Before the results of the Fed meeting became known, the pair was below the moving average line and desperately tried to adjust and not fall even lower. Recall that at the moment the quotes of the European currency are near their 20-year lows and threaten to update them in the near future. What changed after the results of the Fed meeting became known? Especially, nothing. Here is such a paradox. The pair has been falling over the past week and lost almost 400 points in an almost recoilless movement, and after the main event of the month showed fairly strong growth. Only now it does not change anything dramatically, since today the pair may rush down again. In our previous articles, we have already said that the market may well have already taken into account any increase in the key rate. Therefore, there will be no strong dollar growth. On the other hand, the growth of the European currency was also not observed immediately after the meeting, so it cannot be said that the market played a 0.75% increase in advance and will now move the pair in the other direction.

Therefore, if we take it in general, the technical picture has not changed at all over the past week. The global downward trend persists, all trend indicators are directed downwards, and the European currency has not had fundamental support either. After all, what does an increase in the Fed's key rate mean, and even immediately by 0.75%? Only investment conditions in the United States are becoming much more attractive than in the European Union in the medium term. Perhaps in a couple of years, the ECB will raise its rate to the level of the Fed rate. Perhaps the Fed itself will lower its rate and conditions will level out. But for the coming months, the American currency will have an advantage. Moreover, next month, the Fed may raise the rate by another 0.5% minimum.

What are the results of the Fed meeting?

If you ignore all the "water" that Jerome Powell said to the markets, and focus only on the most important points, then this is the case. The Fed understands that a further rate hike will lead to a slowdown in the economy. Economic growth forecasts for 2022 have been lowered, and unemployment forecasts have been raised. However, the Fed's forecast in annual terms is still positive. Thus, no recession is expected in the long term. The decline in GDP rates can be observed in the context of several quarters, which, in principle, is not too critical. But the highest inflation is critical. Therefore, the Fed will primarily fight inflation and will sacrifice economic growth. This was almost openly stated by Powell. He said that the American economy is strong enough, so it will cope with a noticeable tightening of monetary policy.

Further. The rate was raised by 0.75%, the highest value in the last 28 years, but the market was ready for such a decision since after the last inflation report it could not have been any other way. We wrote in recent articles about the "James Bullard plan". It seems that inside the monetary committee, he managed to convince the other members of the expediency of this plan. That is, the Fed will now raise the rate as quickly as possible. As early as next month, it may be increased by another 0.75%, which Powell also almost openly stated. Of course, he said "by 0.5% or 0.75%", however, from our point of view, the second option will be implemented. Inflation simply will not have time to slow down in just one month for the Fed to calm down and start tightening monetary policy at a calmer pace. After all, the inflation report for June will be released next month, and the rate was raised only in mid-June. Accordingly, inflation has 14 days to fall as much as it will be enough to convince the Fed of its sufficient rate of slowdown. We think this is an unrealistic plan. Thus, the dollar is likely to continue to grow against the European currency in the medium term. Moreover, the long-term trend persists.

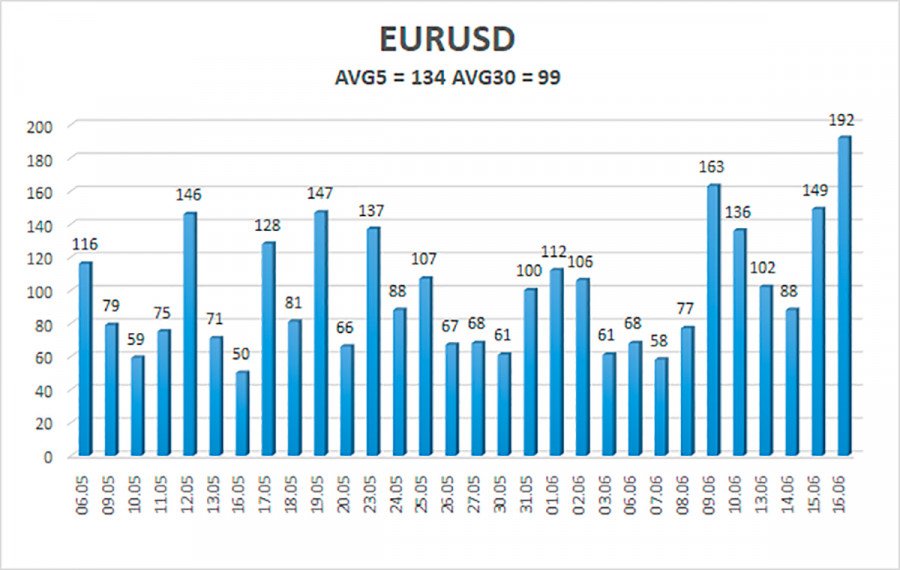

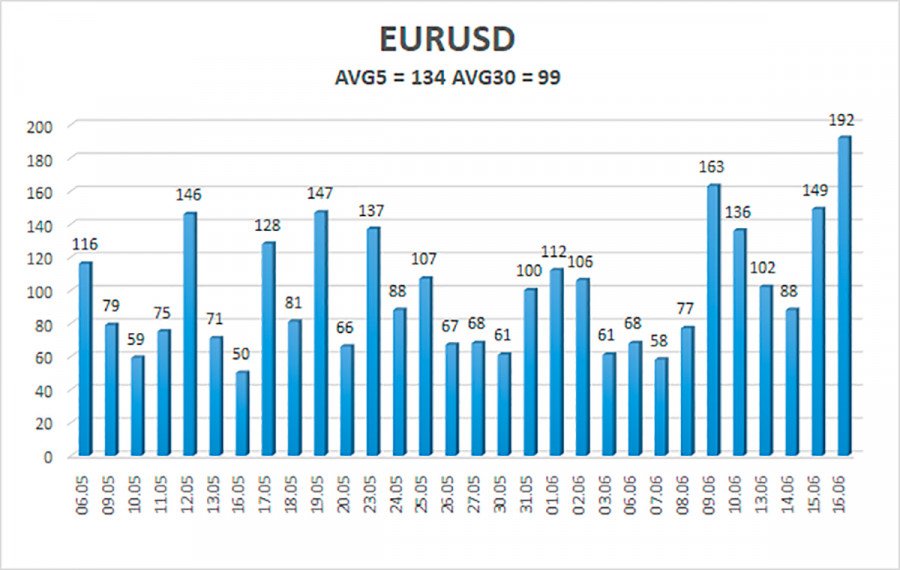

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 17 is 134 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0430 and 1.0699. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864Trading recommendations:

The EUR/USD pair has started a strong growth, but it may not be long. Thus, it is now possible to stay in long positions with a target of 1.0620 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0430 if the price is fixed below the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.