Analysis of previous deals:

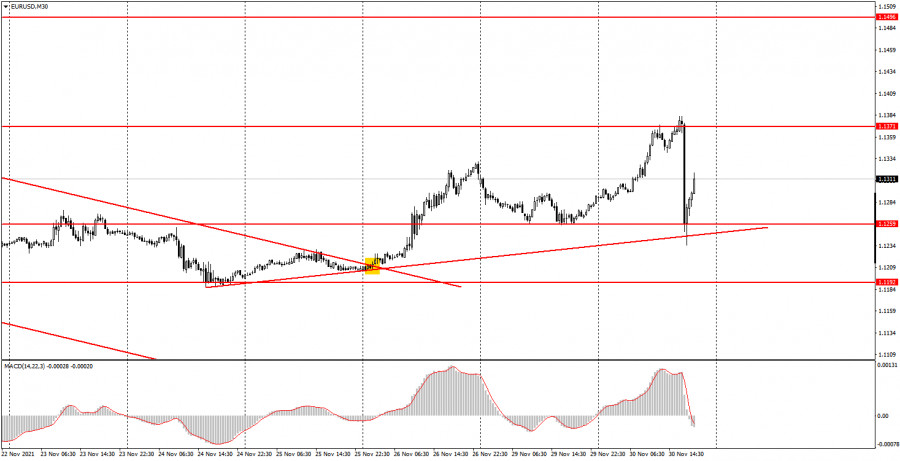

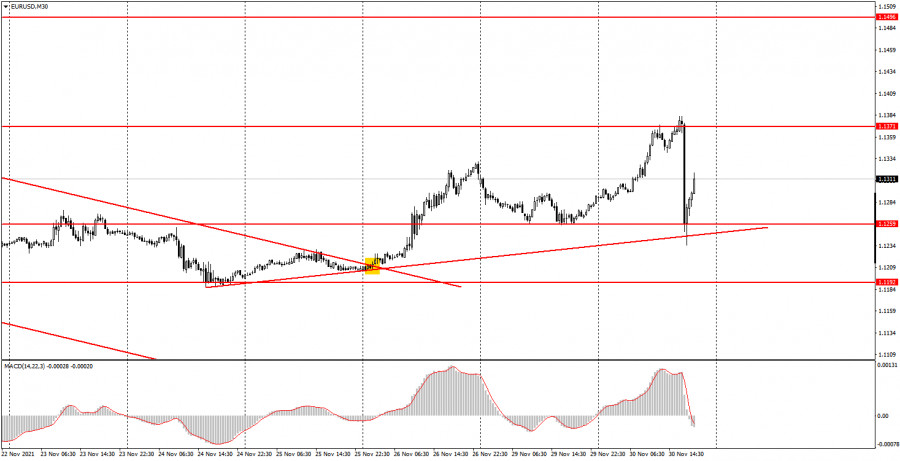

30M chart of the EUR/USD pair

The EUR/USD pair began the day with the resumption of the upward movement. Moreover, quite strong, which has already cast doubt on its validity. In the morning the European Union published a report on inflation for November, which, as it turned out, rose from 4.1% y/y to 4.9% y/y. However, this report did not generate any strong movement (the first checkbox in the chart below). The whole upward movement (the growth of the euro currency) happened just before this publication. The most interesting thing is that the growth of the euro was, it turns out, logical, since the acceleration of inflation in the EU increases the likelihood of a tightening of monetary policy by the central bank, which is a bullish factor for the currency. By a similar principle, the US dollar has grown in recent weeks and even months. However, how to explain the fact that the markets started buying up the euro much earlier than the report? Insider information? If so, then it was impossible to predict such a movement of the pair. It is also quite interesting that in the second half of the day the euro fell, but rather, it must be said: the dollar rose. Because the dollar rose in price against the euro and the pound after Federal Reserve Chairman Jerome Powell's speech began. As a result, the pair dropped to the upward trend line and bounced off it, which could be used as a buy signal.

