Today is quite an interesting day, where everything may change in one minute: the markets could plunge into the abyss, or nothing will happen. Let's figure out how to act.

Federal Reserve Chairman Jerome Powell plans to make the highest consecutive rate hike in recent decades today, but investors expect that since September, the Fed's aggressiveness will wane, and autumn will be a gentler season without stress and fresh shocks. Against this background, in reality, there was a spike in risky assets, like the euro and the British pound, after the committee meeting in June this year.

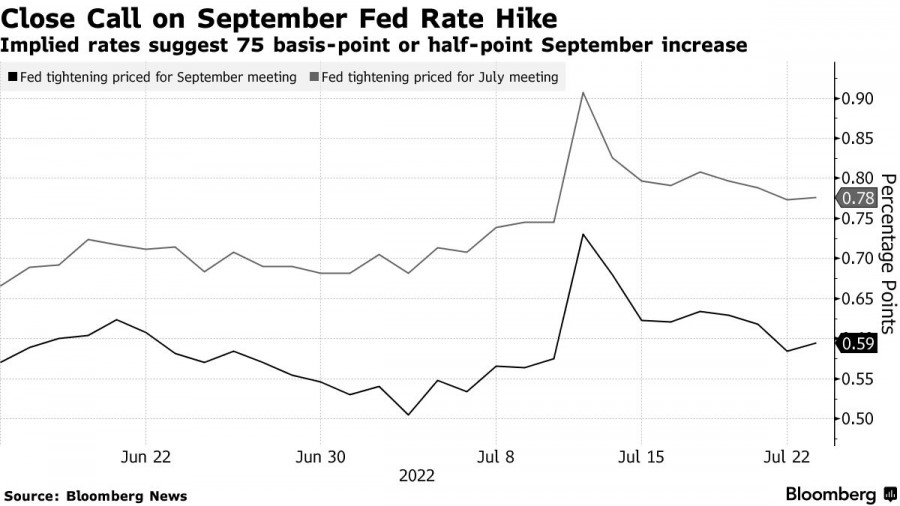

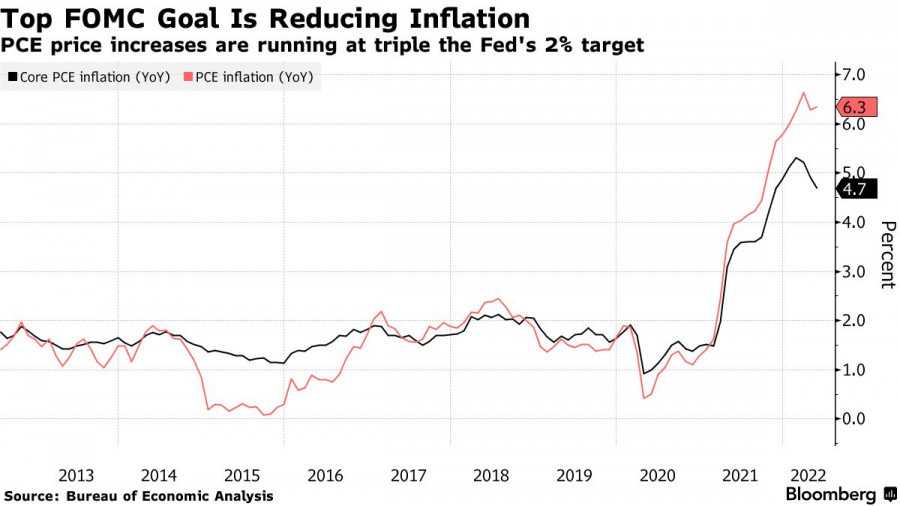

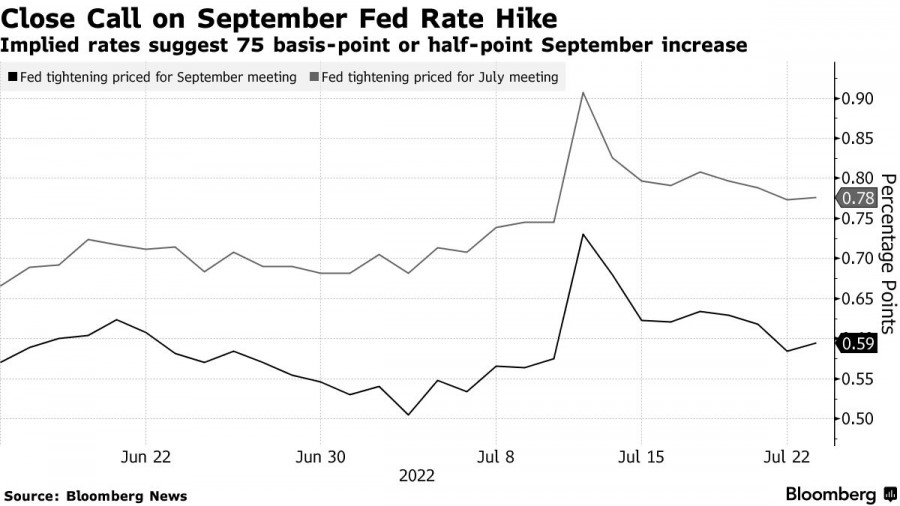

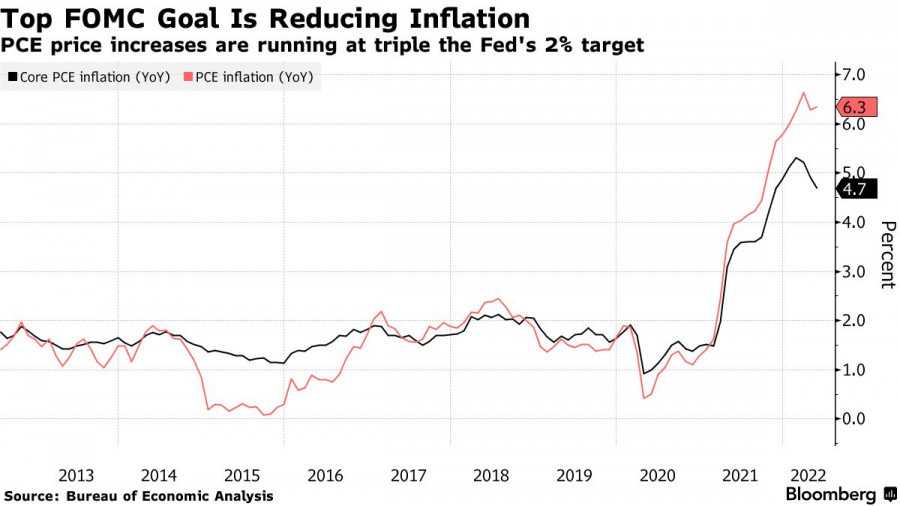

The Federal Open Market Committee is projected to raise rates by 75 basis points for the second month in a row, which will be the most aggressive policy tightening since the 1980s. In 30 minutes, Powell will have a press conference - that's when everything will be decided. The head of the Fed may indicate that he is open to a stance of a lower 0.5 percent hike in interest rates in September, but he will do it if he sees signs of a slowdown in inflation after this summer. However, it is evident to everyone that this will happen if economic development slows down and commodity prices fall. Until then, all the Fed's efforts will not have such a substantial effect, and it will have to hike rates more in the expectation of lowering inflation, which updates its top number every month.

The outcome of this meeting is a predetermined conclusion, but the question is what will happen next. Most likely, the entire news conference will be devoted to forecasts and hints on how the Fed will act during the September meeting and what it will pay attention to at this time. An increase of half a percent will be the mildest scenario that investors are betting on, but everything will depend on the data.

As I noted above, the Fed is now trying to curb the highest inflation in the last 40 years amid criticism that the central bank reacted very slowly to price increases last year, stirring up financial markets and allowing a fairly high probability of recession with subsequent aggressive interest rate hikes. Today's 75 basis point hike will bring the Fed's benchmark to a target range of 2.25 percent to 2.5 percent, which equals a neutral rate. According to politicians, this threshold does not boost or impede growth. In June, Powell said that a 50 or 75 basis point hike was most expected at the July meeting.

