The EUR/USD currency pair continued its downward movement on Tuesday, fully confirming our assumptions. Recall that we are currently considering two possible scenarios. The first is a downward trend that has been going on since 2021. This option also explains the recent growth of the pair to the level of 1.1475: we assume that this was an "acceleration" before a new attempt to overcome the level of 1.1230. The second option is to return the pair to the side channel 1.1230-1.1360. But in this case, the minimum is also expected to fall to the level of 1.1230, since the price has already rebounded from the upper limit of the channel. In general, at the beginning of this week, the movement of the pair was quite calm, the participants of the foreign exchange market did not show any nerves. But the nearest "neighbor" of the euro currency, the pound fell against the US currency much more intensively. It turns out to be a situation in which the pound first rose much more than the euro currency, and now it is falling much more than the euro currency. But in any case, both major pairs have adjusted and are now ready for a new round of the downward trend. Fundamental factors do not yet give grounds to assume that the US dollar will stop getting more expensive. We have already said that the movement to the south can stop only when the bears get tired of the pair's sales, but the fundamental background can support the US dollar for a long time. Especially if the Fed does not deviate from the planned path of tightening monetary policy.

Can the Fed announce a rate hike as early as January?

In principle, the key and only important event of today is the Fed meeting. Of course, after the announcement of the official results of the meeting, Jerome Powell will make a speech, but now more attention will be focused not on his rhetoric, but specific decisions of the US central bank. The fact is that the markets are already more or less familiar with the Fed's action plan. Thus, Jerome Powell can hardly surprise them now by saying that in March the QE program will be fully completed or the first increase in the key rate will take place. But the Fed is quite capable of surprising by raising the key rate in January. Of course, the probability of this is small, but recall that the probability of a key rate increase by the Bank of England in December was also small. In recent weeks, many experts have spoken out in favor of the fact that this year the Fed may raise the rate not even 3 to 4 times, but 6 or 7 times. A couple of months ago, this option looked like a fantasy. However, difficult times require difficult decisions. The Fed, like many other central banks, has struggled for years with a stagnant economy and low inflation, but now it is forced to struggle with high inflation, which is also a double-edged sword. The fact is that the growth rate of the economy has begun to return to normal, but inflation is very high. If it returns to 2% now, it will mean a serious cooling and slowing of the economy. Consequently, its growth rates may decrease to zero or minimal, which is unlikely to be included in the Fed's plans. But at the same time, Powell and the company simply have no other choice. Prices in the US are rising too fast. The lower strata of the population are forced to face depreciation of their incomes and wages. Therefore, we are almost certain that the Fed will continue to bend the "hawkish line" this year. Well, for the dollar, this means that its chances of growth are growing again. The more times the Fed raises the rate in 2022, the more likely it is that the dollar's advantage over the euro and the pound will remain all this time. As for today's meeting, the same dependence will work here: the more hawkish decisions are made, the more hawkish decisions are made, the stronger the dollar will grow following the results of the monetary committee meeting. But do not forget that in any case, we are talking about the reaction of the market. It should be remembered that the nature of a fundamental event does not always coincide with the reaction of market participants.

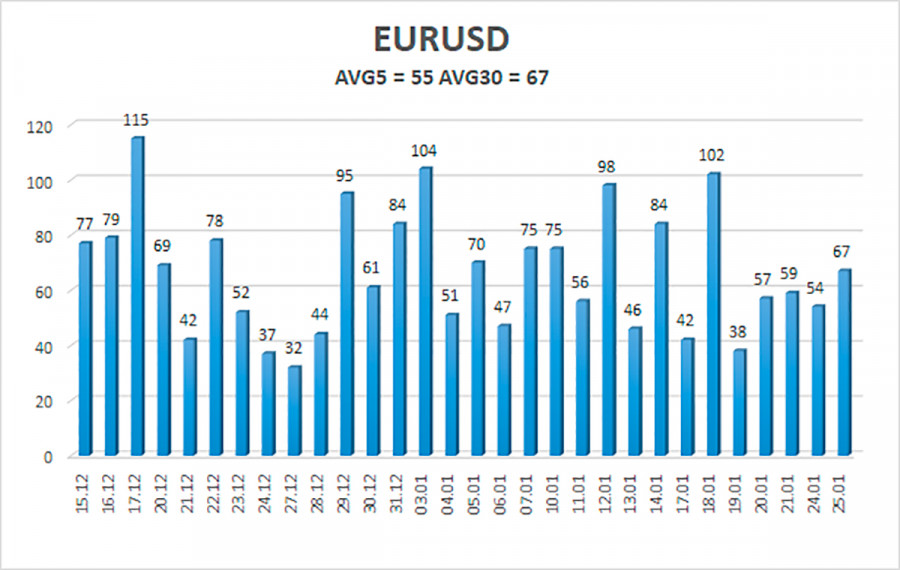

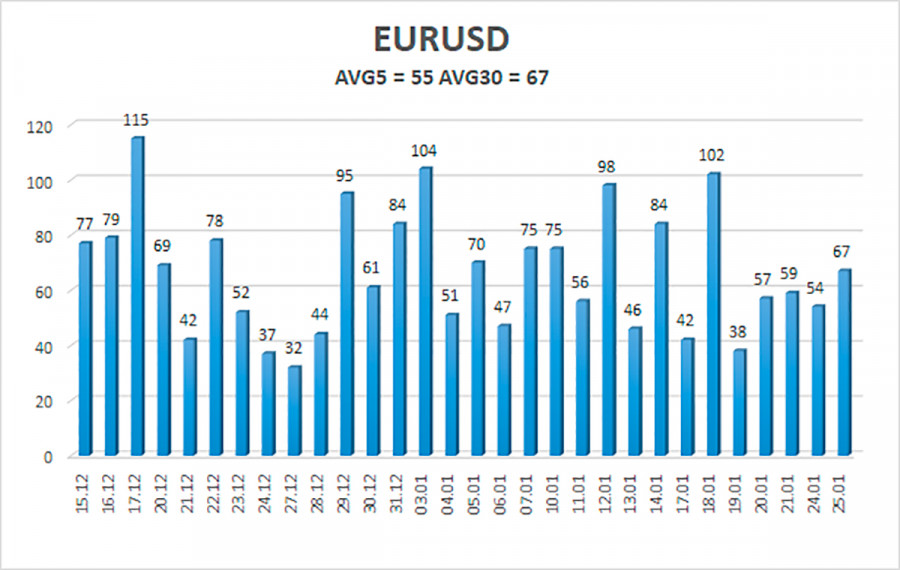

The volatility of the euro/dollar currency pair as of January 26 is 55 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1229 and 1.1339. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.1261

S2 – 1.1230

S3 – 1.1200

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1322

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues its downward movement. Thus, now you should stay in short positions with targets of 1.1261 and 1.1230 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1383 and 1.1414.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.