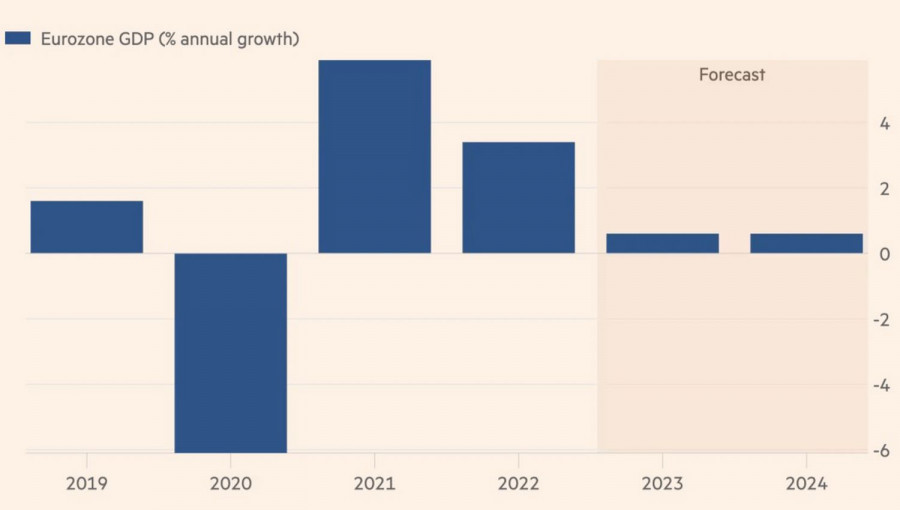

A strong economy translates to a strong currency. This fundamental analysis principle at the end of 2023 faces no criticism. While the U.S. GDP rose at a 4.9% annualized pace in the third quarter, and Bloomberg experts forecast a soft landing, the eurozone could be facing a recession. Almost two-thirds of the 48 economists surveyed by the FT said they believed the single currency bloc was already in a recession. Nevertheless, the economic downturn in the EU does not hinder the rise of EUR/USD.

On average, the economists polled by the FT forecast that the eurozone economy would grow by just over 0.6% in 2024. This is less than what the European Central Bank (+0.8%) or the International Monetary Fund (+1.2%) anticipate. If the risks materialize, the actual outcome could be even worse.

Economists' GDP forecasts for the eurozone

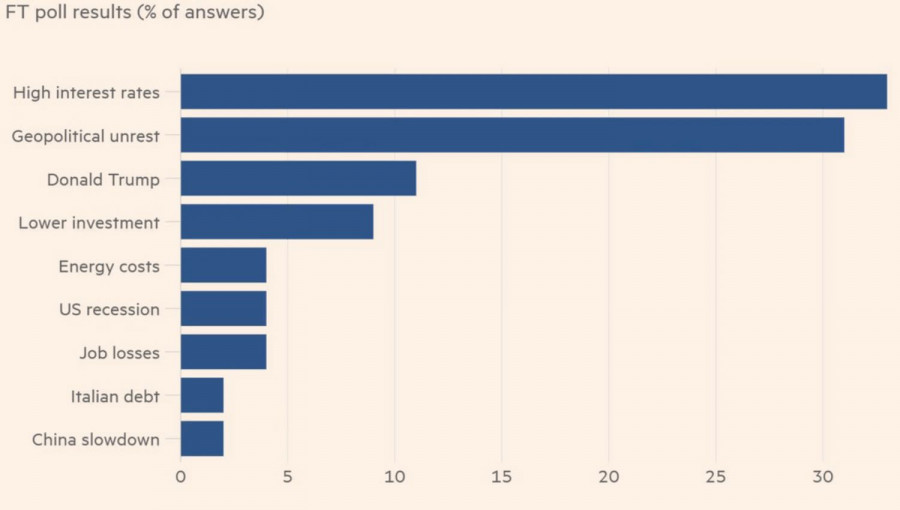

Thus, former ECB Vice President Vitor Constancio believes that the most significant threat to the currency bloc is recessions in Germany or Italy. Berenberg notes that if, after Donald Trump's victory in the U.S. presidential elections, support for Ukraine is withdrawn, and the EU is threatened with a trade war, the entire world will suffer, not just the European economy. Amundi Asset Management asserts that the greatest risk to the eurozone is the high ECB deposit rate.

Therefore, the currency bloc is weak and may become even weaker, and yet the EUR/USD is still rising. In reality, the divergence in economic growth does not work that way. The United States is at its peak, and in the future, its GDP will slow down. On the other hand, the eurozone is in recession, with recovery expected in 2024. The difference in GDP expansion is expected to narrow. This is a reason to buy the euro against the U.S. dollar.

Key risks to the European economy

Certainly, if the risks described by Financial Times analysts materialize, EUR/USD will decline. There is also a possibility that they could be wrong. For instance, in December 2022, about 85% of Financial Times respondents predicted a recession in the U.S. economy. This did not happen, influencing the balance of power in financial markets.

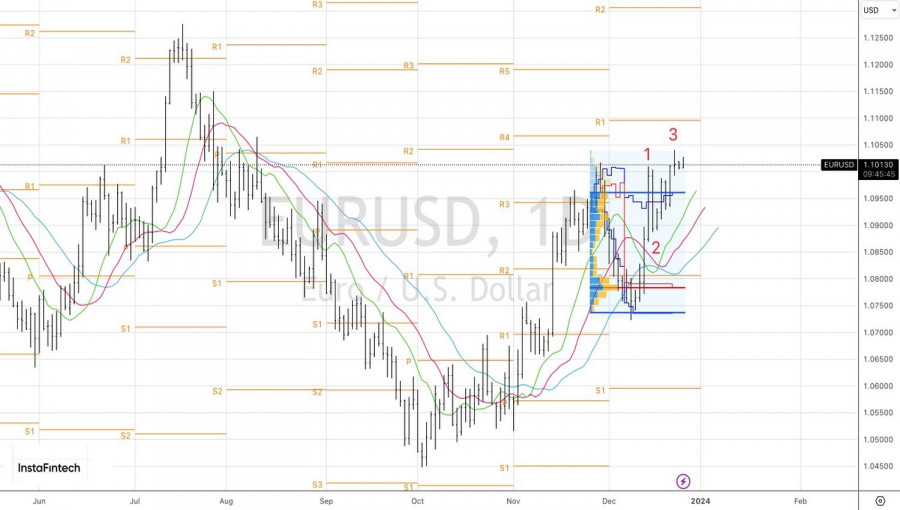

Currently, holiday moods and expectations of the continuation of the Santa Claus rally in the U.S. stock market are prevailing. If this rally does not materialize, and the S&P 500 undergoes a correction, worsening global risk appetite could catalyze EUR/USD sell-offs. Conversely, if the broad stock index sets a record high around 2023-2024, the euro could reach $1.12. It's not surprising that during the closing of the U.S. stock market, the main currency pair remained subdued.

Technically, on the daily chart, there is still a possibility of a doji bar reversal. Therefore, you may consider selling once the price drops below 1.099. This would increase the probability of activating a combination of reversal patterns - the Anti-Turtles and the 1-2-3. In order to implement this strategy, the pair must return to the fair value range of 1.074-1.096. As long as it trades above the upper band, the bulls remain in control.