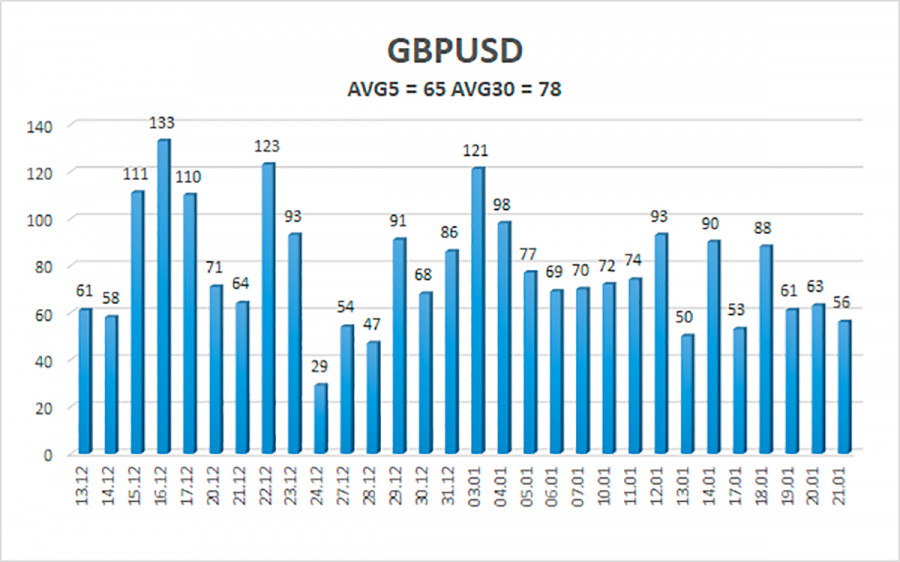

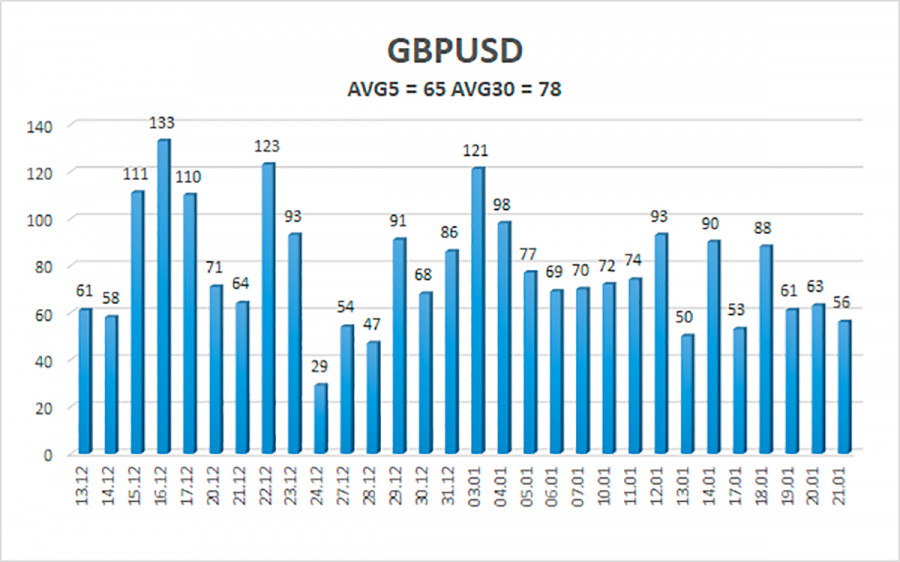

The GBP/USD currency pair continued to fall on Friday, unlike the EUR/USD pair. In general, the pound has been moving much more trendily in recent months. It is "trending", and not "volatile" because volatility has not always been on top. For example, on the same Friday, it was only 56 points. Before that, it was about 60 points for two consecutive days. This is very little for the pound and even the euro currency has passed more. Nevertheless, the pound is much less often corrected and rolled back against the trend. That is why it is much more pleasant to trade. However, on Friday, there was an explanation for such a movement. Back in the morning, a report on retail sales for December was published in the UK. Its values turned out to be much worse than the forecast ones, which provoked a one-way movement of the pair during the day. But at the same time, as already mentioned, the pound has not fallen in price too much. The overall picture also suggests a further decline in the British currency. The pound has been growing against the dollar for a month and during this time managed to grow by 600 points. Moreover, it had no fundamental reasons for such strong growth. It is unlikely that traders have been buying the pound for a whole month based on a single increase in the key rate by the Bank of England. Thus, in a way, the pound is now paying off its debt to the US currency for its unjustified growth. However, if we do not see any reason for the euro currency to grow now, then the pound has them. However, everything will now depend on the actions of the same Bank of England. If its rate hike was not a one-time action and it will continue to tighten monetary policy, then the pound has an excellent chance of growth in 2022, since the Fed's tightening will be offset by the BA's tightening. Otherwise, the pound sterling may follow the euro currency until traders get tired of constant purchases of the US currency.

Will business activity in the UK decrease?

