Long positions on EUR/USD:

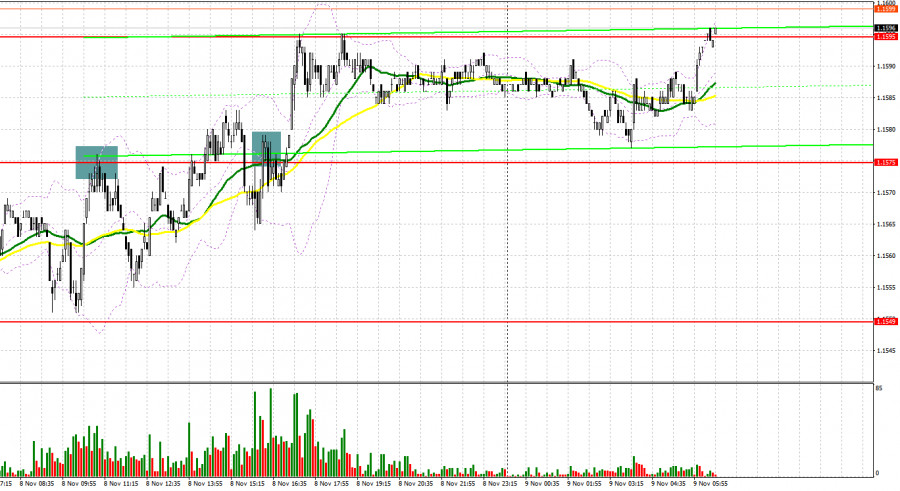

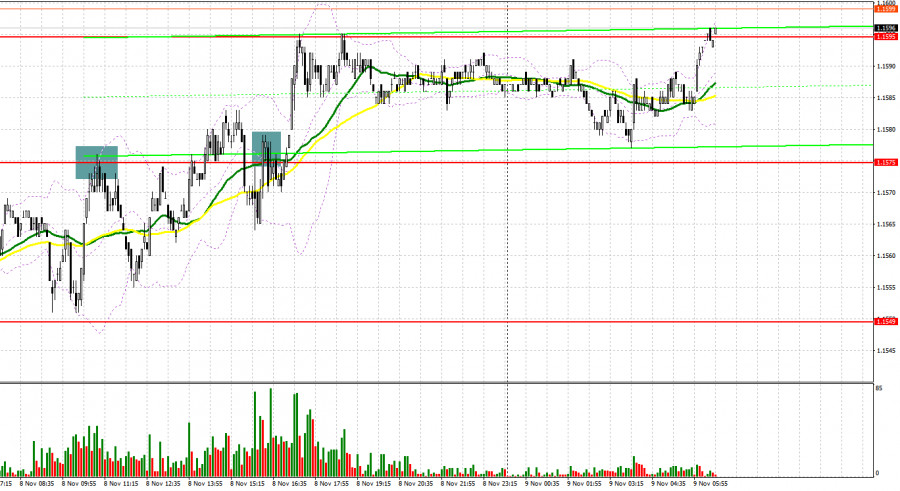

There were several entry signals on Monday. Let's look at the M5 chart and analyze the entry points. Due to an empty macroeconomic calendar, the market was bullish. In the previous review, the focus was on the level of 1.1575 where I told you to consider entering the market. Bulls failed to break above 1.1575 even despite positive economic sentiment forecasts in the eurozone. After several unsuccessful attempts to leave the range, a sell signal appeared. The price rose by just 15 pips and bulls had to return to 1.1575. In the second half of the day, a sell signal was produced after a failed attempt to break through 1.1571 and consolidate below it. Anyway, traders had no time to go short as the euro surged to 1.1595 and settled there at the close of the trading day.

