Hello, dear traders!

The pound/dollar pair closed the previous week with a confident rise. Macroeconomic reports from the US and the UK turned out to be mixed. That is why they had an insignificant influence on the pair's movement. It is highly possible that the pair advanced amid some technical reasons. Let us take a look at them.

Weekly

As usual, we will begin with the analysis of last week's results. During the period from December 20 to December 24, the pound/dollar pair was gaining in value and closed the week at the level of 1.3395. There are several important factors that are worth paying attention to. On the one hand, bulls of the pound sterling managed to close the week above a strong orange exponential moving average. It is an absolutely positive factor. On the other hand, the pair closed the week slightly below the strong and important level of 1.3400. It needed several pips to close the trading week above the 34 pattern. In addition, the quote returned to the weekly Ichimoku cloud. Notably, above the highs located near 1.3436, there are an 89-period exponential moving average and a red Tenkan line of the Ichimoku indicator that are located every close to the essential psychological level of 1.3500. If the pair continues rising, this level will be the first target of bulls. At least, such predictions could be done according to the weekly chart. At the same time, for bears the support level of 1.3170 became a real obstacle. For three weeks in a row, bears were trying to break the level, but failed. Thus, the pair is likely to resume falling after a real breakout of the level of 1.3170 and fixation below it. To continue gaining in value, the pair should break one target after another and consolidate above the psychological level of 1.3500.

Daily

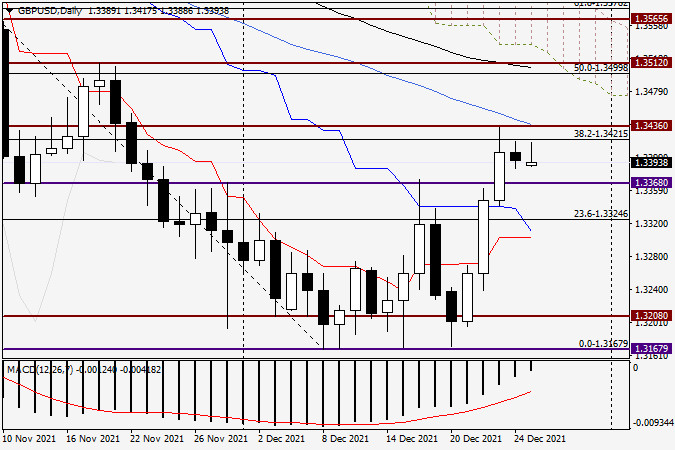

On the daily chart, the pair's rise could be considered a correctional movement after a drop to 1.3832-1.3168. This could be proved by the fact that the pound/dollar pair hit the second retracement Fibonacci level of 38.2. However, the level is quite strong and pushed the price lower. In addition, the 50-period moving average is located at 1.3445. Thus, the nearest resistance zone could be seen at 1.3420-1.3445. Of course, the price should break this area and only after that, it may reach 1.3500. Interestingly, the pound/dollar pair broke the red Tenkan line and the blue Kijun line of the Ichimoku indicator and consolidated above them. Now, these two lines may act as strong support levels.

Under the current conditions, it is extremely difficult to predict the pair's further movement and give trading recommendations. That is why it is better to buy after insignificant correctional drops to 1.3370, 1.3360, and 1.3350.If the pair fixes below 1.3350, the upward movement will hardly be possible. Traders may open sell positions after they see bearish reversal patterns between 13400 and 1.3450 on the daily or smaller periods. That is all for now. Tomorrow, we are planning to examine smaller periods and alter our forecasts if it is necessary.

Good luck!