The focus of attention is still on inflation. UK data turned out to be slightly worse than expected, which led to a slight downward pullback of the GBP/USD pair; nevertheless, it is still significantly above the Bank of England's target levels. A little later, the inflation report will be published by Eurostat and will be followed by the release of the Beige Book from the US Fed in the evening.

Demand for risk remains high, and yields continue to increase despite the deterioration of global growth forecasts, reflecting markets' reactions to concerns about the long-term nature of inflation. The Fed's speeches were cautious, which slightly reduced demand for the US dollar – Michelle Bowman said she supports the start of a gradual decline in purchases this year (and preferably in November), while Christopher Waller is "very worried" about the risks of rising inflation and believes that the next few months will be "critical" for assessing the dynamics of inflation.

USD/CAD

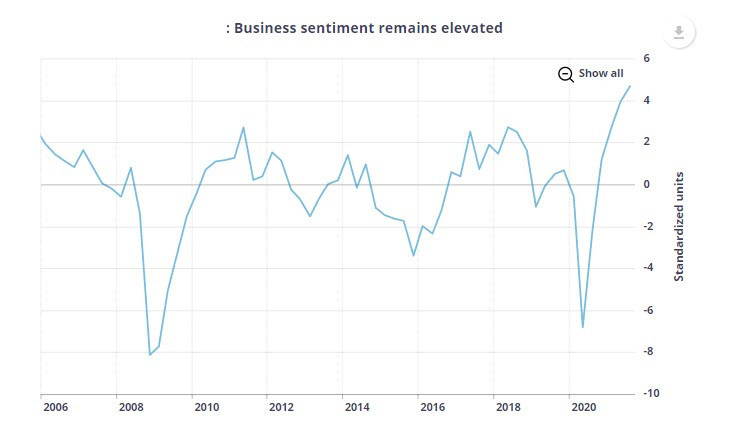

Recent research by the Bank of Canada shows the growing threat of inflation, which is gaining strength at a faster pace than in the United States. The main indicator of business sentiment in the Business Outlook Survey has gone above not only the dock levels but also exceeded the indicators before the 2008 crisis, which indicates an extremely positive mood.

Most companies expect an increase in domestic and external demand. They are also preparing to increase capital expenditures and suffer from an acute shortage of labor.

As the survey of consumer sentiment showed, a significant increase in spending is expected, which even the delta strain will not prevent. The yield of short-term Canadian bonds (an indicator of positive expectations) is growing faster than in the United States. A record proportion of companies believe that inflation will average above 3% over the next two years. The same opinion is shared by consumers.

Today, a report on Canadian inflation in September will be published, which is forecasted to rise to 4.3%. The only thing that inspires a certain threat is the risk of delayed deliveries.

The pressure on the Bank of Canada is rising, which increases the chances of a faster exit from the ultra-soft policy than previously predicted.

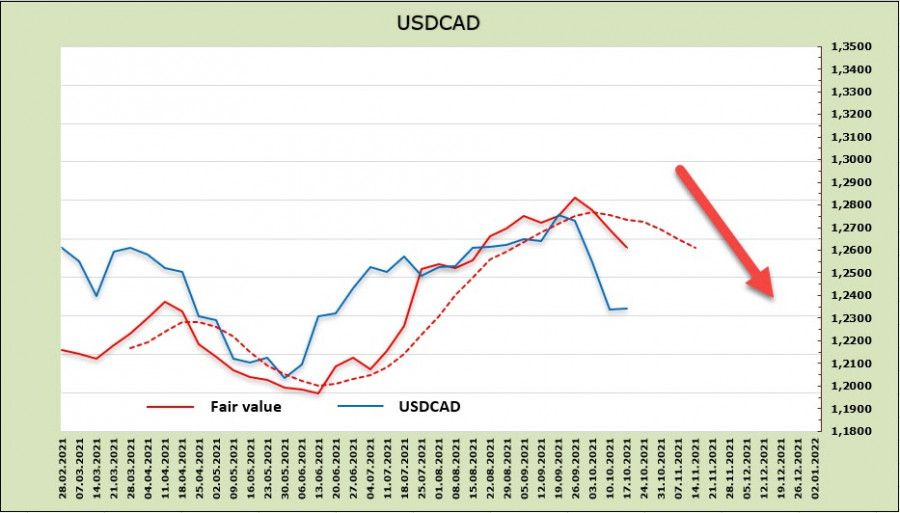

However, not everything is so simple. According to the CFTC, the net short position is not decreasing, so the decline in the target price cannot be considered long-term yet. At the same time, major players have not yet attempted to start forming a long position in CAD.

