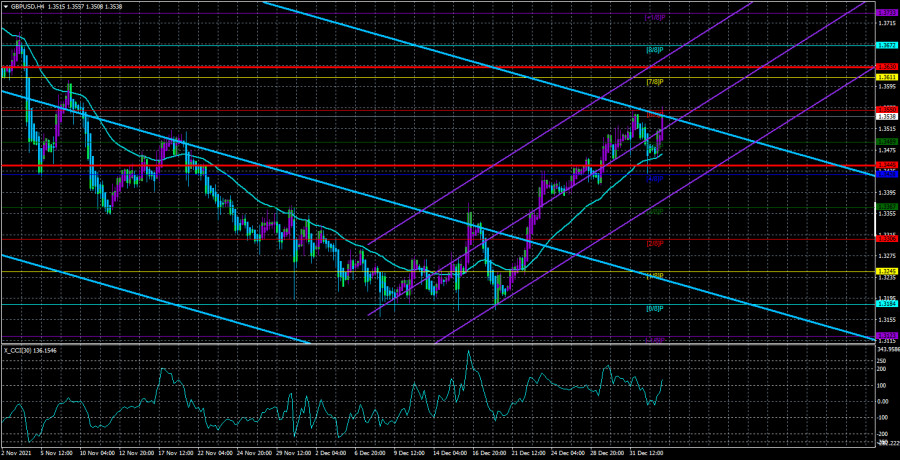

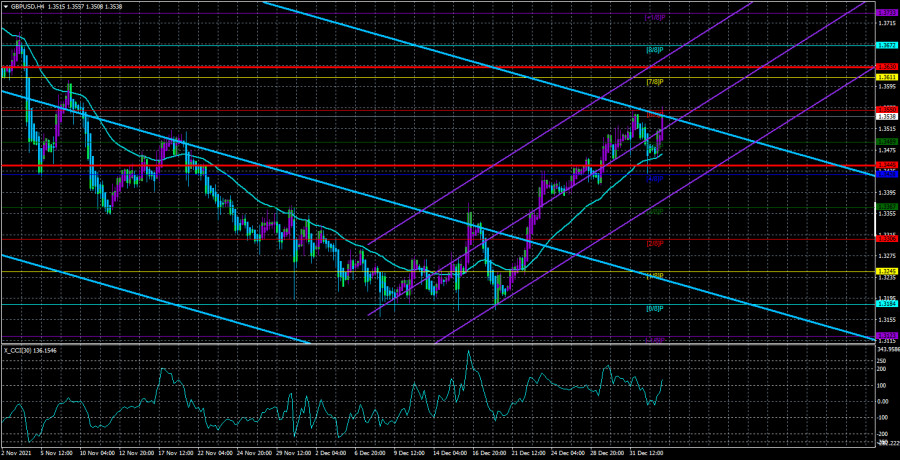

The GBP/USD currency pair also fell on Monday. However, at the same time, an unambiguous upward trend remains for the pound/dollar pair. And even yesterday, when the price worked out the moving average line, it bounced off it and then resumed its upward movement. Or at least maintained the upward trend of the 4-hour TF. Thus, the pound continues to grow against the US dollar. And, most likely, this process continues to be carried out solely based on a technical factor. We have already said earlier that the British pound could not overcome the Murray level of "0/8" - 1.3184 on the current TF, and also failed to overcome the 38.2% Fibonacci level on the 24-hour timeframe. There was a double rebound from important levels at once. In addition, the pound fell in price until the last growth area for quite a long time, so a technical correction was brewing in any case. But whether the British currency will be able to continue its upward movement without having any fundamental reasons for this is a big question. By and large, the only support for the pound remains the Bank of England, which at the end of 2021 quite unexpectedly raised the key rate by 0.15%. Of course, this does not mean that the second and third rate increases will now follow. This does not even mean that the British regulator will raise the rate at least once again in 2022. Nevertheless, the pound has some support due to this factor. At the same time, nothing else. We believe that in the coming months, the pound may grow solely on the basis that all the factors of the dollar's growth could have already been won back by the market several times. Recall that over the past six months, when the dollar was actively growing, it also did not have a large number of supporting factors. The market was actively buying up the US currency on expectations of QE curtailment and rate hike. Now, these factors have been worked out "in advance" many times.

In the UK, the year starts with secondary reports.

If a super-important Nonfarm report is published in the States this week on Friday, then nothing is planned in the UK except for a couple of business activity indices. But about everything in order. This week, the PMI for the manufacturing sector for December was already published in Britain, which increased slightly compared to November. Tomorrow, the PMI will be published for the service sector, which was supposed to suffer in December due to a new "wave" of the pandemic. And on Friday, another PMI for the construction sector will be released. These are all the planned publications for this week in the UK. Recall that the number one topic there remains a new "wave" of the "omicron strain", which continues to spread and infect the British.

