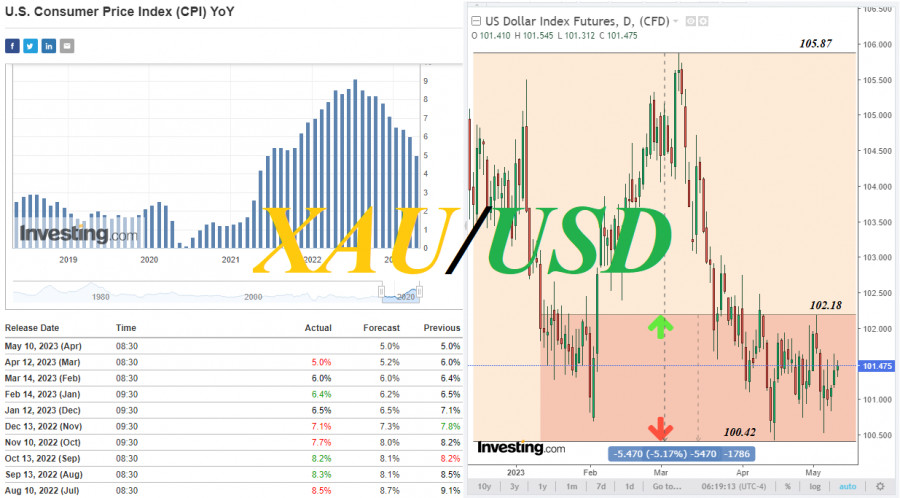

Undoubtedly, the focus of investors today is the publication of fresh inflation data in the United States: at 12:30 (GMT), consumer price indices will be published. As we noted in our previous review, consumer prices account for a large part of overall inflation. Rising prices force the central bank to raise interest rates to curb inflation, and conversely, when inflation decreases or there are signs of deflation (when the purchasing power of money increases and prices for goods and services fall), the central bank usually seeks to devalue the national currency by lowering interest rates to increase aggregate demand.

Lately, data from the United States has indicated a slowdown in inflation.

Previous CPI figures since the beginning of the year:

In January, +0.4% (+5.6% in annual terms);

In February, +0.5% (+5.5% in annual terms); and

In March, +0.4% (+5.6% in annual terms).

The downward dynamics of inflation in the United States create a basis for the Federal Reserve to slow down or pause the tightening cycle of its credit and monetary policy. As is known, following the meeting that ended last Wednesday, the Federal Reserve raised the interest rate by 25 basis points to 5.25%. In the accompanying statement, the wording that further tightening of policy might be required to achieve a "sufficiently restrictive" course and return inflation to the 2% level over time was omitted, and "the degree of appropriateness of additional tightening will take into account the tightening already carried out to date, the lagging of policy, and other events."

Speaking slightly later, Federal Reserve Chairman Jerome Powell tried to smooth out the initial negative impression of investors from the results of the Central Bank meeting, stating that "inflationary pressure continues to remain high" and "we need to focus on reducing inflation."

However, his speech did not make a strong impression on market participants, and now most economists tend to believe that this was the last interest rate hike by the Federal Reserve this year. Moreover, they believe that by the end of the year, the Federal Reserve will switch to easing its policy altogether.

The dollar remains under pressure, also taking into account disagreements in the U.S. Congress over raising or canceling the U.S. public debt limit, which already exceeds $31 trillion (U.S. President Joe Biden demands to raise the limit without any preconditions, while Republicans insist on cutting budget spending). At the same time, U.S. Treasury Secretary Janet Yellen states that at current rates of public debt growth, and if the problem with raising the limit or its complete cancellation is not resolved, problems with financing government operations may arise as early as the beginning of June.

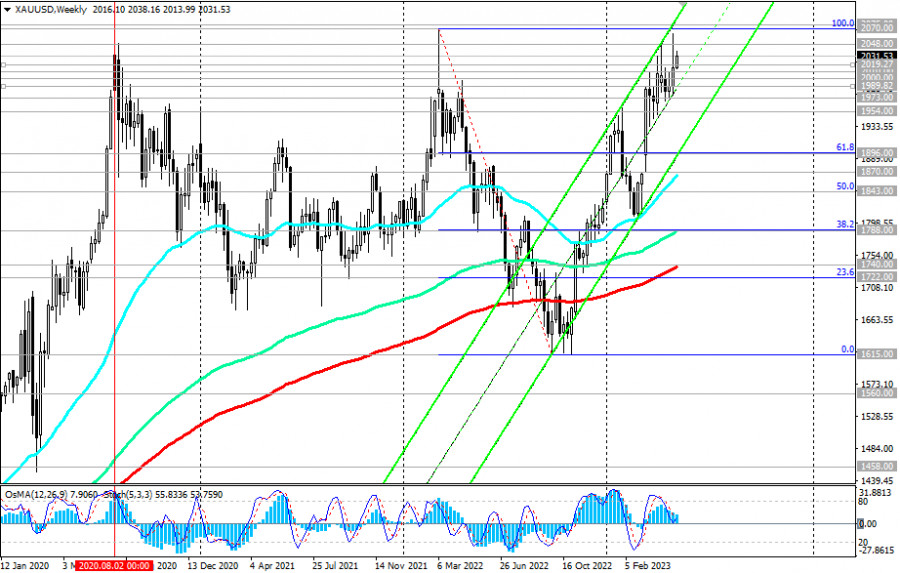

In the current situation of uncertainty, cautious investors prefer to stay in defensive assets, such as one of the most popular—gold. Its quotes last week and the day after the Federal Reserve meeting jumped to a new record high of 2077.00, updating the previous year's March high of 2070.00.

At the beginning of today's European session, after finding support at 2029.00, the XAU/USD rallied again after declining slightly in the Asian session, but made a new three-day high at 2038.00.

Overall, the upward dynamics of XAU/USD persists, and our main forecast is betting on its further growth.

As for the dollar, it is still under pressure. As of writing, the DXY futures were trading 47 points above 101.00. The nearest resistance levels to overcome for the DXY to develop an upward trend are at resistance levels 102.00, 102.18, 102.50 and 102.75. DXY continues to be in a downward trend despite today's upward dynamics. The index is trying to develop an upward trend from the beginning of the week on the strong data from the U.S. Labor Department released last Friday and in anticipation of today's fresh inflation data release. Dollar buyers are likely counting on some growth in the CPI indices for the reporting month (in April).

The dollar also enjoys the status of a defensive asset but still gives way to gold here.

As for the expected publication, the forecast for April (Core Consumer Price Index, Core CPI) is +0.4% (+5.5% in annual terms) after the previous value of +0.4% (+5.6% in annual terms). If the data is confirmed, it is unlikely to provide support to the dollar, indicating a stabilization of inflation growth in monthly terms and its slowdown in annual terms.

From a technical point of view, to resume short positions on the DXY index (CFD #USDX in the MT4 terminal), sellers need at least a breakdown of the 101.51 support level.