Euro sank again due to growing inflationary pressures brought by the sharp jump in energy prices. In-party problems among Democrats also persist, while Republicans continue to oppose a raise on the US national debt ceiling. At the same time, strong reports on the US labor market helped dollar rally in the markets.

Another noteworthy issue was the recent harsh criticisms from US Senator Elizabeth Warren. She said Fed Chairman Jerome Powell "failed as a leader", in response to the scandal that some senior Fed officials were actively trading in securities during the coronavirus crisis.

But US President Joe Biden said he has full confidence in Powell, who promised to figure everything out. Powell's term as Fed chief is ending in February next year, so such protection from the president is very beneficial. And based on the statements of many senators, it is clear that quite a number of officials want Powell to extend his term. But no less are those that are against it, especially given that Powell is a Republican and was appointed under Donald Trump. This is one of the reasons why Warren, who is a Democrat, said she would not endorse the incumbent Fed chief for a second term. The other is that he is sluggish in his financial oversight and conducts bank stress tests that are "worse than open book exams".

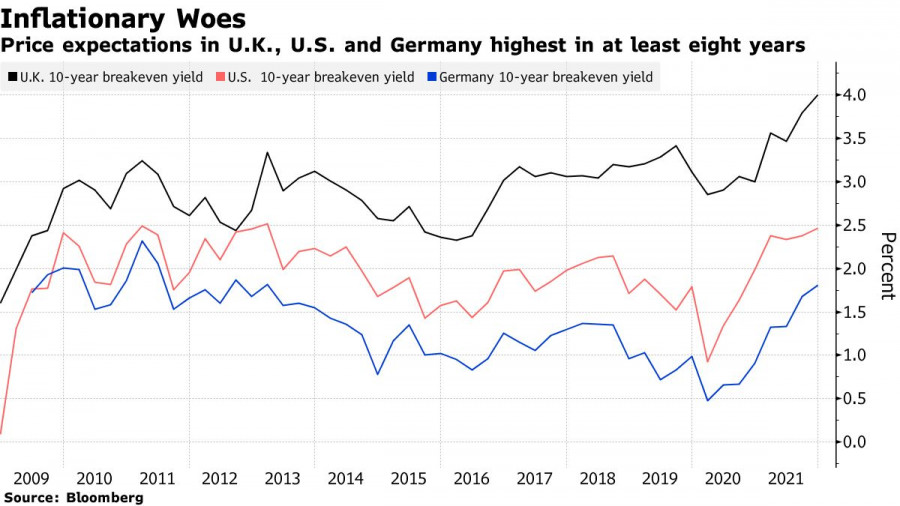

On a different note, signs have emerged that global recovery is picking up steam, which rekindles the topic of reflation. The issue initially faded in mid-May this year, when Fed officials began openly discussing cutbacks in bond purchases. But now the situation has changed and investors do not strongly believe in what the central bank is saying. In addition, CPI growth is deteriorating even more because of supply chain disruptions and sharp increases in energy prices.

The Bloomberg commodity spot index, which tracks futures contracts for 23 commodities, rose to a record high on Tuesday, gaining more than 30% this year.

Based on this, many are confident that the Fed will taper stimulus programs in November, although a lot will still depend on the labor market data for September. If there is another slump in the data, the Fed will be forced to extend its measures. But if the figures are better than expected, the central bank will immediately announce a curtailment of stimulus.

Stakes on tighter monetary policy are also increasing in the UK. And, it is possible that after the latest data on EU inflation, the European Central Bank will do so as well.

