Trade Analysis and Recommendations for the British Pound

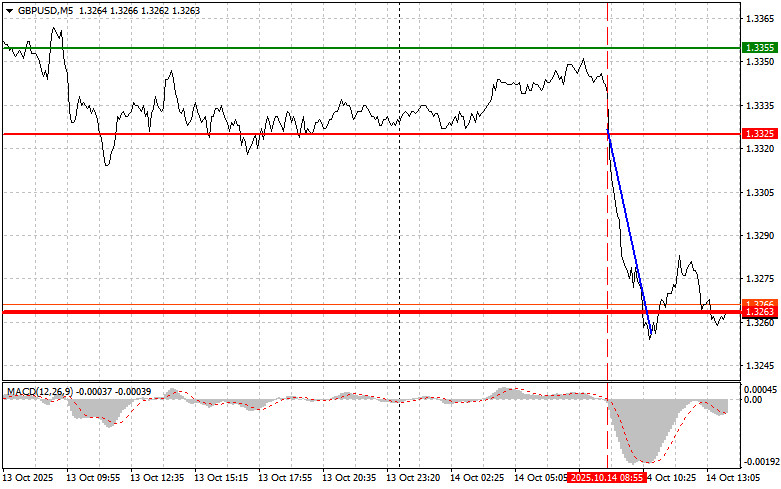

The price test of 1.3325 occurred at the moment when the MACD indicator had just begun moving down from the zero mark, confirming the correct entry point for selling the pound and resulting in a drop of more than 60 points.

A sharp increase in the number of unemployment benefit claims and in the unemployment rate in the U.K. led to a sell-off of the pound. Investors reacted instantly, alarmed by signs of a slowdown in economic growth. The data published by the Office for National Statistics caused some turbulence. In particular, the rise in jobless claims pointed to potential issues in the labor market, intensifying concerns about consumer spending and the overall economic health of the U.K. The Bank of England now finds itself in a difficult position. On one hand, the regulator must curb inflation, which remains high; on the other, high interest rates could further worsen the labor market situation.

During the U.S. session, data from the NFIB Small Business Optimism Index will be released, which may increase pressure on the British pound. However, weak optimism figures could also signal a slowdown in U.S. economic growth — which, in turn, could trigger a sell-off of the U.S. dollar. Market participants will also be closely watching speeches from Federal Reserve officials. Any indications that the Fed plans to continue aggressive rate hikes could further strengthen the dollar and add pressure on the pound sterling.

As for the intraday strategy, I will primarily rely on Scenarios No. 1 and No. 2.

Buy Signal

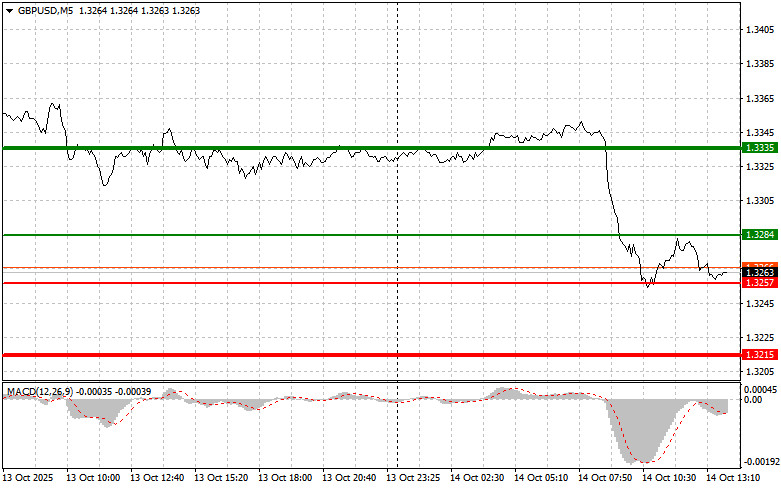

Scenario No. 1: I plan to buy the pound today when the price reaches the entry point around 1.3284 (green line on the chart), with a target of rising to 1.3335 (thicker green line on the chart). Around 1.3335, I plan to close buy positions and open sell positions in the opposite direction, expecting a 30–35 point pullback from that level. A strong rally in the pound is unlikely today.Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound if the price tests 1.3257 twice in a row, at a time when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger an upward market reversal. Growth can be expected toward the opposite levels of 1.3284 and 1.3335.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the level of 1.3257 (red line on the chart) is updated, which will lead to a quick decline in the pair. The main target for sellers will be 1.3215, where I plan to exit sales and immediately open buy positions in the opposite direction (expecting a 20–25 point reversal from the level). The pound could fall sharply in the second half of the day.Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today if the price tests 1.3284 twice in a row, at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3257 and 1.3215 can be expected.

Chart Legend:

- Thin green line – Entry price for buying the trading instrument;

- Thick green line – Estimated level for placing Take Profit or manually locking in profit, since further growth above this level is unlikely;

- Thin red line – Entry price for selling the trading instrument;

- Thick red line – Estimated level for placing Take Profit or manually locking in profit, since further decline below this level is unlikely;

- MACD indicator – When entering the market, it is important to consider overbought and oversold zones.

Important Note

Beginner Forex traders should make market entry decisions with great caution. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit—especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one I've outlined above. Spontaneous trading decisions based on the current market situation are, by nature, a losing strategy for any intraday trader.