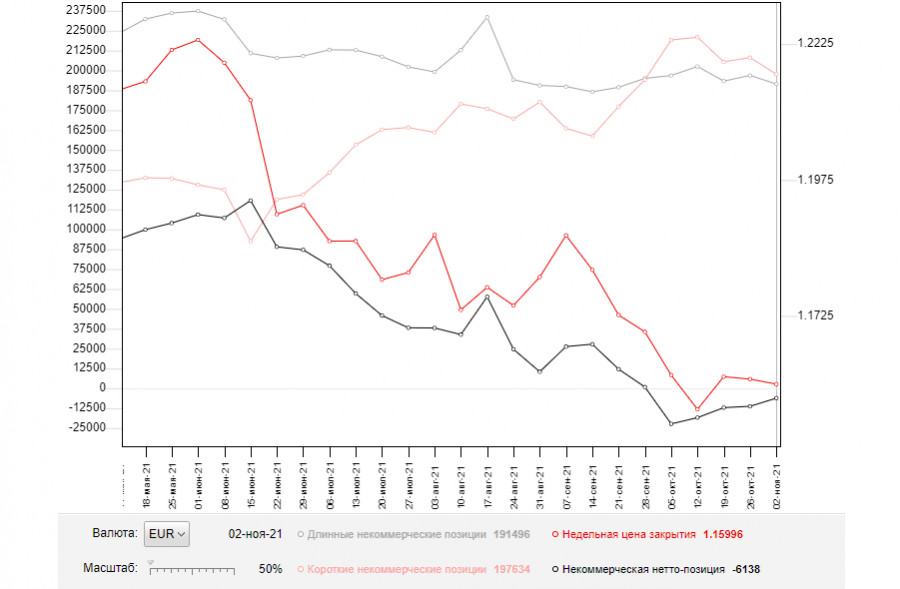

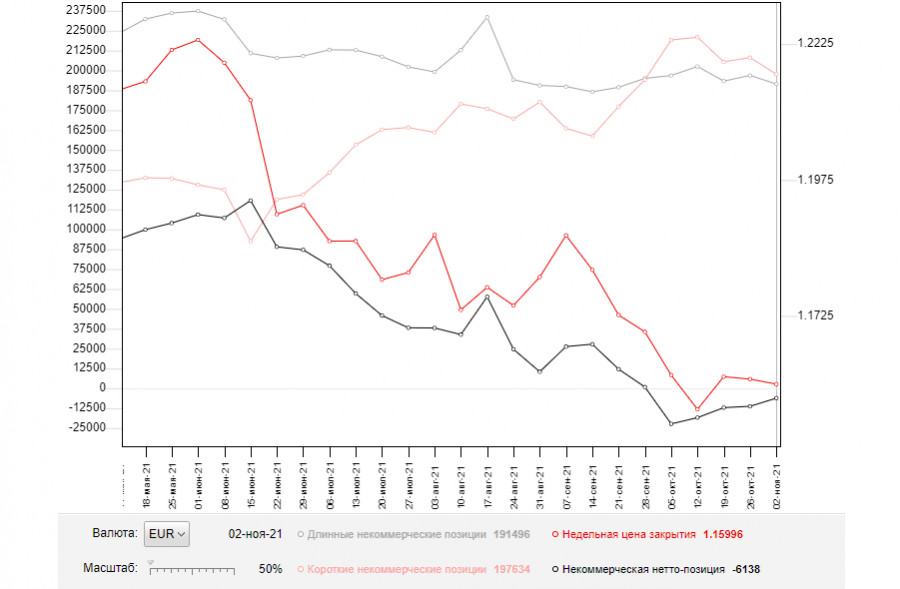

Before proceeding with the EUR/USD outlook, let's look at what was happening in the futures market and see how the Commitment of Traders changed. The COT report as of November 2 logged a decrease in both long and short positions, which led to a negative delta since more sellers had exited the market than buyers. The monetary policy meetings of the leading central banks last week had a minor impact on the market. The Fed's stance on monetary policy boosted investors' optimism and restored faith in the continuing economic recovery. At the same time, expectations that the ECB, despite all its statements, will have to tighten its policy soon amid rising inflation give EUR a chance to recover in the intermediate term. With each new fall in price, demand for the euro increases. Tomorrow, the United States will deliver its inflation report. The greenback's future movement versus its main counterparts depends on its outcome. According to the COT report, long non-commercial positions declined to 191,496 from 196,880 and short non-commercial positions fell to 197,634 from 208,136. The total non-commercial net position recovered slightly to -6,388 versus -11,256. The weekly closing price dropped to 1.1599 from 1.1608.

Today, a row of macroeconomic data will be published in the eurozone. The focus will be on the ZEW Economic Sentiment Index in Germany and the eurozone. If the figures beat economists' forecasts, it could provide support for the euro. Bulls' task for today would be to break and consolidate above 1.1606. A breakout and a retest of this mark bottom/top are likely to generate a buy signal. If so, the price could extend its upward movement and remain in a wider sideways channel. Another task would be to regain control over the resistance level of 1.1634. A breakout of this range and consolidation above it could produce an additional buy entry point. Consequently, EUR/USD could head towards the swing high of 1.1653 where traders should lock in profit. It would also be wise to open long positions in case of a downward correction to the support level of 1.1579 in the first half of the day. Bullish moving averages are located slightly below this mark. A false breakout there will make a strong buy signal. Traders could consider opening long positions immediately on a bounce only after the first test of the low of 1.1553 or from the level of 1.1527, allowing a 15-20 pips correction intraday.

Short positions on EUR/USD:

Bears failed to protect the resistance level of 1.1571. Today's speech by ECB President Christine Lagarde could change their plans to regain control over the market. In the first half of the day, bears' task would be to protect the resistance level of 1.1606 that the pair almost approached during the Asian session. A false breakout there is likely to generate the first sell signal and produce a strong entry point with the target at the support level of 1.1579. A breakout and a test of this range bottom/top are likely to increase pressure on EUR/USD. Consequently, the price might go down to the lows of 1.1553 and 1.1527. Traders should consider locking in profit there. In case of a bullish euro during the European session and the lack of bear activity at around 1.1606, short positions could be opened only after a test of the support level of 1.1634 and the formation of a false breakout there. The best option for going short would be on a bounce from the high of 1.1653, allowing a 15-20 pips correction.

Indicator signals:

Moving averages

Trading is carried out above 30- and 50-period MAs, indicating the formation of a new upward correction.

Important! The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

The pair is likely to rise in case of a breakout of the upper band at 1.1600. Support is seen at the lower band at around 1.1565.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.