Trading recommendations

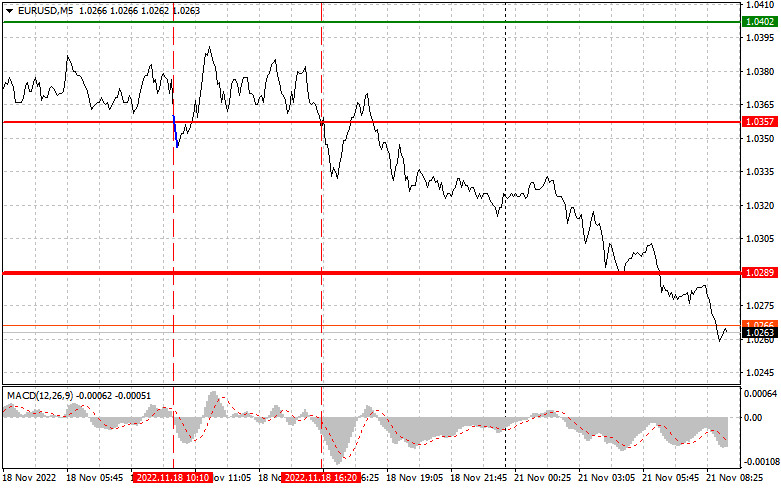

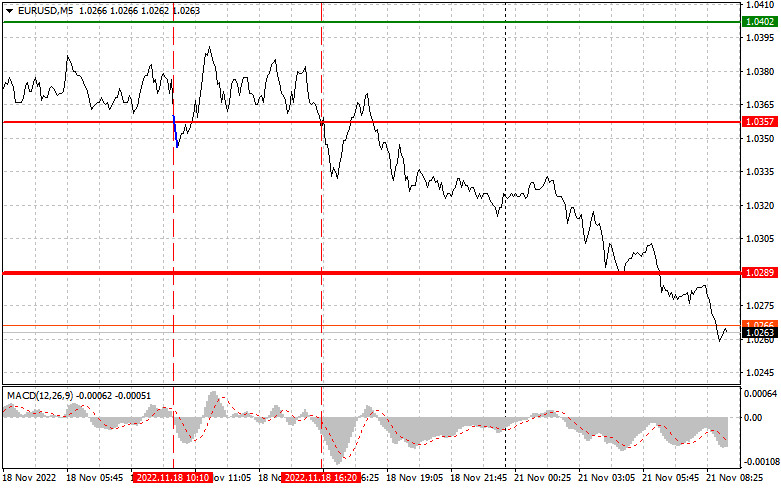

The price tested 1.0357 when the MACD indicator started moving downwards from zero. This proved that the entry point for sell orders was right. However, the pair failed to show a considerable drop. As a result, traders suffered losses. In the second part of the day, the pair once again tested 1.0357, but the MACD indicator was well below zero. That is why I decided to avoid sell orders and not to enter the market, but it was a false assumption. Pressure on the euro returned and the pair continued falling.

The ECB president's speech did not support the market and the pair had no reason to continue its rally in the first part of the day. What is more, the US dollar was supported by the US existing hone sales data. Today, there are no reports that may boost the euro/dollar pair. Early today, Germany will disclose its producer price data. If the indicator slackens, traders may sell the euro within the day, since lower inflation will allow the ECB to calm down. In the second part of the day, traders may focus only on the Chicago Fed National Activity report. Against the backdrop, the market volatility is expected to be modest.

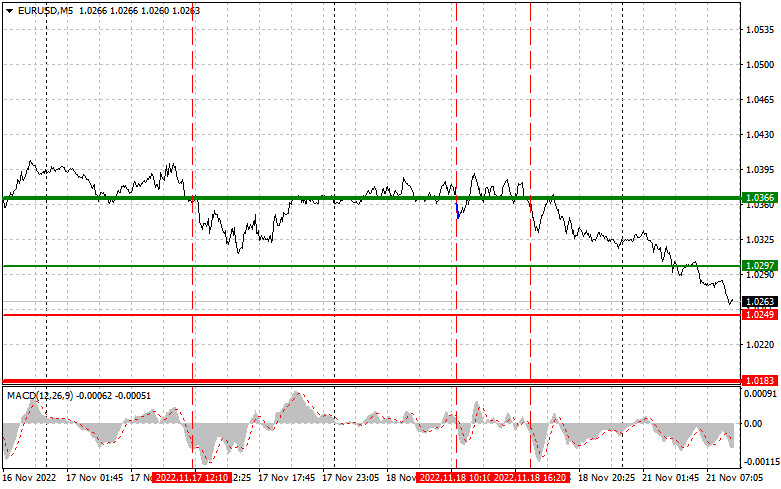

Signals to buy EUR/USD:

Scenario 1: today, traders may buy the euro if the price hits 1.0297 (a green line in the chart) with the target at 1.0366. At this level it is recommended to leave the market and open an opposite order, expecting a change of 30-35 pips. Later, the pair will hardly show a rise. Only strong inflation data may boost the pair. Notably, before opening buy orders, make sure that the MACD indicator is above zero and is starting to climb from this level.

Scenario 2: traders may also go long if the price touches 1.0249. At that moment, the MACD indicator should be in the oversold area, which will cap the downward potential of the pair. This, in turn, will lead to a market reversal. In this case, the pair may rise to 1.0297 or 1.0366.

Signals to sell EUR/USD:

Scenario 1: traders may sell the euro once the price reaches 1.0249 (a red line in the chart). The target is located at 1.0183, where it is recommended to leave the market and open buy orders, expecting a rise of 20-25 pips. Pressure on the euro is likely to remain intact, especially amid news from China about a new wave of coronavirus. Notably, before opening sell orders, make sure that the MACD indicator is below zero and is starting to drop from it.

Scenario 2: today, traders may also sell the euro if it hits 1.0297. At that moment, the MACD indicator should be in the overbought area. This will cap the upward potential of the pair and cause a downward reversal of the market. The price may slide to 1.0249 and 1.0183.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.