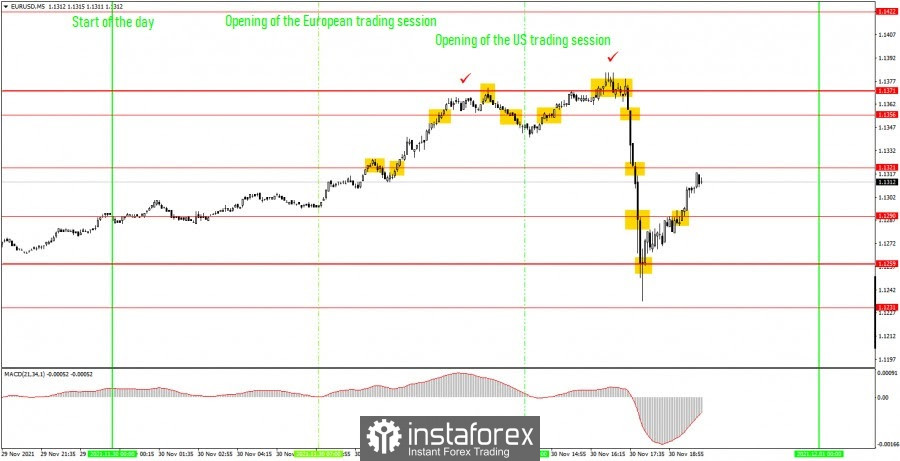

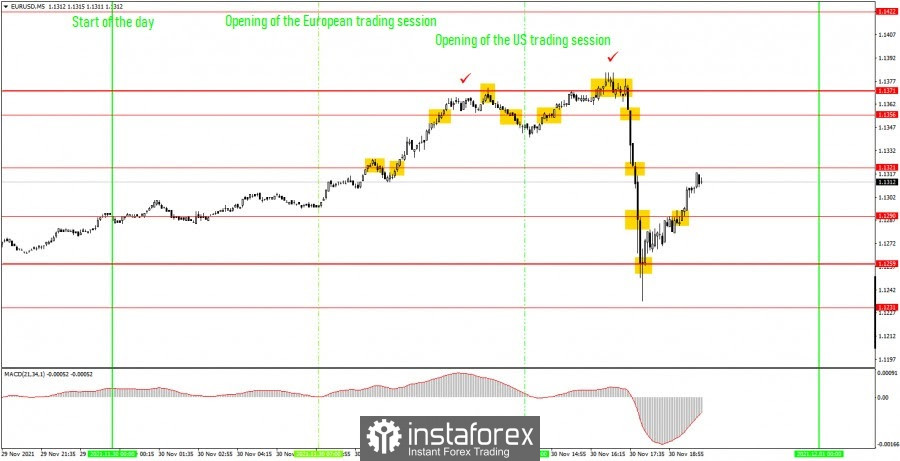

5M chart of the EUR/USD pair

The picture on the 5-minute timeframe on Tuesday was almost shocking. The volatility of the pair was about 140 points, with a strong movement in the first half of the day and in the second. Both up and down. Thus, a huge number of trading signals were formed during the day. It remains only to figure out how they should have been worked out. It all started pretty badly for novice traders. The pair bounced off the 1.1321 level, forming a false sell signal, which resulted in a 12 points loss. The next buy signal was more successful, and the pair worked out and bounced off the level of 1.1371, where the long position should have been closed at 35 points profit. And immediately open short positions on a sell signal. The downward movement did not last long, as the price settled back above the level of 1.1356. However, the levels 1.1356 and 1.1371 should be considered in a pair, as they are too close to each other. As a result, it was only necessary to work out a signal to sell for consolidation below 1.1356, and not for a rebound from 1.1371. It was formed at the opening of the US session, and could be canceled, since the price went far enough from the point of formation. However, with the start of Powell's speech (the second check mark), it began to move in the right direction, allowing novice traders to earn decent money - about 75 more points. The short position was very complex and controversial. It could have been skipped, but the newcomers in any case remained in profit after Tuesday. Moreover, it was also possible to work out a buy signal from the level of 1.1259, which also turned out to be profitable.

How to trade on Wednesday:

The downward trend has reversed on the 30-minute timeframe, but the upward movement is not strong. Thus, the euro's growth may continue for some time, but the movement is unlikely to be strong. However, long positions remain appropriate as long as the upward trend line remains relevant. The key levels on the 5-minute timeframe as of December 1 are 1.1192, 1.1231, 1.1259, 1.1290, 1.1321, 1.1356, 1.1371. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - to breakeven when the price passes in the right direction by 15 points. At the 5M TF, the target can be the nearest level if it is not too close or too far away. If it is, then you should act according to the situation or work according to Take Profit. The European Union will publish a report on business activity in the manufacturing sector (weak) on Wednesday. In the US, we have the ADP report on changes in the number of employees in the private sector and the ISM manufacturing index. US reports are more likely to be used up by the markets.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.