The demand for the US dollar is growing after hawkish comments by Fed Vice Chairman Clarida and Chairman of the Board of Directors Waller, who noted that "a faster reduction in quantitative easing might be worthwhile," with Waller hinting that if the Fed will have the flexibility to raise rates earlier if necessary. It is still unclear whether there will be such a need or not, but the markets have received a clear signal that will support the US dollar.

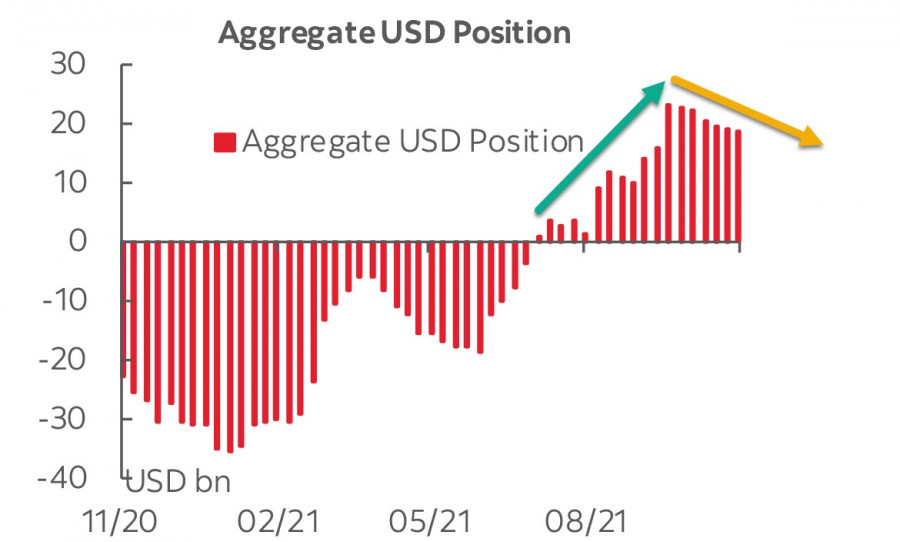

The cumulative long position on the US dollar fell by 554 million. This has been observed for the sixth week in a row – the dollar lost about 20% from the peak in early October (+23.2 billion). It seems that the dynamics are bearish, but the accumulated bullish advantage (+18.5 billion) still looks powerful and gives no reason to believe that a bearish reversal has occurred in the currency.

The report, among other things, contains clear signs of rising tensions. First, this is a rather noticeable decline in the euro and the pound, which hints at the development of the energy crisis in Europe. Second, the synchronous growth of demand for protective assets. The net-short position on the yen declined by 1.529 billion, while the franc also did so by 1.143 billion.

Meanwhile, the net bullish position on gold increased by 2.245 billion, reaching 48.076 billion. These are signs of an increase in anti-risk sentiment, signs that investors see the threat of a full-fledged crisis and increase demand for protective assets. The depth of this crisis cannot yet be seen from the available data, but it would be frivolous to ignore its development. The dynamics of demand in the futures market indicates a growing demand for protective instruments.

