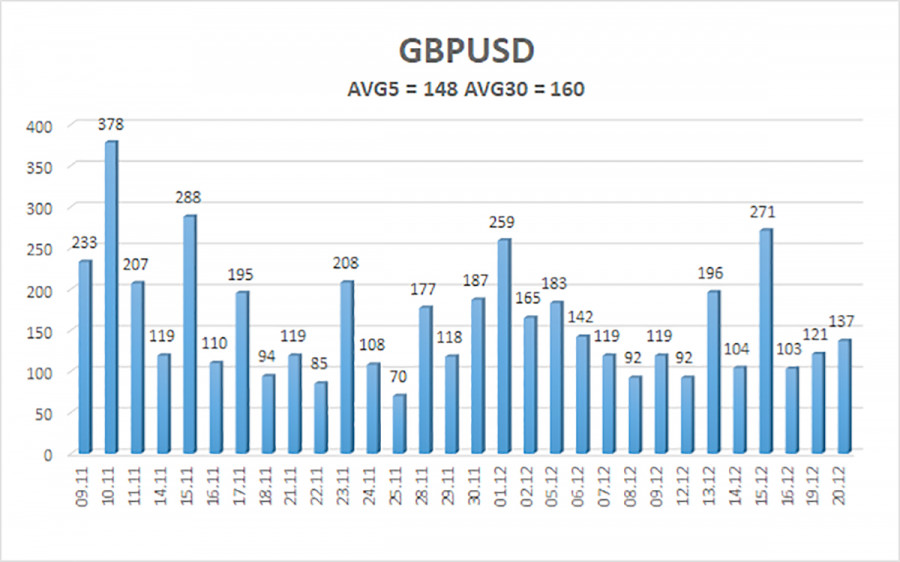

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 148 points. This value is "high" for the dollar/pound exchange rate. Thus, on Wednesday, December 21, we anticipate movement that is constrained by the levels of 1.1991 and 1.2287 to remain inside the channel. A round of upward correction will begin if the Heiken Ashi indicator reverses direction upward.

Nearest levels of support

S1 – 1.2085

Nearest levels of resistance

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still trending downward. As a result, for the time being, you should maintain sell orders with targets of 1.2085 and 1.1991 until the Heiken Ashi indicator appears. When the moving average is fixed above, buy orders should be placed with targets of 1.2287 and 1.2329.

Explanations for the illustrations:

Determine the current trend with the aid of linear regression channels. The trend is strong right now if they are both moving in the same direction.

The short-term trend and the direction in which trading should be done at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for movements and adjustments.

Based on the most recent volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

The CCI indicator's entry into the oversold (below -250) or overbought (above +250) areas indicates that the trend is about to reverse.