The start of the week is characterized by the US dollar's strengthening and the euro's sell-off. Moreover, the yields changed slightly, stock indexes were also without obvious dynamics, and markets are waiting for new factors that can indicate the direction.

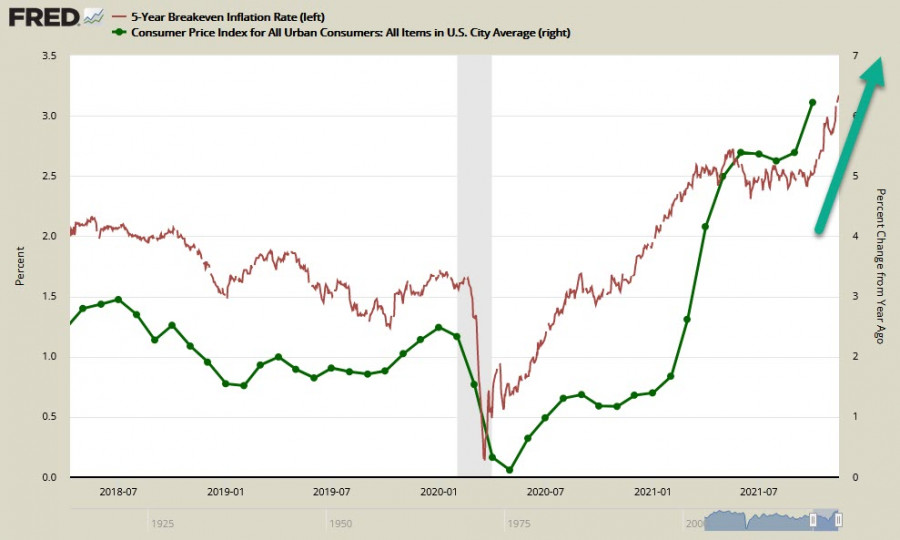

The US dollar is primarily supported by high inflation expectations, and not so much directly by expectations as by the need to respond to inflation. Dudley, the former head of the New York Fed, and Richmond's Lacker, who recently left his post, spoke in solidarity about the Fed rate hike, noting that the Fed will probably have to raise its target federal funds rate to at least 3% to try to contain inflation.

Meanwhile, current Fed officials are still trying not to comment on the situation with inflation, but it is clear that they have little choice. Today, four FOMC members are expected to speak at once, so comments on inflation, the pace of economic recovery, and other things that can lead to an increase in volatility are quite likely.

In the meantime, we will monitor the dynamics of the yield of 5-year TIPS bonds, which has already risen to 3.17%. Business sentiment remains in favor of further inflation growth, which means more aggressive actions by the FOMC.

We can assume that the US dollar remains the market favorite, while commodity currencies give way to the defensive ones.

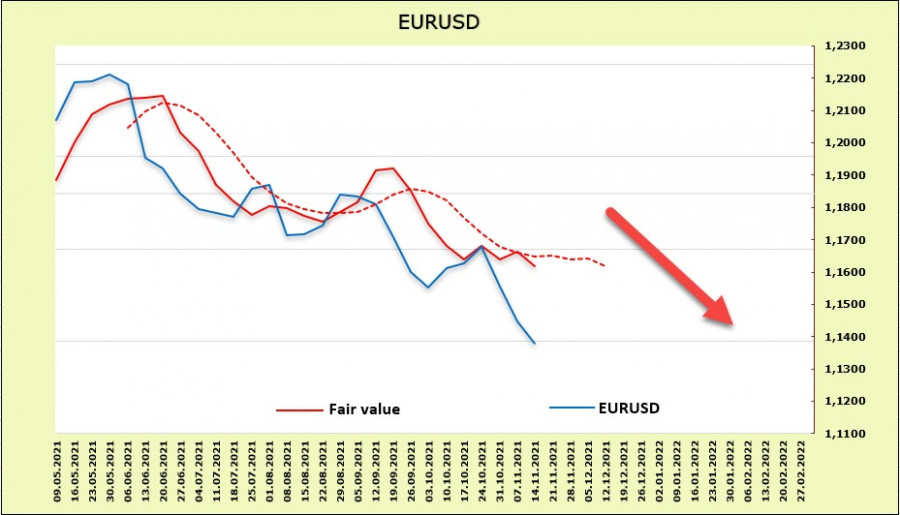

EUR/USD

ECB President Lagarde, speaking in the EU parliament, confirmed the Bank's opinion that inflationary pressure should decrease in the medium term, while the risks of wage growth and secondary effects are limited. Lagarde noted that "if we applied any tightening approach to the current situation, it would actually do more harm than good."

Lagarde's speech should be regarded as frankly dovish since the ECB will not take steps that could lead to the strengthening of the euro.