It can be assumed that short-term factors contribute to a further decline in the USD/CAD pair. A consolidation below the level of 1.2360 and even an attempt to go to 1.20 is likely, but until a long position is formed in the futures market, the chances of going below are regarded as low.

USD/JPY

The Japanese yen continues to lose position, which is caused by a number of both external and internal factors. First, the external ones include the increase in energy prices, which is quite a strong blow for Japan. A net importer – the trade deficit in September increased significantly to 625 billion yen against 272 billion a month earlier.

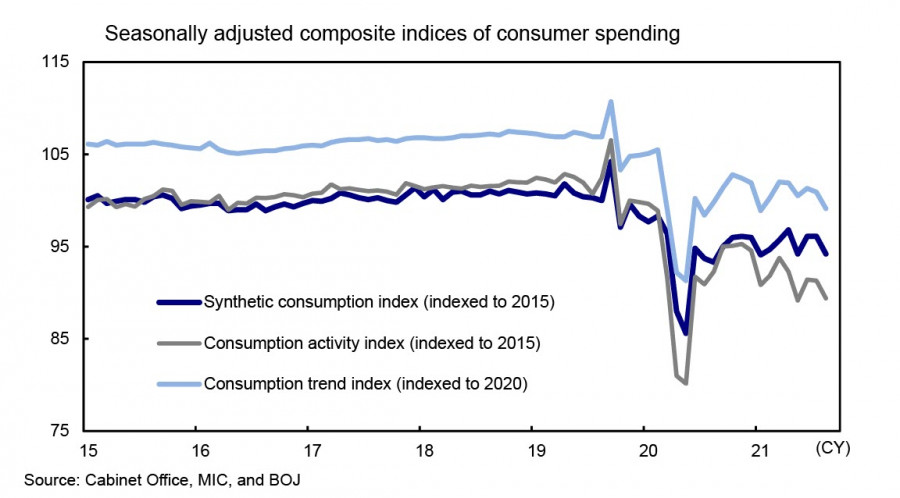

As for internal reasons, there is the adjustment of the financial policy after the Cabinet change, which will lead to an increase in budget expenditures, and the general economic situation. According to the Cabinet of Ministers, all 3 consumer spending indices (synthetic consumption index, consumption dynamics, and activity index from the Bank of Japan) decreased in August.

Looking at the graph, there was no pullback to the dock levels, and, as analysts at Mizuho Bank predict, further chaotic distribution of money to families by the state is unlikely to lead to an increase in spending.

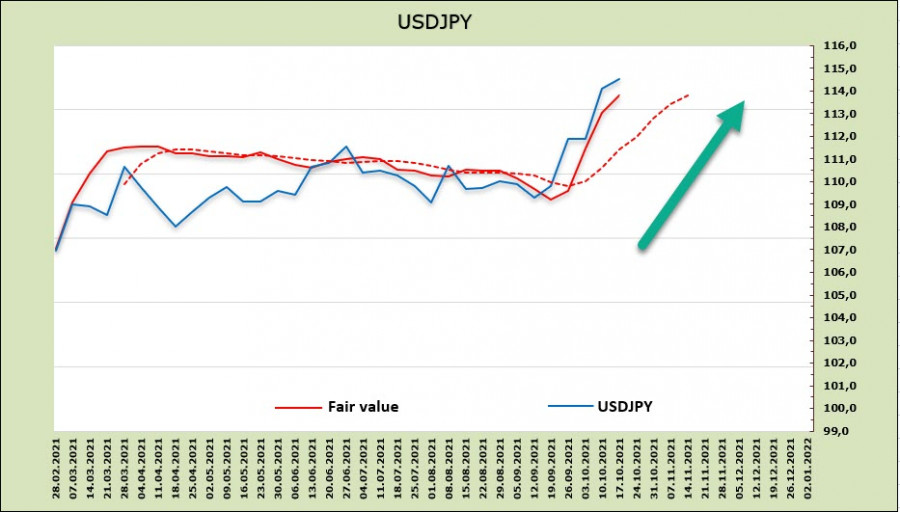

In the context of rising energy prices and declining consumer activity, it is not necessary to expect any measures from the Bank of Japan to get out of the ultra-soft policy, which, in turn, is obviously a bearish factor for the yen.

As reported by the CFTC, the yen's net short position rose by 1.29 billion over the reporting week, namely to -9.432 billion, making the yen an absolute outsider among the G10 currencies. The estimated price continues to move upward.

The USD/JPY is expected to continue its growth. There is currently an attempt to consolidate above the resistance zone of 114.50/70. Here, the next target is 118.70, and the long-term target of 125 remains relevant until the end of the year.