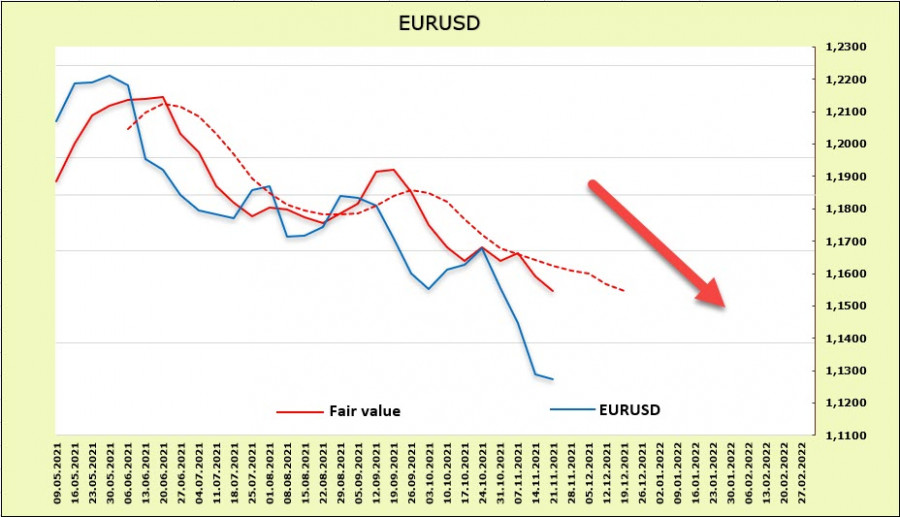

EUR/USD

The euro is under strong pressure after Austria. The first of the major countries announced on Friday that it was entering a nationwide lockdown, as well as its intention to make vaccination against COVID-19 mandatory from February 1. At the same time, Germany, the Czech Republic, and Slovakia are introducing additional restrictions for the unvaccinated, while Belgium is extending the terms of remote monitoring for workers. The restrictions sparked a series of protests across Europe over the weekend, with thousands of demonstrators taking to the streets in the Netherlands, Austria, Croatia, and Italy. The reaction of the markets was reflected by a strong increase in demand for 10-year bonds, which led to a sharp drop in global yields.

According to the CFTC report, the euro lost 1.088 billion over the week. A short position (-541 million) was formed again, and the advantage is minimal, but one thing is clear – a Christmas rally in the euro this year is hardly possible. The target price continues to go down considering the dynamics of both the debt and stock markets, which indicates growing pressure on the euro.

On Monday morning, the EUR/USD pair is trading in the support zone of 1.1270/1310, technically after reaching a correction of 61.8% of growth in 2020, which is also the lower limit of the channel. An upward pullback is possible, with the nearest resistance zone being 1.1500/20, but a possible upward pullback will be used for new mass sales. There are no grounds for a full-fledged upward turn. The long-term target is 1.10.

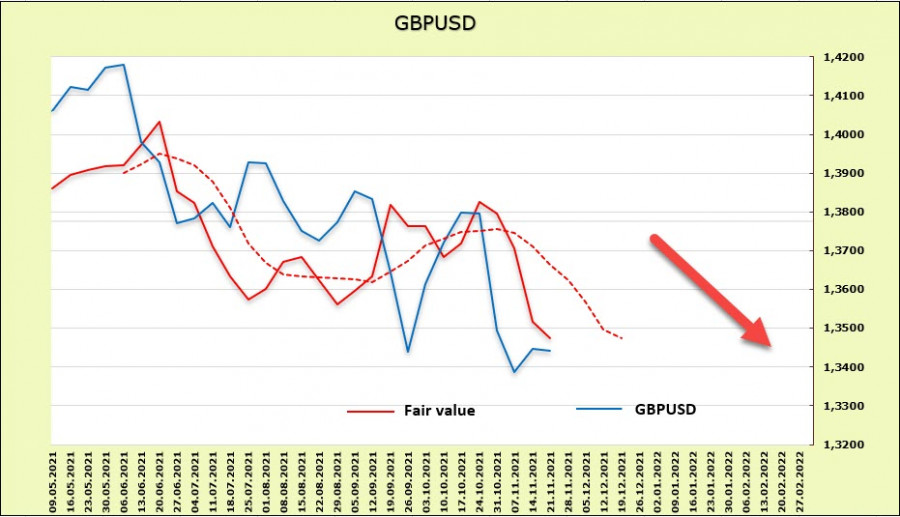

GBP/USD

The statistical reports published last week were generally noticeably better than forecasts, which indicates a good growth rate of the UK economy, but the pound reacted sluggishly since the comments of the chief economist of the Bank of England Pill looked forced and unintelligible. It seems that the Bank of England does not want to start a cycle of increase earlier than the Fed and will look for reasons not to do so.

The pound added 1.6 billion in addition to the previously formed short position. The bearish advantage reached 2.65 billion as follows from the CFTC report. The estimated price is steadily falling.

So far, the pound is declining much more smoothly when compared with the euro, but there is a risk of accelerating the decline since the settlement price is rapidly going down. The target is 1.3150/70, which represents the lower border of the channel and at the same time a correction of 38.2% from the high of 1.4244. It can be assumed that the chances of reaching it are good. The resistance zone is 1.3550/70, where sales are likely to increase if this upward correction takes place.