Risk appetite unexpectedly decreased on Wednesday as stock markets turned red, yields fell, and the US dollar slightly recovered from the previous days' losses. The rally that was about to form after last week's FOMC meeting came to a halt.

The economic reports on Wednesday were neutral – inflation unexpectedly decreased in the UK, while consumer sentiment is recovering in both the US and the eurozone. Federal Reserve representative Harker also contributed to the shift in sentiment by warning the market that numerous factors could still hinder a soft landing, and expectations are outpacing incoming data.

Nevertheless, the situation has not fundamentally changed – markets expect the Fed to lead the way in interest rate cuts, with other central banks acting with a lag, ensuring the dollar's weakness. There are no reasons to expect a deviation from this scenario at the moment.

USD/CAD

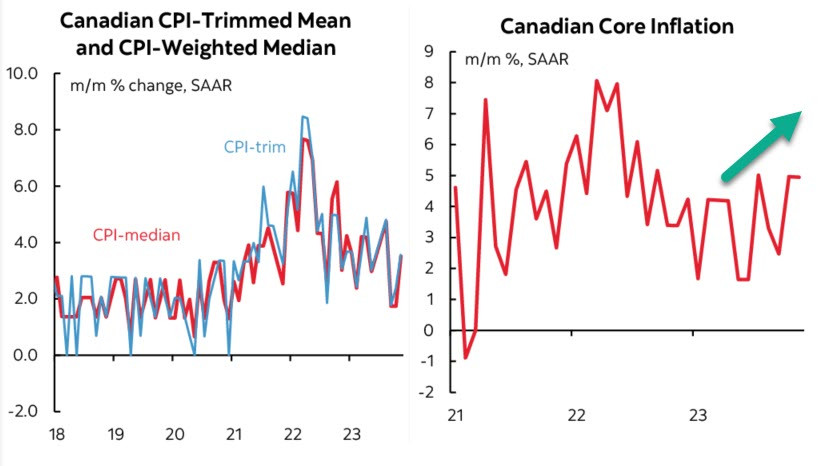

Canada's annual inflation rate unexpectedly remained at 3.1% in November, instead of the expected decrease to 2.9% YoY, and the core index even increased from 2.7% to 2.8%. Inflation in Canada is more inclined to rise than fall, and such a conclusion could be a reason to reassess the Bank of Canada's actions and the market prospects for the loonie.

The inflation report supported the loonie, which strengthened to its highest level since August. Wages, when compared to inflation, are high, even too high, as labor productivity is declining. Considering that a third of workers are unionized, it will be very challenging to slow down the wage growth. The primary source of both price and wage growth has been the service sector, with goods prices playing a lesser role. What will happen if commodities start to rise? Inflation will resume its growth, preventing the Bank of Canada from ending the rate hike cycle.

Since the Bank of Canada previously announced that discussions about rate cuts will not begin until core inflation shows a stable decline for at least a few months, we can assume that conditions have formed for supporting the CAD's growth. Markets will play out this situation for a long time.

