The GBP/USD currency pair also started plunging on Tuesday out of the blue. However, this is only at first glance. Recall that the euro and the pound have shown practically identical movements recently; therefore, we are not shocked by the unidirectional movement of both pairs on Tuesday. It should be noted that there were no big macroeconomic statistics or fundamental events on Tuesday, either in the States, the UK, or the EU. That is, traders had nothing to react to during the day.

Nevertheless, the dollar has started to expand again, and we correlate this movement with only one event — the Fed meeting, which will end tonight. Much like the euro, the pound has not been able to adjust normally for a very long time. This merely means that there is no demand for British money at all. If so, the pair has already exceeded the correction plan and is poised to hit new lows. In the case of the British pound, we are still discussing updating merely 2-year lows. However, we recall that we consider a very real target of 1.1400, which functions as the absolute minimum of the pair for at least the last 30 years.

There are no other considerations but the foundation and geopolitics presently. If the political crisis in the UK had at least some impact on the market, then the pound, at least in the previous two weeks, has moved a little differently than the euro currency. Therefore, the election of a new Prime Minister is an essential and interesting topic, but no more. We have already said that the implications of a change of government (after all, not only the prime minister will change, but also many ministries and many other senior positions) will be long-term. The most mundane things that come to mind are an improvement in the economic condition if Rishi Sunak comes to power and a change in the geopolitical vector if Liz Truss is in charge. Sunak is an economist to the core, and perhaps, his recommendations are not too popular, but they can deliver the necessary results in the long term. Truss is a fairly popular politician who understands world politics and geopolitics given the nature of her service (Foreign Minister). Thus, the external vector of the country's development speaks in her favor.

What will be the results of the election of the new Prime Minister?

In principle, from the very first preliminary round of elections, we have said that the outcome of voting in the last final round may come as a surprise to many. We said Liz Truss and Rishi Sunak are likely to enter the final round. With all due respect to Penny Mordaunt, her name was not as well-known as the names of the first two British officials. And in this instance, a popular individual backed by the electorate must become the party's leader and the government. The results of the parliamentary elections will depend on where the British vote, not the Conservatives.

Under the reign of Boris Johnson, the ratings of the Conservative Party were only dropping, and now the Labour Party is breathing down their backs, which suffered a humiliating setback in the "Brexit" parliamentary elections. Then, we recall, the British voted for Johnson on the "American principle." Johnson offered a clear strategy to break up relations with the European Union, and the British were just bored of this soap opera called "Brexit." Therefore, the votes were handed to the Conservatives so that they could implement the secession from the European Union without interference. However, three years later, it became evident that Brexit was nearly the single merit of Johnson. But there were so many issues with his participation that he could not continue to be Prime Minister. Now the Conservatives urgently need to rebuild trust with the British. Thus, their leader should be a person who will be popular among, first of all, the populace. But the Conservatives themselves should elect him. Rishi Sunak, who is an adherent of high taxation, is not very appropriate for this post. But Liz Truss made it clear in her election statements that she intends to reduce taxes (the British support is provided). In the conflict between Ukraine and Russia, she will stand firmly in support of Ukraine (which is also important since the whole of Europe is interested in completing it) (which is also important, since the whole of Europe is interested in completing it). The pre-election debate between Sunak and Truss, according to many experts, ended with the win of the second. So far, everything is going to ensure that it is Liz who will win.

