The GBP/USD currency pair tried to continue its upward movement during the week but could not do so. As in the case of the euro currency, the pound's growth lasted only a few days, so despite overcoming the moving average line, we still doubt the ability of the British currency to continue growing. As we have already said, the geopolitical situation is deteriorating, primarily concerning European countries. In the UK, an energy crisis is brewing, a drop in living standards, a serious recession, and even a collapse of the economy (as many experts and conservatives believe) due to Liz Truss' plan to reduce taxes. Of course, it can be assumed that those conservatives whose interests are affected by this decision oppose this plan. And criticism from journalists and experts has always been integral to any economy. Any decision of any government will always be criticized by a certain group of people whose interests suffer most because of this decision. Therefore, it is still too early to dismiss Liz Truss. Moreover, she was chosen for the post of prime minister by the Conservatives themselves, not the British people. It would be absurd if the Conservatives dismissed her less than a month after her appointment.

However, it cannot be denied that the British economy may face serious problems due to tax cuts. Experts have already estimated that the budget deficit may grow by 200 billion pounds, which must be taken somewhere. The Bank of England can buy long-term bonds from the government to pay off this deficit, but this would be another QE stimulus program. Then what is the point of raising the key rate (tightening monetary policy) and simultaneously launching a new QE (easing monetary policy)?

Liz Truss managed to quarrel with the King of Great Britain.

Meanwhile, the new Prime Minister of Great Britain could not find a common language with the new King of Great Britain. Disagreements arose based on the UN conference on climate change. King Charles III would like to attend this event and make a presentation at it, but Liz Truss asked him not to do this for unknown reasons. It should be noted that Charles III is an ardent environmentalist, and it would be important for him to attend the UN event. Moreover, this could be the first event where he would officially act as the King of Great Britain. British publications immediately wrote that relations between the King and the Prime Minister could worsen. Still, Downing Street said that the discussion of this issue took place in a friendly atmosphere, and there were no disagreements between Charles III and Liz.

There will be a small number of fundamental and macroeconomic events in the UK in the next week. Indices of business activity in the service and manufacturing sectors are all that traders will be able to pay attention to. The situation will be much better in the States. The ISM manufacturing business activity index will be published on Monday. On Wednesday, the ADP report on changes in the number of employees in the private sector and the ISM index for the service sector will be released. On Friday – Nonfarm payrolls and the unemployment rate. Naturally, the main attention of traders will be focused on nonfarm. However, from our point of view, this report cannot dramatically affect the market's mood right now. If the market has decided that it no longer makes sense to sell the pound, the pound will grow for some time, despite the macroeconomic background. But at the same time, geopolitics can return it to a downward trend since the pound is a much riskier currency than the US dollar. Thus, the market reaction to Non-farm will follow, and traders may consider buying the pound this week if the pair remains above the moving average.