As for the changes in the foreign exchange market, now almost everyone is counting on an increase of 75 basis points, although there is an external risk of surprise: Nomura economists predict an increase of 100 basis points to demonstrate the determination of the Fed's actions to combat inflation after consumer prices rose by 9.1 percent in June this year. But the vast bulk of Wall Street is counting on 75 basis points.

Here is a brief forecast from the world's biggest banks:

Bank of America: 75 bps

Barclays: 75 bps

Citigroup: 75 bps

Deutsche Bank: 75 bps

JPMorgan Chase: 75 bps

Goldman Sachs: 75 bps

Morgan Stanley: 75 bps

Wells Fargo: 75 bps

The FOMC statement is anticipated to acknowledge a slowdown in economic growth in the US, reflecting a fall in consumer spending. According to a survey of analysts, GDP growth in the second quarter is estimated at 0.4 percent. The Fed will also reaffirm its intentions to shrink the balance sheet, gradually lowering it to a feasible $ 1.1 trillion per year. Economists forecast that by the end of the year, the balance will reach $8.4 trillion, and in December 2024, it will shrink to $6.5 trillion.

If the Fed leaves the policy unaltered, buyers of risky assets will have a strong chance of ongoing growth. In the EURUSD pair, stabilization at the level of 1.0170 will create opportunities for recovery to the range of 1.0220 and 1.0270. In the case of a decrease in the euro, buyers must show something around 1.0120. Otherwise, the pressure on the trading instrument will only increase. Having missed 1.0120, you can say goodbye to prospects for recovery, which will open a direct road to 1.0080 and 1.0040. A breakthrough in this support level will undoubtedly boost the pressure on the trading instrument, offering the potential for a return to the trade.

The pound, albeit fictitious, still has the potential for continued expansion. It is feasible to talk about a larger growth in the current conditions, but only when the bulls manage an exit beyond the resistance of 1.2090. Only after that, you can bet on a breakthrough to the area of 1.2160 and 1.2210, where purchasers will have even more challenges. In the case of a larger upward movement of the pound, we can talk about the 1.2270 update. If the bears break below 1.2035, the pressure on the trading instrument will rise - this is a straight route to 1.1970. Going over this range will lead to a reversal of the bullish trend and a significant downward swing already to the lows: 1.1890 and 1.1810.