The GBP/USD currency pair also began to adjust on Friday. There were also no specific fundamental or macroeconomic reasons for this, as in the case of the euro currency. However, the pound, just like the euro, is very much oversold, and an upward correction has been brewing for several days. Therefore, from a technical point of view, the pair had to start a correction. We also believe that the sales plan has been exceeded in the case of the pound sterling. However, everything will depend, no matter how banal it sounds, on the traders themselves. If most of them or the largest players continue to get rid of the British pound (and COT reports now indicate exactly this), then the pound will continue to fall against the dollar. Also, as in the case of the euro currency, we recommend not to start buying the pair until clear buy signals begin to appear and an upward trend is formed.

As mentioned earlier, the pound now has less reason to fall. After all, the Bank of England has raised the key rate three times, and this week it may do it for the fourth time. Thus, so far the situation is as follows: the Fed is talking about raising the rate, and the Bank of England is raising it. Thus, in a very good way, now the pound should not fall against the dollar. Of course, the factor of geopolitics, the factor of the "reserve currency" of the US dollar, and the factor of the impending energy and food crisis in Europe play a role. But let's be honest, the crises haven't started yet, the problems in the UK and US economies are quite similar (high inflation), and geopolitics can't affect the pound forever. Thus, we still expect that at least a strong correction will begin in the near future, which may last several weeks.

Will the BA meeting become a starting point for the pound to go up?

A series of secondary reports will be published in the UK this week. These are business activity indices, which are unlikely to provoke a reaction from traders. However, the main event of the week will take place on Thursday - the meeting of the Bank of England. According to forecasts, the market believes in a fourth consecutive increase in the key rate to the level of 1.00%. We are also inclined to believe that the rate will be raised, but, as we can see, the tightening of monetary policy in the UK has not yet provided any support to the British currency. Over the past few weeks, doubts have appeared in the foreign exchange market that the rate will be raised in May. Experts have started talking about a pause in the tightening cycle, but we still believe that there will be no pause. So far, the UK economy shows no signs of slowing down, and inflation continues to grow, so the first three rate hikes have not had any special effect.

In the States, business activity indices in the service and manufacturing sectors will also be published this week, as well as the ADP report on the number of employees in the private sector, NonFarm Payrolls, and the unemployment rate. Of course, the key report will be Nonfarm Payrolls. The forecast for this indicator does not matter now, since everything will depend on how much the actual value will correspond to it. On Wednesday, the May meeting of the Fed will take place, at which (no one doubts this anymore) the rate will be increased by at least 0.5%. We put the BA meeting in the first place in terms of importance, and not the Fed because everything has been clear with the Fed for a long time. The market has probably already raised the rate five times in May, so we are waiting for a maximum surge of emotions during the announcement of the results of the meeting. In general, we can say that Wednesday, Thursday, and Friday can be very volatile, although now the volatility of the pound/dollar pair is already off the scale. We do not believe that the dollar will receive new fundamental support these days, most likely, the market will consider all the most important events of the week as an opportunity to take profits on short positions. We are waiting for the growth of the pound/dollar pair.

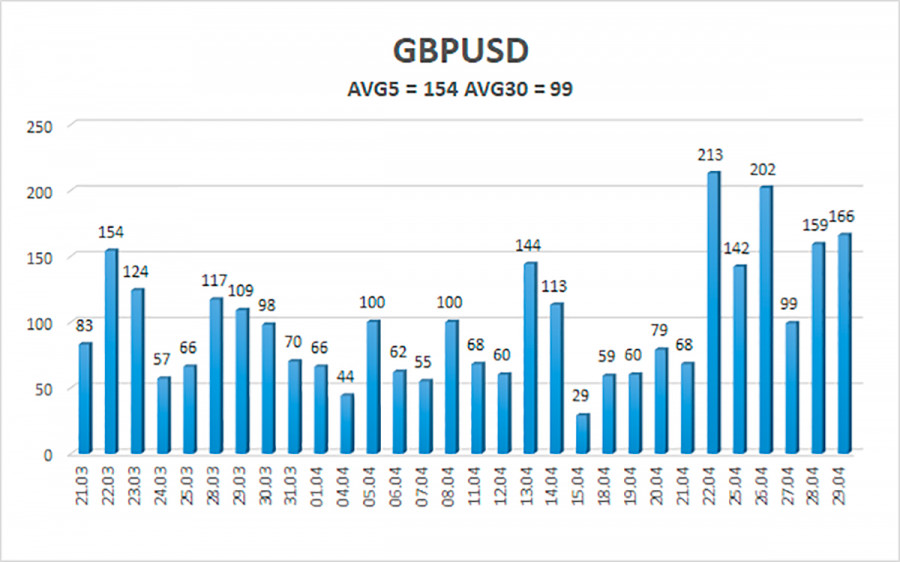

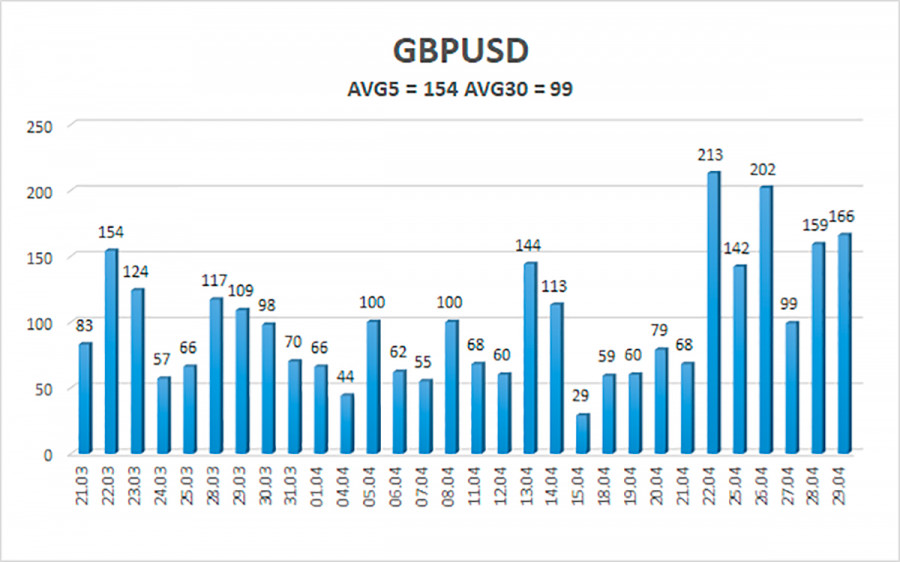

The average volatility of the GBP/USD pair over the last 5 trading days is 154 points. For the pound/dollar pair, this value is "high". On Monday, May 2, thus, we expect movement inside the channel, limited by the levels of 1.2419 and 1.2727. The upward reversal of the Heiken Ashi indicator signaled the beginning of an upward correction.

Nearest support levels:

S1 – 1.2451

S2 – 1.2329

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2695

R3 – 1.2817

Trading recommendations:

The GBP/USD pair began to adjust in the 4-hour timeframe. Thus, at this time, new sell orders with targets of 1.2451 and 1.2419 should be considered in the event of a downward reversal of the Heiken Ashi indicator. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2817.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.