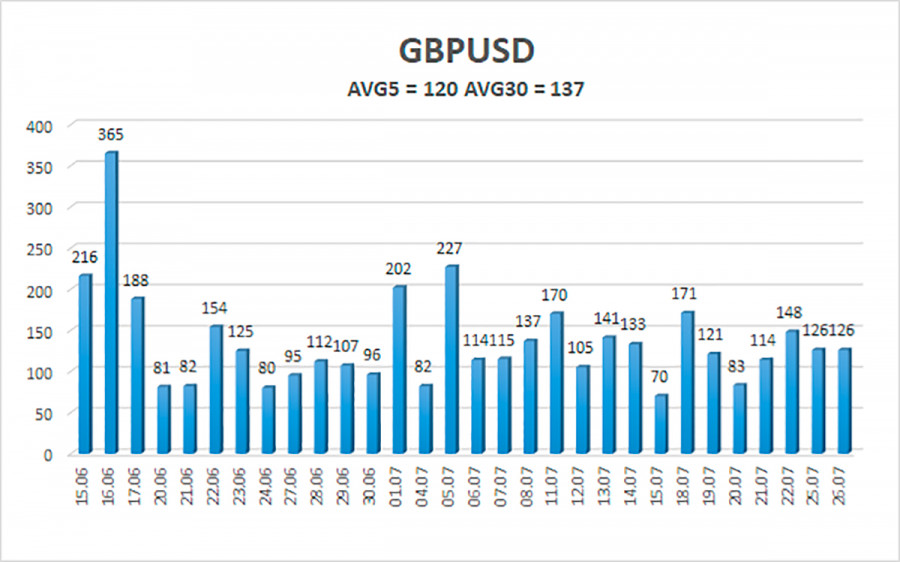

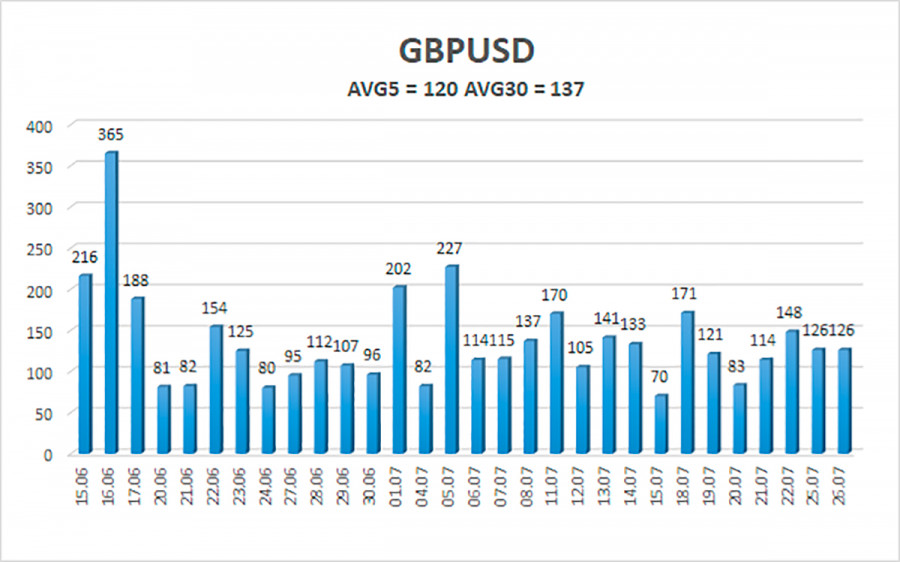

The average volatility of the GBP/USD pair over the last 5 trading days is 120 points. This value is "high" for the pound/dollar pair. On Wednesday, July 27, thus, we predict activity inside the channel, limited by the levels of 1.1910 and 1.2151. A reversal of the Heiken Ashi indicator higher will imply a likely resumption of the upward trajectory.

Nearest support levels:

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest resistance levels:

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Recommendations:

The GBP/USD pair continues to be situated above the moving average on the 4-hour timeframe. Therefore, for the moment, new buy orders should be set with goals of 1.2085 and 1.2146 in case of a price rebound from the moving average. Sell orders should be opened when anchoring below the moving average line with targets of 1.1902 and 1.1841.

Explanations of the illustrations:

Linear regression channels – help determine the present trend. If both are directed in the same direction, then the trend is strong presently.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade presently.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the expected price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) implies that a trend reversal in the opposite direction is imminent.