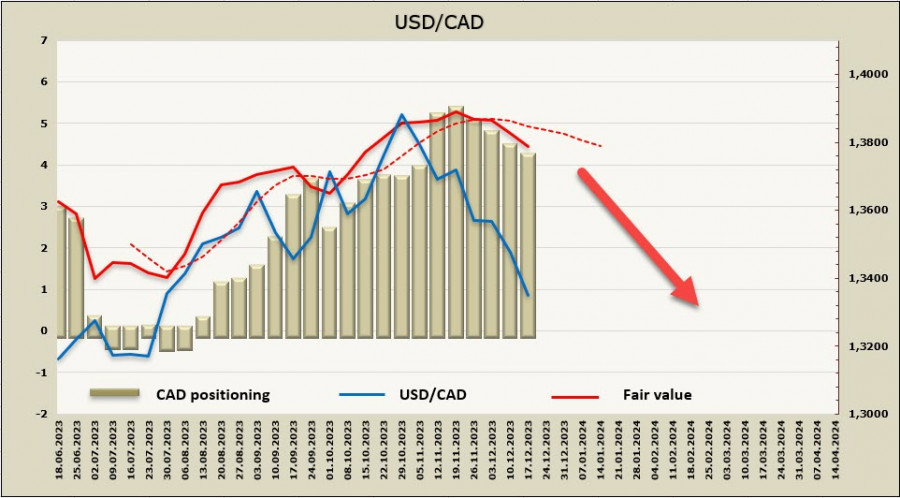

The net short CAD position decreased by 191 million to -4.065 billion over the reporting week. A bearish bias, despite the decrease in the volume of short positions observed for the fourth consecutive week. The price is below the long-term average and continues to move further to the downside.

USD/CAD overcame the support at 1.3380/3400 and consolidated below this mark. The pair has a good chance of falling further, the Christmas lull and the growing probability of a technical correction may prevent the loonie from rising. A possible bullish pullback will meet the resistance at 1.3380/3400, where the sell-off may resume, the nearest target is the technical level of 1.3233, then 1.3090.

USD/JPY

The Bank of Japan, as expected, kept quantitative and qualitative easing with yield curve control policy unchanged. The discount rate remains at -0.1 percent and the target yield on the 10-year bond remains around 0, with an upper bound of 1.0 percent as the benchmark rate.

The BOJ gave no indication of plans to tighten policy in 2024 and even expressed a pledge to "not hesitate to take additional easing measures if necessary." The results of the meeting relieved some nervousness amid rumors that the BOJ might consider a rate hike at Tuesday's meeting.

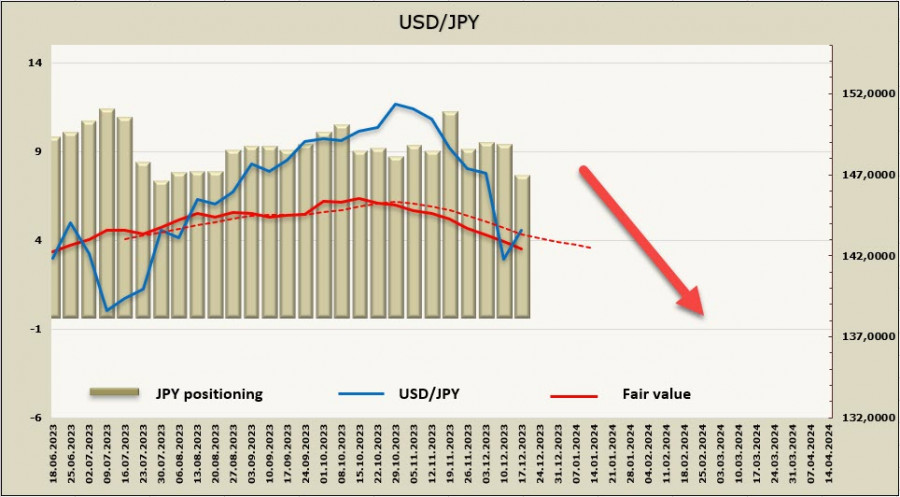

The Fed has shifted from the "where to stop" mode to the "when it is appropriate to start reducing rates" mode, while the BOJ is preparing to raise rates. This contrast, especially when the first steps are taken by either bank, serves as the main force that will continue to exert pressure on the USD/JPY pair. The BOJ also said that it would act very cautiously and raise rates when this increase is already fully priced in by the market. Accordingly, the yen will continue to strengthen until it reaches equilibrium.

The net short JPY position decreased by 1.943 billion, the most significant change among major currencies, reaching -6.972 billion over the reporting week. The bearish bias remains intact, considering the accumulated imbalance that favors weakness over many months. However, the trend toward buying the yen is becoming more noticeable. The price is below the long-term average and continues to fall.

Neutral outcomes of the BOJ meeting, where rumors of a possible rate change were not confirmed, allowed the dollar to recoup some losses against the yen. However, the overall trend remains the same. At the moment, the pair is consolidating, and the most likely scenario is a decline to the recent low of 140.98, followed by the target of 139.40/80.