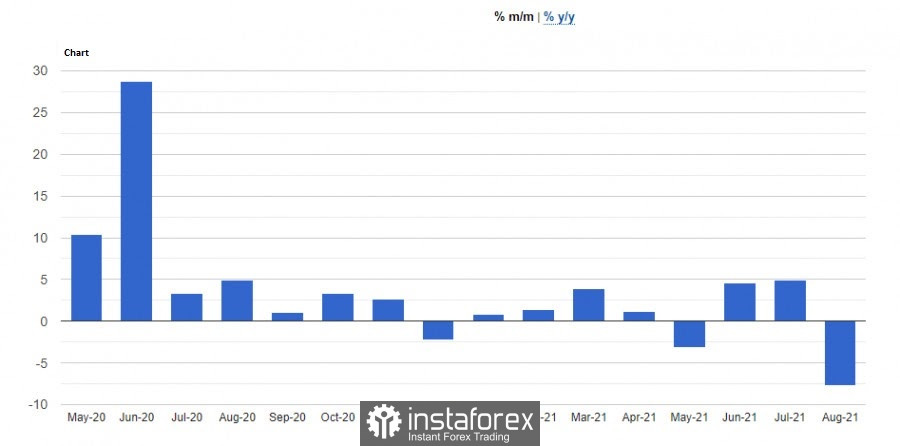

Talking about statistics, Eurostat reported on Wednesday that retail sales in the Euro area rose less than expected in August. The index was up 0.3% m / m rather than the projected 0.8%. On a yearly basis, retail sales remained unchanged.

Sales undoubtedly peaked after quarantine restrictions were lifted, but excluding growth in September, retail sales rose only 0.2% in the third quarter. Personal consumption may also slow this fourth quarter because of the sharp rise in energy prices and inflation, as well as the slower pace of GDP recovery.

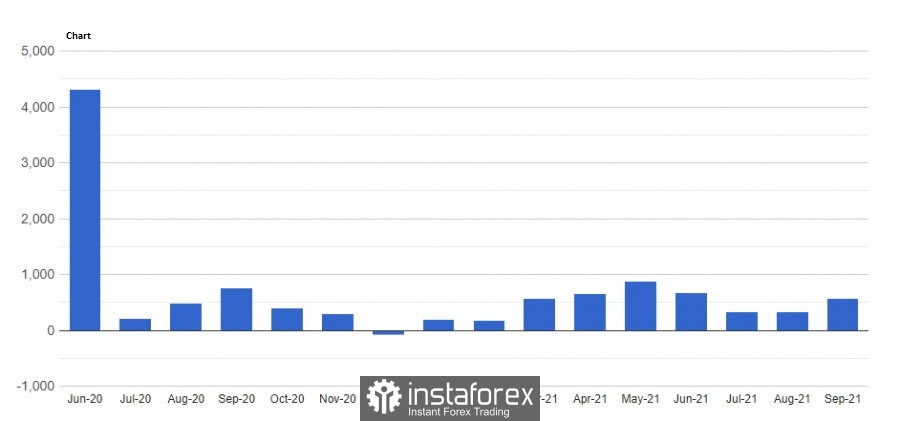

In Germany, manufacturing orders fell more than expected, dropping 7.7% m / m in August. This cancels out the 4.9% gain in July.

Going back to the United States, ADP reported that private sector employment jumped 568,000 in September, indicating continued recovery despite a marked slowdown in job growth. It seems that citizens are becoming less and less afraid of the problems associated with COVID-19, continuing to be active in finding work, which creates the basis for further increase in jobs in the coming months.

Stronger-than-expected growth in private sector jobs was also driven in part by a marked increase in employment in the leisure and hospitality industry, which created 226,000 jobs. Manufacturing employment also rose by 102,000.

On Friday, the US will again release data on the labor market, where economists expect a 488,000 increase in monthly employment. They also project a 5.1% drop in the unemployment rate.

With regards to EUR/USD, a lot currently depends on 1.1530 because declining below it will result in a further collapse to 1.1480 and 1.1450. But if the quote rises above the level, the pair will jump to 1.1560, 1.1580 and 1.1610.

GBP

Pound also dropped yesterday because of weak macro statistics from UK. Construction PMI reportedly fell to 52.6 points in September, from 55.2 points in August. But a reading above 50.0 still indicates growth.

Now, a lot depends on 1.3540 because dropping below it will result in a slump to 1.3490 and 1.3420. But if the quote jumps above the level, the pair will rise to 1.3650 and 1.3690.