The euro reacted to the release of US inflation data with a sharp sell-off, confidently breaking through the support level of 1.15. The estimated price is below the long-term average, the dynamics in the futures market are minimal, and the chances of corrective growth are small.

A sharp decline to the level of 1.1350 increases the probability of a correction, which is technically limited by the trend line in the 1.1550/70 zone, but there are practically no grounds for such a deep correction. The euro remains under pressure. The nearest target is 1.1270/1310, while the long-term target is shifting to the psychological level of 1.10. Only a reduction in inflationary pressure and the resumption of global industry growth can prevent the decline, which looks very unlikely amid the current world energy prices.

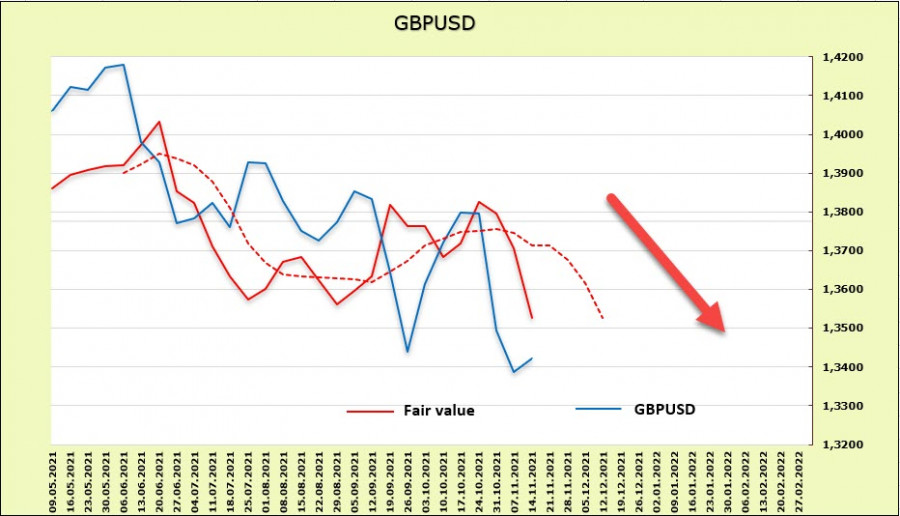

GBPUSD

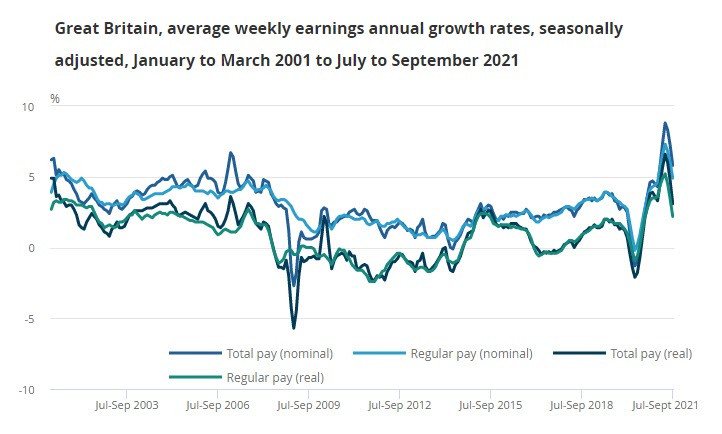

The report on the UK labor market for the 3 months to September inclusive should be considered positive for the pound as a whole, because, firstly, the unemployment rate decreased from 4.5% to 4.3%, and secondly, the explosive growth of average wages slowed down. The latter factor is in favor of a more balanced economic recovery, since, on the one hand, it indicates steady growth, on the other, it reduces inflationary risks.

The Bank of England can breathe a sigh of relief as the need to urgently raise the rate in order to reduce inflation has become slightly lower, which would increase the risks for the pound against the background of the development of the Brexit situation in a negative scenario.

Negotiations between the Johnson government and the EU rest on significant differences regarding the status of Northern Ireland. By itself, a not very significant issue can trigger a mechanism in which the EU will terminate the agreement in the event of unilateral actions by the UK, which in turn, will deprive it of all trade preferences. In addition, trade with the EU will switch to the general WTO rules, which will mean a significant deterioration of the UK's position in foreign trade and will bring the economic crisis closer since the UK's current account is already in a large deficit. It is clear that under these conditions, the Bank of England cannot take hasty steps to normalize monetary policy, and a decrease in wage growth is a positive factor since it reduces the risk of stagflation.

At the moment, the futures market predicts a 1.15% rate increase until the end of 2022, which makes the pound more attractive than the euro, but weaker than the US dollar. The CFTC report published on Monday is negative for the pound. A net short position has formed and the settlement price has rushed down.

It can be assumed that the possible upward correction will be temporary. It is advisable to sell with the target at 1.3260/80, then 1.3150 when the resistance zone of 1.3560/70 is reached.