The pound paired with the dollar continues to slide down, updating new price lows. Although recently, the British pound was the favorite of the foreign exchange market, thanks to hawkish rumors about possible actions of the Bank of England. Traders assumed that the British regulator would outpace the Fed and raise the interest rate by 15 basis points at the November meeting, reacting to a strong increase in inflation and good data in the labor market. But this scenario did not materialize.

At this year's penultimate meeting, the Bank of England adopted a cautious and wait-and-see attitude. Despite the fact that the "hawk wing" of the central bank was strengthened by another member of the Committee (Catherine Mann), most of her colleagues decided not to get ahead of the story.

As Andrew Bailey noted, before talking about the tightening of monetary policy parameters, it is necessary to look at the dynamics of key macroeconomic indicators without the influence of stimulus programs. And here it should be noted that one of these programs completed its operation quite recently, at the beginning of autumn (the so-called "Furlough-scheme").

At the same time, the latest data on the UK labor market were published only for August (unemployment rate, wage dynamics) and September (an indicator of an increase in the number of applications for unemployment benefits). Therefore, members of the Bank of England will be able to assess the state of the labor market without the influence of incentives only at the end of this year. In particular, the October unemployment rate will be published as early as December.

Additional pressure on the pound was also exerted by the latest data on the growth of the UK economy, which were published on Thursday.

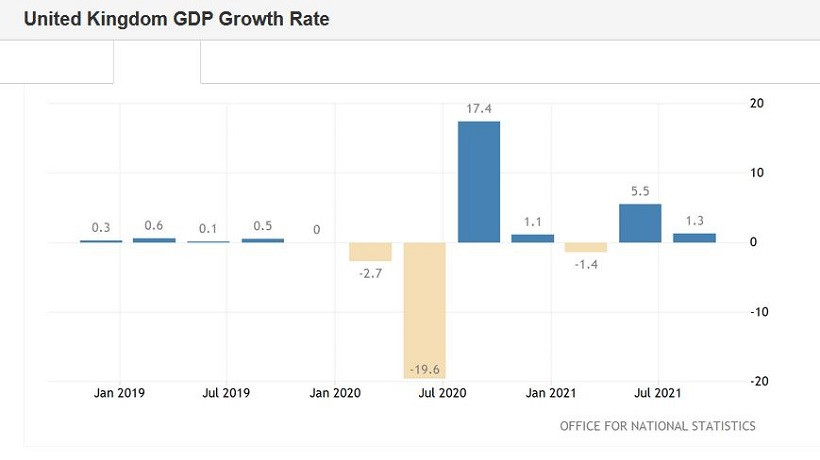

Thus, the volume of UK GDP in the third quarter grew by only 1.3% QoQ against the forecast of growth by 1.6%. For comparison, it should be noted that in the second quarter, the British economy grew by 5.5% QoQ.

As for the September results, on a monthly basis, the situation is comparatively better, but not by much. The key indicator climbed to 0.6%. But industrial production figures were disappointing. On a monthly basis, the indicator again "plunged" into the negative area, being at the level of -0.1% (with the forecast of growth to 0.2%). On an annualized basis, negative dynamics were also recorded: instead of the projected growth to 3.1%, the indicator increased only to 2.8% (in the previous month, an increase of 4.1% was recorded).

A similar situation has developed in the processing industry (-0.1% MoM, 2.8% YoY). In the service sector, both indicators entered the "red zone" - in quarterly terms, the indicator has been declining for the third month in a row. In general, almost all of the above-mentioned releases came out in the "red zone" on Friday, significantly falling short of the forecast values.

These numbers have significantly increased the pressure on the GBP/USD pair, especially against the background of the general strengthening of the greenback. The bears updated their multi-month low on Friday, reaching 1.3352. The last time the pair was at such price lows was in December 2020. During the American session, traders moved away from the reached lows. The so-called "Friday factor" makes itself felt - traders do not risk leaving deals for the weekend. By fixing profits, they thereby contribute to the development of a corrective pullback.

And yet, despite the notorious Friday factor, buyers of GBP/USD failed to gain a foothold in the area of the 34th figure. The US dollar is like a skating rink crushing currencies in dollar pairs - in one way or another, the greenback dominates in all pairs of the "major group."

In my opinion, the downside dynamics of GBP/USD is due not only to the strengthening of the dollar but also to the weakening of the pound. More recently, at the end of September, the British regulator was predicted to be one of the most aggressive central banks of the leading countries of the world.

BoE Governor Andrew Bailey said in early September that at the August meeting, the Committee was equally divided over whether the minimum conditions for raising the interest rate were met. Only the Reserve Bank of New Zealand, which was just planning to increase the interest rate, could boast of such a "hawkish" attitude then. Subsequently, the RBNZ nevertheless raised the rate, but the supporters of the strong pound remained "at a broken trough": the head of the British regulator said that "the Bank of England has never said that it plans to change policy at any particular meeting."

It is noteworthy that the pound ignored a rather hawkish signal on Friday, which was voiced, however, not by representatives of the British central bank, but by representatives of the expert community. Thus, the majority of economists surveyed by Reuters expressed confidence that the Bank of England will raise the rate to 0.25% (ie 15 basis points) at the last meeting this year - December 16. The "silent skepticism" about this forecast from GBP/USD traders suggests that hawkish expectations in the market have declined.

In other words, the pound has lost an important trump card that has been supporting it for several months. Perhaps, closer to the December meeting, traders will again "believe" the hawkish forecasts - but in the medium term, the pound will move in the wake of the US currency.

All this suggests that the downside trend for the GBP/USD pair has not exhausted itself. The pound's vulnerability is obvious, while the greenback continues to gain momentum across the market. Therefore, any more or less large-scale corrective price growth can still be used to open short positions.

Technically, the pair on the daily chart is located between the middle and lower lines of the Bollinger Bands indicator, as well as below all the lines of the Ichimoku indicator, which indicates the priority of the downward movement. The closest support level (the target of the downside movement) is 1.3350 - this is the lower line of the Bollinger Bands, which coincides with the upper border of the Kumo cloud on the daily chart. The main target of the downward trend in the medium term is the psychologically important level of 1.3300.