The GBP/USD currency pair did not trade on Thursday due to Christmas celebrations around the world. The market will open this morning and will close again on Friday evening for the weekend. Thus, Friday will be a day when significant movements in the market are unlikely. We already consider Friday another holiday. Nevertheless, 2026 is approaching, and we should determine what to expect.

In essence, all the factors that should drive the euro higher next year are also relevant for the British pound. In the case of the British currency, the age-old mechanism might even work: when the euro appreciates, the British pound also appreciates. Of course, exceptions to this rule do occur, but 80% of the time, both currencies move in the same direction. Therefore, it is possible that the fundamental backdrop for the British pound is not as important as that for the euro or the dollar. For example, unlike the European Central Bank, the Bank of England will continue to ease monetary policy next year. This results in the pound and dollar being, in some ways, on equal footing. However, in practice, this factor may not have much significance.

It is also worth reminding that the pound has corrected much more strongly than the euro in 2025. We have repeatedly pointed out the illogical nature of this movement. The pound was falling for any reason while the dollar should have been the one declining. Therefore, the British currency may now catch up with the European one.

Technically, despite the strong correction in 2025, the daily timeframe shows the upward trend remains intact. Thus, we anticipate its continuation, as the correction lasted a full five months. This is quite sufficient to expect a new wave of the trend. The key factors for the decline of the U.S. currency next year will be: Trump's trade war (and its possible multiple escalations), the Fed's easing monetary policy, and weakness in the U.S. labor market.

As of November, it is hardly accurate to say that the labor market has begun to recover. Yes, we did see a higher figure than in October, but it is important to remind traders that the NonFarm Payrolls figure is not one where any value above 0, above the forecast, or above the prior month's value is automatically positive. To prevent the labor market from declining, it requires 150,000 to 200,000 new jobs each month. Such NonFarm figures help lower the unemployment rate or keep it stable. Therefore, a figure of +60,000 is, as the youth say, "nothing to write home about."

At the same time, the unemployment rate in November rose to 4.6%, and it is currently unclear by how much the Fed's key rate needs to be lowered to bring NonFarm Payrolls and the unemployment rate back to previous levels. Monetary policy does not manifest itself immediately. Jerome Powell has repeatedly stated that it requires 6 to 12 months for changes to take full effect. Therefore, a pause at the beginning of the year will be relevant. But thereafter, everything will depend again on the U.S. labor market.

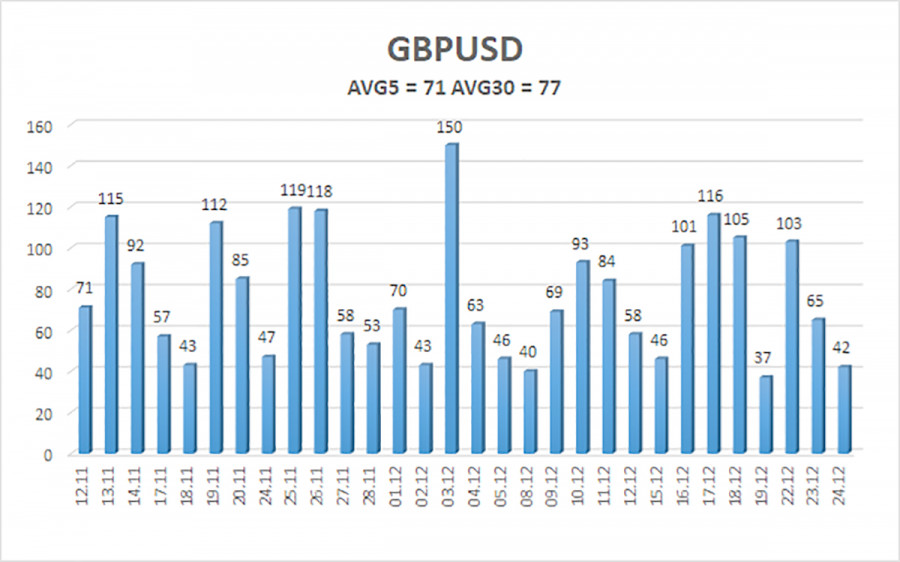

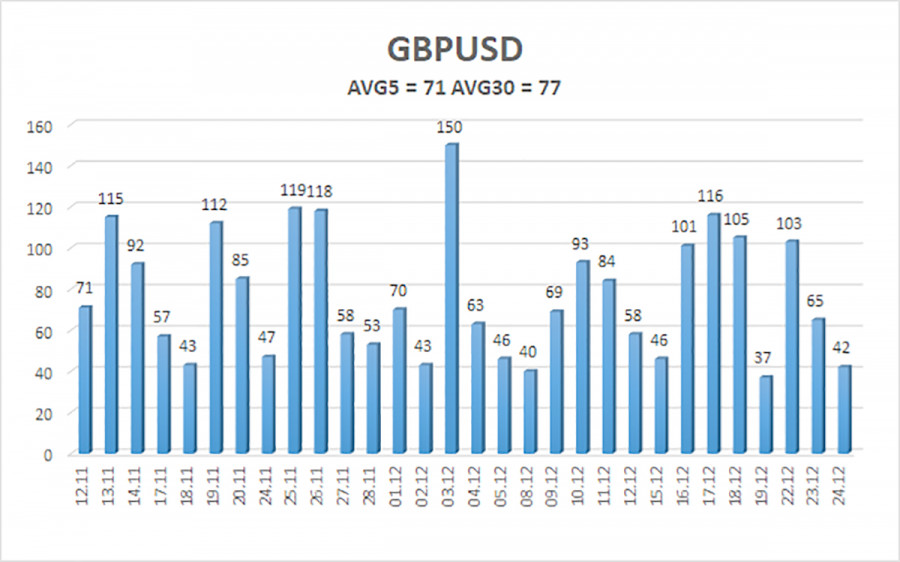

The average volatility of the GBP/USD pair over the last five trading days is 71 pips. For the pound/dollar pair, this value is considered "average." On Friday, December 26, we expect movement within the range limited by the levels of 1.3433 and 1.3575. The upper channel of the linear regression is directed downward, but this is only due to a technical correction on the higher timeframes. The CCI indicator has entered oversold territory six times over the past months and has formed numerous "bullish" divergences, which have consistently warned of a potential resumption of the upward trend. Last week, the indicator formed another bullish divergence, which again warns of a resurgence in growth.

Nearest Support Levels:

- S1 – 1.3489

- S2 – 1.3428

- S3 – 1.3367

Nearest Resistance Levels:

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the upward trend of 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar; therefore, we do not expect the U.S. currency to grow. Thus, long positions with targets at 1.3550 and 1.3575 remain relevant for the near term, provided the price is above the moving average. If the price is below the moving average line, small shorts can be considered with targets at 1.3367 and 1.3306 on technical grounds. From time to time, the U.S. currency shows corrections (in a global sense), but for trend strengthening, it needs signs of resolution in the trade war or other global positive factors.

Explanations to Illustrations:

- Linear regression channels help determine the current trend. If both are aligned in the same direction, the trend is currently strong.

- The moving average line (settings 20.0, smoothed) indicates the short-term trend and the direction in which trading should currently be conducted.

- Murray levels represent target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel where the pair will stay over the next day based on current volatility indicators.

- The CCI indicator's entry into oversold territory (below -250) or into overbought territory (above +250) signals that a trend reversal is approaching in the opposite direction.