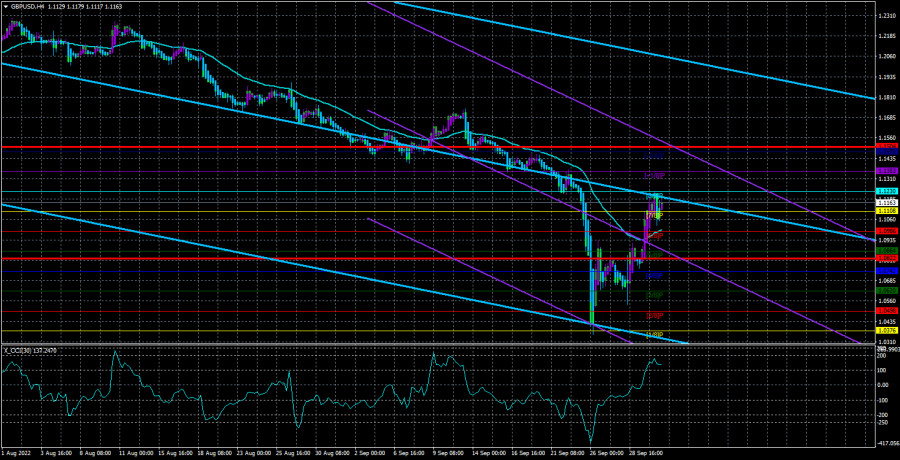

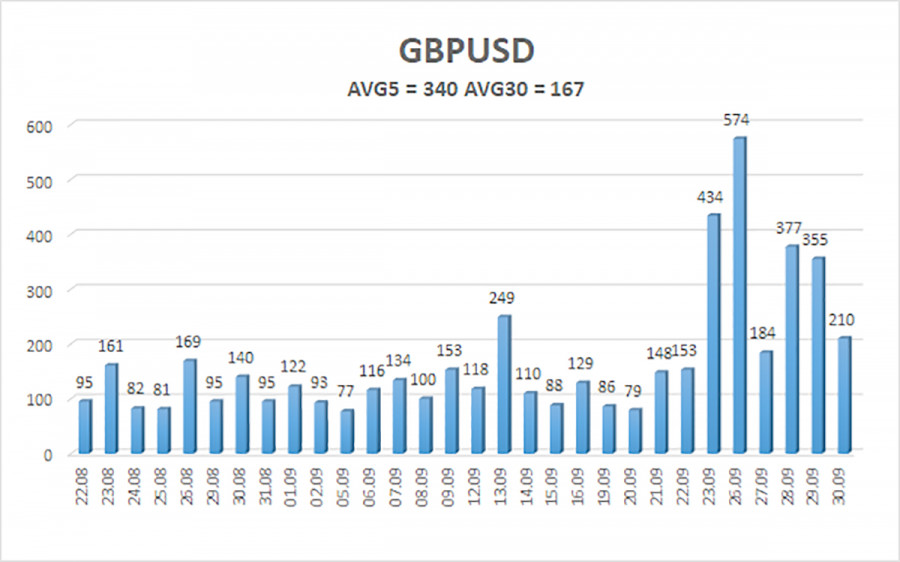

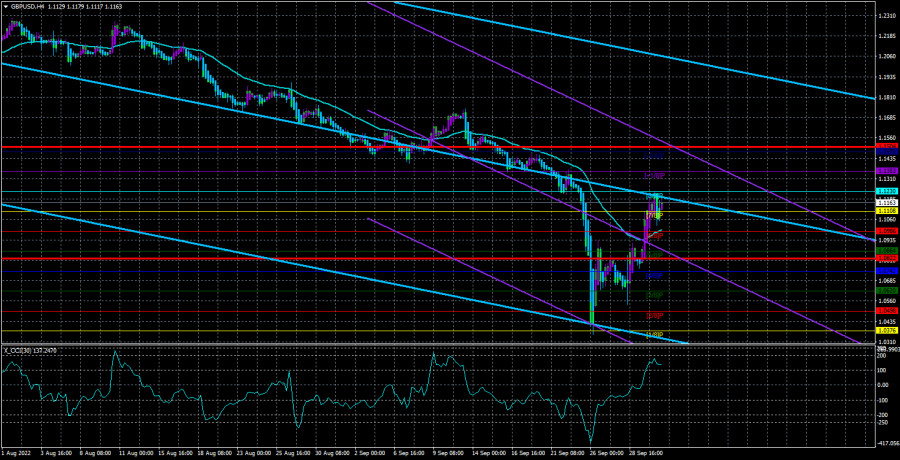

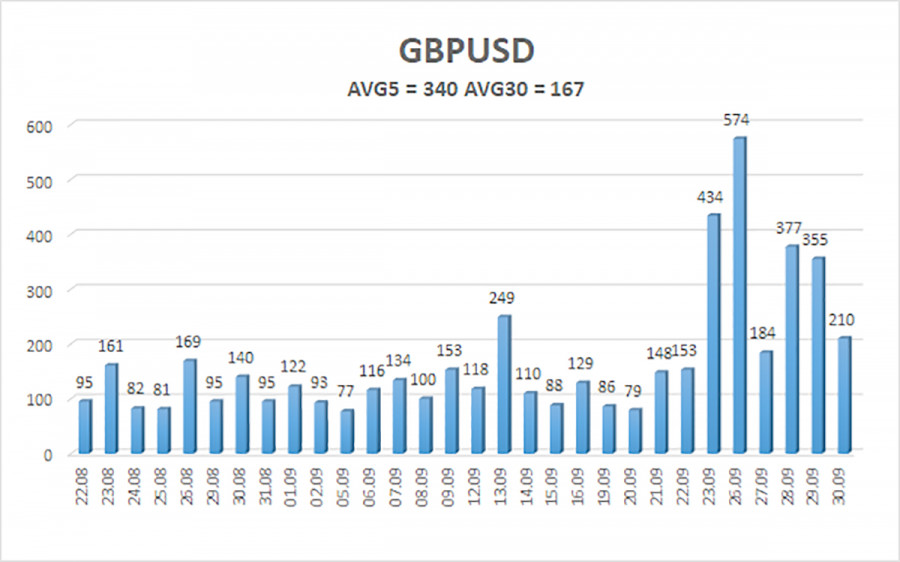

The average volatility of the GBP/USD pair over the last five trading days is 340 points. For the pound/dollar pair, this value is "very high." On Monday, October 3, thus, we expect movement inside the channel, limited by the levels of 1.0822 and 1.1504. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe may continue to increase. Therefore, at the moment, new buy orders with targets of 1.1353 and 1.1475 should be considered in the event of an upward reversal of the Heiken Ashi indicator. Open sell orders should be fixed below the moving average with targets of 1.0864 and 1.0822.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.