Lael Brainard, who is considering her candidacy for the post of Fed's Vice Chairman, said the following in her speech to the Senate Banking Committee: "Bringing inflation back to the 2% target level is the most important challenge facing the US central bank." Brainard sees the Fed's goal as curbing inflation while supporting economic recovery.

The main instrument in lowering inflation is an increase in rates and a reduction in the money supply, that is, a tightening of financial conditions. However, the tightening of financial conditions means cooling of the economy or slowing down the economic growth. So, it is not known how will the Fed will reconcile these two mutually exclusive parameters.

Nevertheless, unity is somewhat emerging in the ranks of Fed officials. The head of the St. Louis Federal Reserve, Bullard, announced that he expects 4 rate hikes this year, not 3, as he had previously assumed. The first increase should be made in March, simultaneously with the completion of QE4.

Mester, who is the head of the Federal Reserve Bank of Cleveland, is also very specific. In her opinion, the decline in inflation indicators will be directly related to the end of the pandemic (which could well be announced at any time, if we count not the number of infections, but the number of hospitalizations and deaths), and also considers March to be quite a suitable month to announce the first increase rates. At the same time, she believes that not only an increase in the rate, but also a reduction in the Fed's balance sheet should occur as quickly as possible, and the only criterion here is not to damage the pace of recovery. The Fed has not yet decided on the timing and procedure for reducing the balance, but through the words of its officials, it leads the markets to the idea that actions in this direction are not far off. In any case, hawkish rhetoric is growing, and it should be assessed as a confidently bullish factor for the US dollar.

The President of the Federal Reserve Bank of San Francisco Mary Daly is changing her rhetoric under the influence of high inflation. Last Friday, she expressed herself in a cautious manner. In her opinion, it is necessary to gradually increase the rate, and after one or the second increase, raise the discussion about reducing the balance. But after the publication of inflation data on Tuesday, she announced that it was time to cancel some measures of monetary policy, and the rate could be raised in March.

Therefore, the literal reaction of FRS officials to high inflation can be observed. If the first increase was planned for June after the December meeting, then now, the expectations are shifted to March. We are talking not about two or three increases in 2022, but three or four.

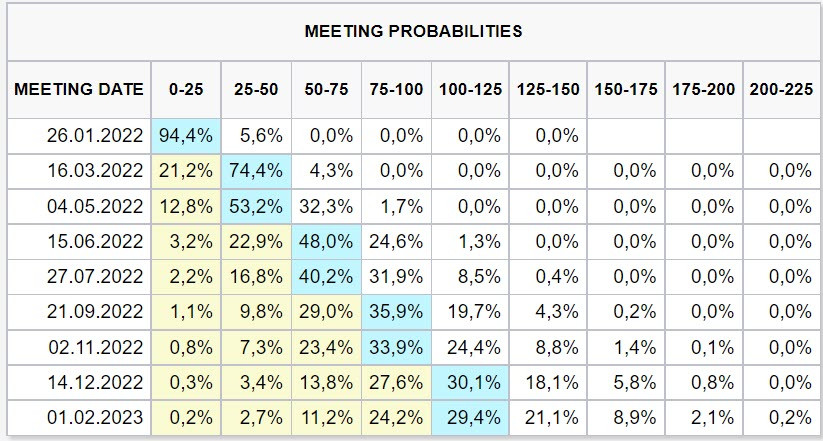

The CME futures market sees a 30% chance that the rate will move in the range of 100-125p by the end of the December meeting, which means four increases.

Will the US economy withstand such a blow? Rather yes than no. According to the Congressional Budget Committee, the federal budget deficit in the first quarter of the fiscal year 2022 amounted to $377 billion, which is $196 billion less than the deficit registered in the same period last year, and slightly more than the deficit registered in the same period two years ago. Revenues from October to December 2021 rose by 31%, which gives some reason for optimism. The US Treasury sees the US budget deficit in December in the amount of 21 billion, and this is at least 2 years. Revenues also increased by 41% compared to December last year.

If Biden's proposed infrastructure project in the amount of 2 trillion is still approved by Congress, then this will clearly lead to an increase in budget expenditures and an increase in the deficit, but at the same time, it will offset any monetary tightening measures that the Fed will pursue. Accordingly, the US economy will be able to maintain high rates of recovery even with four rate hikes.

Let's assume that the conditions for further strengthening of the US dollar across the entire spectrum of the currency market have developed. The yield spread will rise in its favor, which will increase the inflow of investments. In turn, this will increase the demand for the US currency.