4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

The EUR/USD currency pair was trading again in a fairly calm mode on Monday. The pair's quotes continued a slow decline during the day, which resumed after the price again consolidated below the moving average line. Thus, the technical picture remains the same. The downward trend remains strong, as both linear regression channels are still directed downward, and the bulls do not have enough strength even to work out the upper limit of any of the channels. Consequently, there is a high probability of updating the annual lows and it may happen this week. In principle, we can only mark one event now that is worth being afraid of. This event is the US inflation report on Friday. The fact is that if it turns out that inflation continues to grow and exceeds the value of last month, equal to 6.2% y/y, it will be a shock. Recall that initially, Fed Chairman Jerome Powell talked about inflation of 4-5% by the end of the year, which will naturally begin to slow down. As you can see, the forecaster from Jerome Powell is so-so. What will a new increase in inflation mean? The fact that the Fed is even more likely to accelerate the pace of curtailing the economic stimulus program. And this, in turn, means a tightening of monetary policy, which is in the hands of the US currency. Consequently, even now the dollar could resume growth based on the same factor of a high probability of tightening monetary policy in December. It turns out that the markets are waiting for exactly such a development of events and buy dollars in advance on this basis.

"Coronavirus" and its strain "omicron" may be the second reason for the growth of the dollar.

Another equally important factor in the growth of the dollar may be the omicron strain. According to scientists and doctors, the new variant of the virus is spreading across the planet very quickly, has much higher contagiousness, as well as 32 mutations, which is more than any previous strain. However, although omicron causes serious concern among doctors, it is still noted that in those countries where a sufficiently large number of people have become infected with it (for example, South Africa), there is no increase in the number of hospitalizations or deaths. Anthony Fauci, the chief infectious disease specialist of the United States, said that it is too early to conclude about the "excessive severity" of this strain. However, that is why "we have to be careful." Perhaps, Fauci believes that the strain will not be more serious than the delta variant and does not cause complications. However, it is still impossible to draw a definite conclusion about this. Hans Kluge, Director of the WHO European Office, shares approximately the same opinion. "We need more time to study the virus and understand what we are dealing with this time. We cannot yet make recommendations in connection with the spread of the omicron strain," Kluge said. Dr. Kluge also noted that in Europe, so far, there is a predominance of the "delta strain", which is not surprising, since "omicron" was discovered in the world only at the end of November. Also, the head of the WHO European Bureau insists that people should continue to wear masks, get vaccinated, in particular the third booster. Dr. Kluge believes that mandatory vaccination is an extreme measure. People should be vaccinated against the virus themselves, and not under the fear of serious restrictions if they do not do it voluntarily. Earlier, WHO reported that omicron can spread around the world, as it is a more contagious strain than delta.

Thus, at this time everything is going on as usual. The situation with omicron is developing approximately as a small stream flows, which a little further downstream can become a large river. The number of people infected with omicron is growing, but it is not growing too fast. In Europe, things are much worse with the "usual" delta strain. For example, in terms of the number of COVID diseases over the past 4 weeks, Germany has already overtaken the UK, which for a long time was in second place in this sad rating. The situation has also deteriorated significantly in the Netherlands, France, and Belgium, where current morbidity levels already exceed the peaks of the third "wave". Consequently, the US dollar may continue to grow on fears of a new slowdown in the global economy. Recall that the dollar is the world's reserve currency.

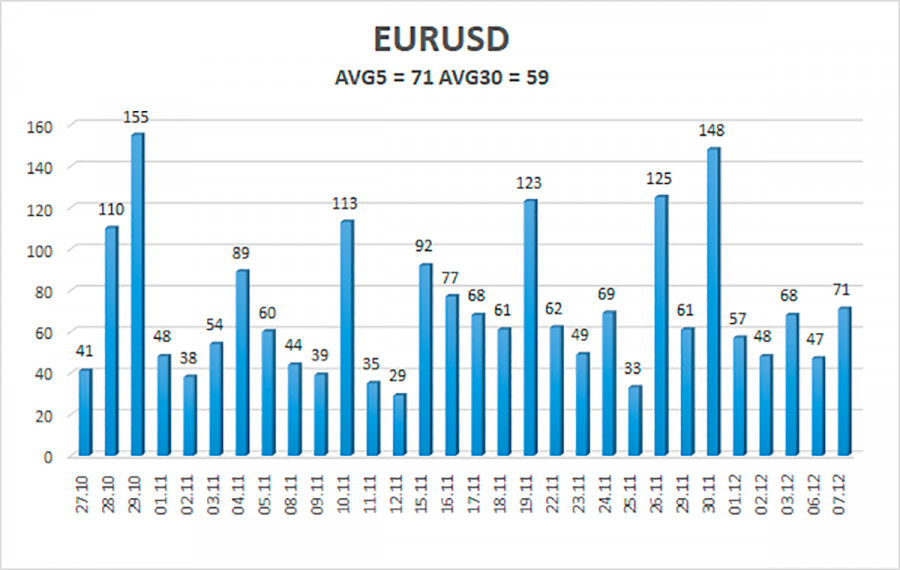

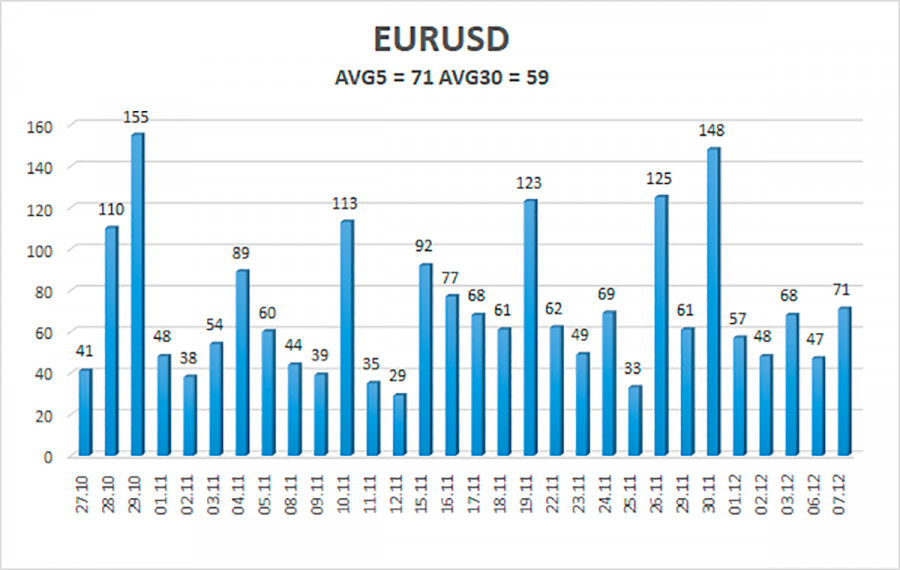

The volatility of the euro/dollar currency pair as of December 8 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1176 and 1.1318. A reversal of the Heiken Ashi indicator upwards will signal a new attempt to start an upward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading recommendations:

The EUR/USD pair continues to be below the moving average. Thus, today it is necessary to stay in sell orders with targets of 1.1176 and 1.1169 until the price is fixed above the moving average line. Purchases of the pair should be considered if the price is fixed above the moving average, with targets of 1.1353 and 1.1414.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.