Analysis of previous deals:

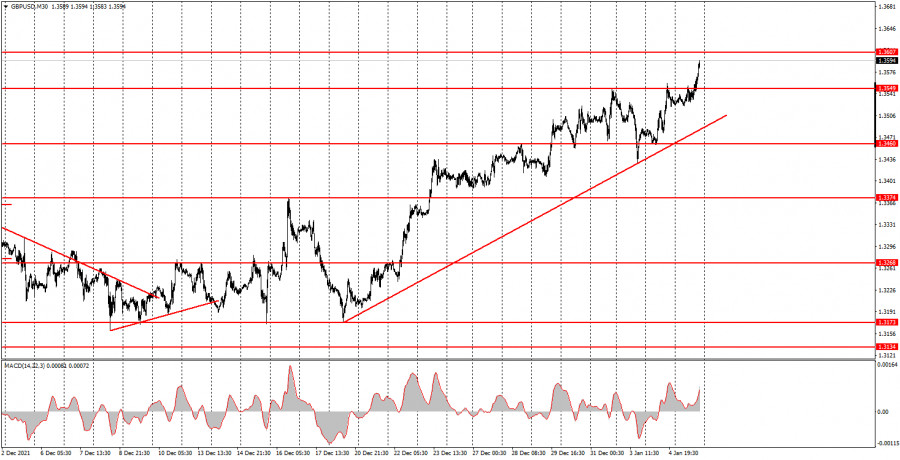

30M chart of the GBP/USD pair

The GBP/USD pair continued its upward movement on Wednesday. Unfortunately, the pair showed an absolutely indistinct movement for most of the day and only resumed its growth by the end of the day. The upward trend line that the pair crossed a couple of days ago is now rebuilt as the upward trend has resumed. In principle, both major currency pairs showed growth during the day, but the pound stood in one place during the day, which is clearly seen in the chart below. Thus, trading today was not very successful, which we will discuss below. In the meantime, it should be noted that macroeconomic data has absolutely nothing to do with today's fall in the US currency. The single most important report of the day - the ADP report on the number of employed in the US private sector - turned out to be twice as strong as forecasted, so it should have provoked a rise in the dollar, not its fall. The publication of the Federal Reserve minutes - formally also a significant event - will take place only in half an hour. Thus, either the dollar fell "in advance," on negative market expectations, or it was a purely technical fall.

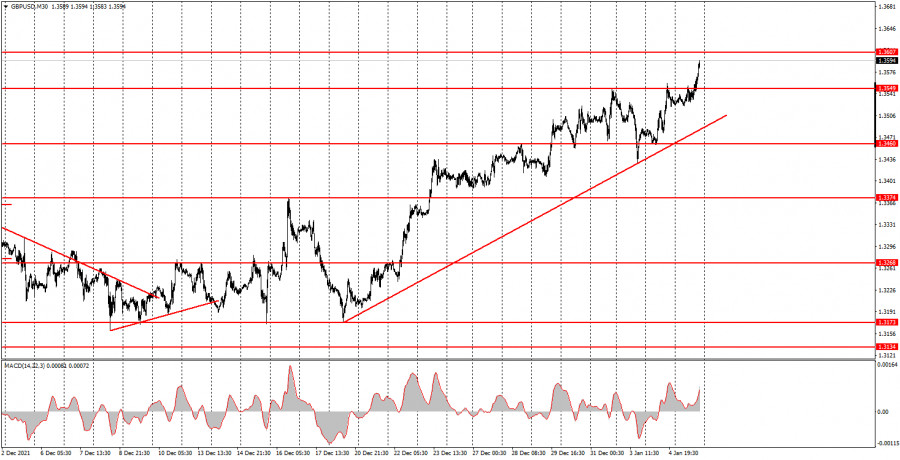

5M chart of the GBP/USD pair

The movement of the pound/dollar pair on the 5-minute timeframe looks quite strange. The problem is that in the Asian, European and half of the US session, the movement was rather weakly volatile and as horizontal as possible. It was only in the second half of the US trading session that a fairly strong upward movement began, which was not provoked by any fundamental or macroeconomic events. Nevertheless, newcomers could get a certain profit today. The first buy signal was formed at the very beginning of the European session. The price rebounded from the level of 1.3521, so at this moment it was necessary to open long positions. However, a sell signal was already formed near the 1.3549 level, so longs should be closed on a rebound from this level and short positions should be opened. The profit was about 10-15 points. The short position did not bring proper profit to novice traders, as the price could not fall to the level of 1.3521. And in the US trading session, the price settled above the level of 1.3549, so we had to close the deal at a loss of 16 points. But new longs should have been opened immediately. The upward movement continued after that, the price overcame the level of 1.3579, so it was possible to earn about 30 points of profit on the last transaction by closing it manually in the late afternoon.

How to trade on Thursday:

The upward trend has recovered on the 30-minute TF, a new upward trend line has been formed. Therefore, longs on this TF are relevant again at this time. On the 5-minute TF tomorrow, it is recommended to trade by levels 1.3521, 1.3549, 1.3579, 1.3606, 1.3638. The price can rebound from these levels, or it can overcome them. As before, we set Take Profit at a distance of 40-50 points. On the 5M TF, you can use all the nearest levels as targets, but then you need to take profit, taking into account the strength of the movement. When passing 20 points in the right direction, we recommend setting the Stop Loss to breakeven. No interesting events and publications are expected in the UK during tomorrow. There will be only one important report in the US – the ISM business activity index in the service sector. It may be followed by a market reaction.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.