The main currency pair EUR/USD has been strongly influenced by two mutually exclusive factors since the end of November, which led to a month-long consolidation period in the range of 1.1230-1.1365

What factors contribute to such a movement? Primarily, the reasons for this behavior are the uncertainty of the ECB's future monetary policy and very vague and even contradictory messages on the Fed's future monetary policy. The last meeting of the European Central Bank has shown so far a complete lack of desire to start radically changing the course of monetary policy from soft to hard. The regulator only limited itself to measures to reduce stimulus programs and did not give any signals about the possible start of the process of raising interest rates, which should have led to a weakening of the euro against the US dollar. However, it turns out everything is not so simple.

Following the meeting of the US Central Bank this month, it was announced that it plans not only to increase the volume of reduction in stimulus measures from 15 billion per month to 30 billion, but also to raise rates 3 times in the new 2022, and twice more in 2023 and 2024. years. It looks like that everything is clear – the ECB took a wait-and-see attitude, and the Fed announced plans to end the soft monetary policy rate by raising the cost of borrowing. That is how it is, but again, things can be complicated.

During the Fed's press conference about the results of the meeting, J. Powell did not announce any clear plans and dates particularly for the start of the rate increase. In fact, he left the start date of this process open, which forced investors to believe that the promise to raise rates was unreal. In any case, the dynamics of government bond yields clearly indicate this. Investors in these government securities do not yet believe that rates in America will rise in the foreseeable future. This means that the US dollar does not have a strong basis in order to sharply rise against the euro.

The situation turns out to be paradoxical. On the one hand, the ECB does not want to tighten monetary policy in the hope that inflation will slow down its growth, in which case the euro has no reason to strengthen its position. On the other hand, the Fed announced decisive plans to fight inflation, but it also secretly hopes that with the victory over the COVID-19, the lives of people and businesses in America will improve, which will lead to a downward pullback of inflation or to its stabilization, which will allow it to keep from raising rates for some time, stimulating economic growth in the post-like period.

So, it turns out that neither the euro nor the dollar has a chance to dominate the EUR/USD pair, which means that it will be doomed to further consolidate in this range until something significant happens. We believe that with the beginning of the new year, the situation in the behavior of the pair will not change significantly.

Forecast for the day:

The EUR/USD pair is likely to remain in the range of 1.1230-1.1365 in the near future.

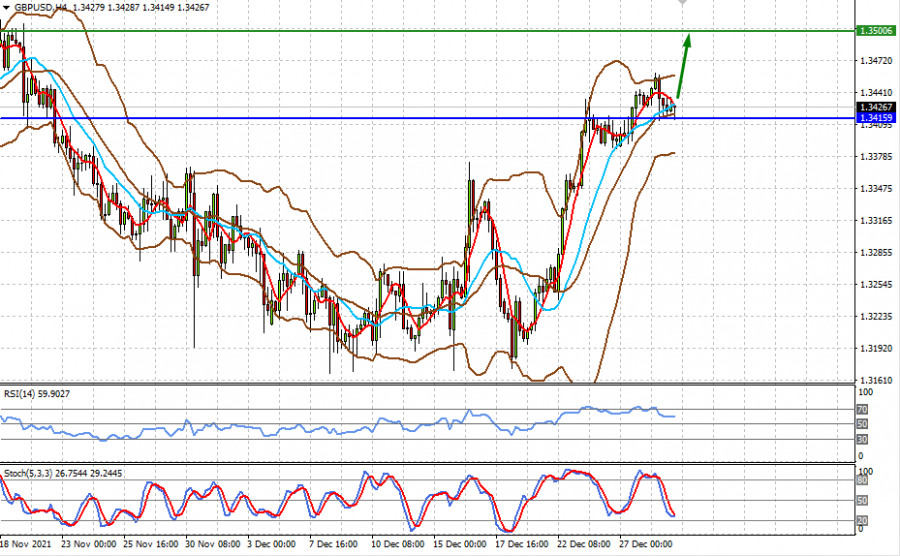

The GBP/USD pair maintains its position at the level of 1.3415. If it settles above it, it will most likely further rise to 1.3500.