Trades analysis and trading tips

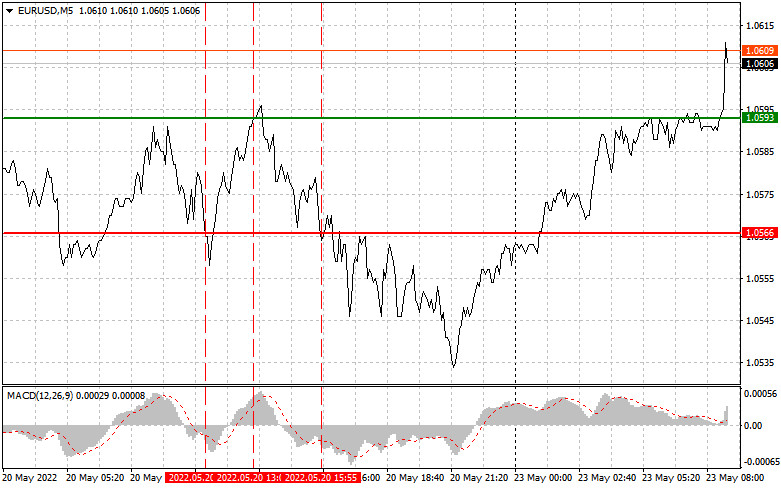

Last Friday, the pair tested many new levels mentioned in my previous review, but there were still no good points to enter the market. The first test of the 1.0566 level in the first half of the day came at the moment when the MACD indicator moved far down from the zero mark, which limited the downside potential of the pair. For this reason, I did not open a sell position and waited for the second scenario to buy the euro. However, this scenario did not come true since there was no retest of this level from top to bottom. In the afternoon, the rise and the test of the level of 1.0593 happened at the moment when the MACD indicator moved far up from the zero mark. I decided not to buy the euro as the upward potential could be limited at the end of the week. The second decline of the pair took place in the middle of the American session, and the level of 1.0566 was tested in the same way it happened in the morning. I was again left without good entry points although the pair went down about 20 pips.

On Friday, the speech by ECB Council member Joachim Nagel and the data on consumer confidence in the euro area did not surprise traders at all although it still limited the upward potential of the pair. Today, I advise traders to focus on Germany's macroeconomic data and the report of the Bundesbank. Markets will also watch the data on the ifo Business Climate Index for May 2022. The preliminary estimates are rather encouraging, so we can expect strengthening in risk assets, including the European currency. The speech by ECB board member Joachim Nagel is unlikely to have any impact on the euro, so it can be skipped. Today in the afternoon, there will be no important news releases, which may notably limit volatility in the market. As for the Fed, markets have got used to its rhetoric, so the interview of FOMC member Rafael Bostic is unlikely to influence the US dollar or help it win back losses against the European currency.

Buy signal

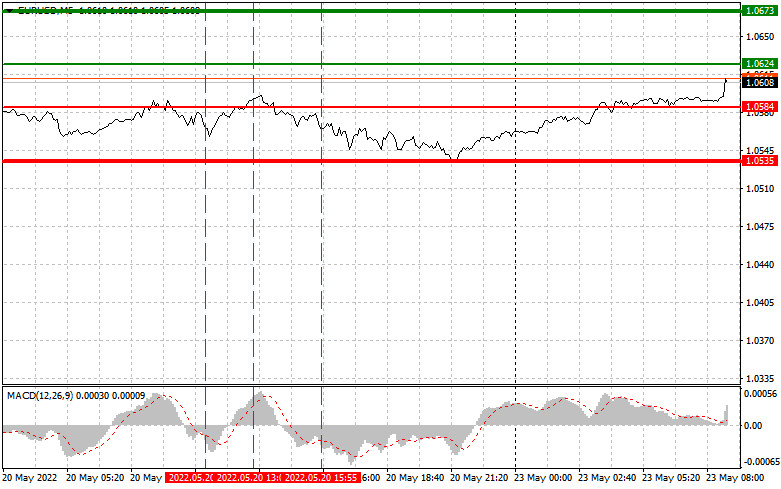

Scenario No. 1: today, it is possible to buy the euro when the price reaches 1.0624 (green line on the chart) with the upward target at 1.0673. I recommend exiting the market as soon as the price hits 1.0673. You may also consider selling the euro keeping in mind a backward movement of 30-35 points in the opposite direction from the entry point. There is a good chance that the euro will rise in the first half of the day. Yet, it is unlikely to make a significant move amid the lack of the fundamental background in the afternoon. Note! Before buying the pair, make sure that the MACD indicator is above the zero line and has just started to rise from it.

Scenario No. 2: you can also buy the euro when the price reaches 1.0584, but the MACD indicator should be in the oversold area at this moment. This will limit the downward potential of the pair and lead to an upside reversal. A rise towards the opposite levels of 1.0624 and 1.0673 is possible.

Sell signal

Scenario No. 1: it is possible to sell the euro upon reaching the level of 1.0584 (red line on the chart) with the target at 1.0535. At this point, I recommend exiting the market and buying the euro immediately, keeping in mind a backward movement of 20-25 pips in the opposite direction from the level. The euro will come under pressure if the bullish activity declines after the price tests new daily highs. Be very careful as the euro may weaken at any moment. Note! Before selling the pair, make sure that the MACD indicator is below the zero line and has just started to decline from it.

Scenario No. 2: you can also sell the euro today if the price reaches 1.0624, but the MACD indicator should be in the overbought area at this moment. This will limit the upward potential of the pair and lead to a downside reversal. A decline towards the opposite levels of 1.0584 and 1.0535 is possible.

On the chart:

The thin green line is the entry price to buy the trading instrument.

The thick green line is the estimated price where you can place a Take Profit or lock in profit manually since further growth is unlikely above this level.

The thin red line is the entry price to sell the trading instrument.

The thick red line is the estimated price where you can place a Take Profit or lock in profit manually since a further decline is unlikely below this level.

The MACD indicator is important for checking the overbought and oversold zones.

Important: beginners on Forex need to be very careful when making their entry decisions. It is better to stay out of the market ahead of important news releases in order to avoid sharp price fluctuations. If you decide to trade at the moment of publication, then always place stop-loss orders to minimize losses. Without a Stop Loss, you can easily lose your entire deposit, especially if you do not follow money management and trade in large volumes.

For successful trading, you need to have a clear trading plan, like the one presented above. Spontaneous decision-making based on the current market situation is a losing strategy for an intraday trader.