But in the USA, in addition to NonFarm Payrolls, the unemployment rate and the payroll report will also be published. To be honest, these two reports have much less impact on traders than the Nonfarm report. But under certain conditions, they can also affect the dollar exchange rate. Most likely, the following situation is possible. The Nonfarm report will come out much stronger or much weaker than the forecast, and the data on unemployment and wages will only strengthen the effect of the first report. But in any case, this is important data and it should not be ignored.

In the UK, Prime Minister Boris Johnson has already managed to speak in the New Year, who said that no strict restrictions will be introduced in connection with the omicron strain in the country. Despite the continued increase in the number of diseases, almost all patients carry the disease easily, so there is no need to tighten quarantine, Johnson said. He also said that the UK is in a much better position than several other countries because of the highest rates and levels of vaccination. He also urged everyone who has not yet received the vaccine to do so in the near future, because this is the only way to avoid the burden on the healthcare system. At the same time, Johnson noted that now there is no question of ending the pandemic and urged everyone to remain vigilant.

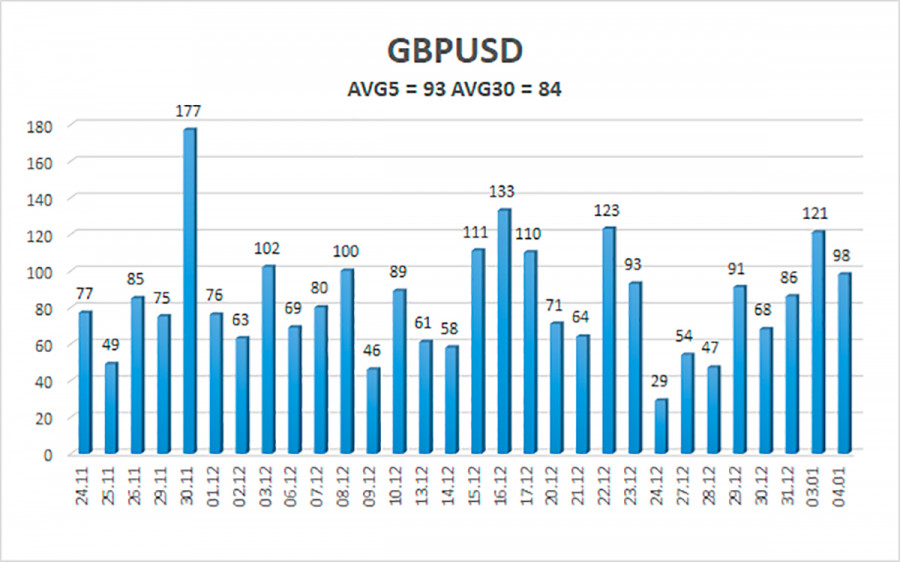

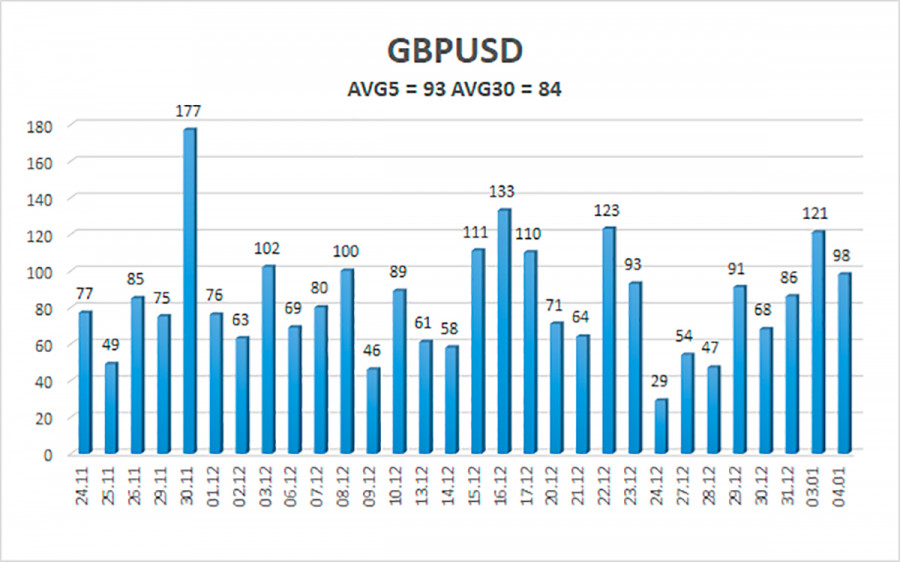

The average volatility of the GBP/USD pair is currently 93 points per day. For the pound/dollar pair, this value is "average". On Wednesday, January 5, therefore, we expect movement inside the channel, limited by the levels of 1.3445 and 1.3630. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time, stay in the longs with targets of 1.3611 and 1.3630 until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed back below the moving average with targets of 1.3428 and 1.3367, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.