What is needed to open long positions on EUR/USD

Yesterday, the euro buyers were eager to defend support at about 1.1280, but they failed to push the price above 1.1300. It sets the stage for a further decline of EUR/USD by the end of the week. Today traders are focused on fundamental data for the eurozone. Meanwhile, the technical picture does not benefit buyers of risky assets.

Today market participants are alert to a batch of PMIs for the eurozone's countries. Unfortunately, the PMIs reflecting business conditions in late of 2021 will hardly show upbeat readings. Indeed, the Omicron variant obviously is making its adverse impact on the EU economy. So, it would be better for buyers to focus on 1.1279. Only a false breakout like it was yesterday as well as good services PMIs and composite PMIs for the eurozone will generate a signal for buying the euro. The pair could rise again to resistance at 1.1306. Yesterday, the price could not surpass it. Apparently, large sellers are present in the market who are anticipating the bearish scenario for EUR/USD. Their major task is to break this zone. The reversal test downwards will open the way to the area of 1.1329 and 1.1354 where I recommend profit taking.

The level of 1.1381 is seen as a more distant target. If EUR/USD is trading lower in the European session and the bulls lack activity at 1.1279, it would be better to cancel long positions until larger support at 1.1252. Nevertheless, I would recommend opening long positions there only on condition of a fake breakout.

The sellers could revive hopes that the pair remains in a trading range if the price hits a low of 1.1224. From there, we could open long positions immediately at a bounce, bearing in mind a 20-25 pips intraday correction.

What is needed to open short positions on EUR/USD

Yesterday, the sellers did a lot to keep the pair below 1.1300. Apparently, the bears are leased as the currency pair is reversing its direction downwards. In case EUR/USD grows again in the European session today after the release of PMIs and Italy's inflation data, the sellers will have to make every effort to defend resistance at 1.1306. They should not allow the price to go above this level because it will change the trajectory. The first market entry point for short positions will be created by a false breakout at 1.1306 as the sellers will count on the downward pressure and another decline to 1.1179. They will have to fight for this level. If it broken and tested upwards, the sellers will have an extra signal to open short positions with the outlook of a decline to a major low at 1.1252. If the price drop below this level, this move will activate the buyers' stop losses and trigger a larger decline of EUR/USD. The pair is expected to print lower lows of 1.1224 and 1.1208 where I recommend profit taking. In case the euro asserts strength and the bears lack activity at 1.1306, it would be wise to cancel short positions. The best scenario will be opening short positions on condition of a false breakout at about 1.1329. It would be good to sell EUR/USD immediately at a drop off the high at 1.1354 or even higher at 1.1381. Let's consider a downward 15-20-pips intraday correction.

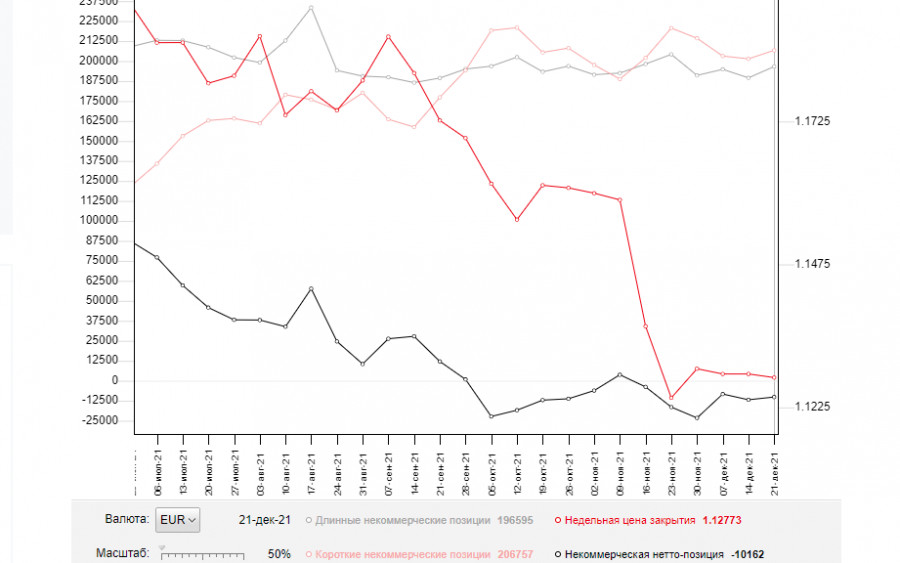

The COT report (Commitment of Traders) dated December 21 logs an increase both on short and long positions, albeit long positions grew to a less degree. This contracted the negative value of the delta. Such data reflect the recent policy meetings of the Federal Reserve and the ECB. However, judging by overall market sentiment, nothing has changed. This is confirmed by the chart. A lot of headwinds in the EU and US economies persist due to the Omicron variant that puts central banks on edge. Apparently, the Omicron situation in the new year will determine further monetary policy of the US Fed and the ECB.

The COT report shows that buyers of risky assets, in particular the euro, are in no hurry to increase long positions even in light of the EB announcements that it is planning to withdraw its emergency bond buying program in March 2022. On the other hand, the US dollar has solid support as the Federal Reserve aims to raise interest rates in the spring 2022 that enhances its investment appeal.

According to the COT report, long non-commercial grew from 189,530 to 196,595, whereas short non-commercial positions rose from 201,409 to 206,757. It means that the bulls and bears are fighting for their direction. As a result, the overall net non-commercial positions decreased its negative value from -11,879 to -10,162. EUR/USD remained in a trading range for the whole week and closed last week almost at 1.1277, almost at the same level as 1.1283 a week ago.

Indicator signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates uncertain market conditions and an unclear direction after the New Year's holidays.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a downward move, the indicators' lower border at 1.1275 will serve as support. Alternatively, if the pair grows, the upper border at 1.1306 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.