A lot of different statistics were published in the UK last week. Everything started well, as the unemployment rate fell, wages rose well, and inflation continued to accelerate, which increases the likelihood of tightening monetary policy. All these factors can be safely written down as "bullish" for the British currency. However, the week ended with a completely disastrous report on retail sales, and this week nothing but business activity indices in the service and manufacturing sectors will be published in Britain. The situation with business activity in Britain is about the same as in the Eurozone. In the service sector, it may fall below the 50.0 mark, as it now stands at 53.6 points, and it is possible to expect a deterioration in January due to omicron. There will be no more interesting information during the week, respectively, traders will focus their attention on the US GDP report and the Fed meeting.

The Fed meeting is in any case the most important event of the week. Markets expect that the Fed will continue to stick to the planned path and again reduce the asset purchase program by $ 30 billion. Now it is $75 billion a month. Thus, it can be completed as early as March. We believe that the Fed will not raise the rate yet, but even if this does not happen, the results of the meeting still promise to be as "hawkish" as possible. This means that we can count on the strengthening of the US currency, at least on Wednesday. It will also be important what Jerome Powell will say after the meeting, whose rhetoric is usually as neutral as possible, so when he makes "hawkish" statements, they have a double effect. By and large, it all boils down to Powell openly stating that the rate will be raised in March. Or, on the contrary, that it will not be increased in March. This is what traders are interested in now. In any case, this week we do not see how the British currency can show growth. Although there can always be surprises.

The average volatility of the GBP/USD pair is currently 65 points per day. For the pound/dollar pair, this value is "average". On Monday, January 24, thus, we expect movement inside the channel, limited by the levels of 1.3485 and 1.3615. A reversal of the Heiken Ashi indicator upwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.3550

S2 – 1.3519

S3 – 1.3489

Nearest resistance levels:

R1 – 1.3580

R2 – 1.3611

R3 – 1.3641

Trading recommendations:

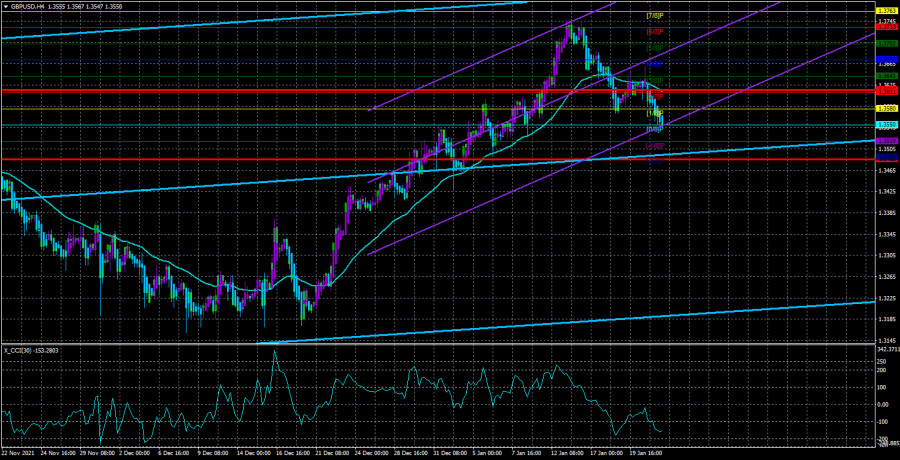

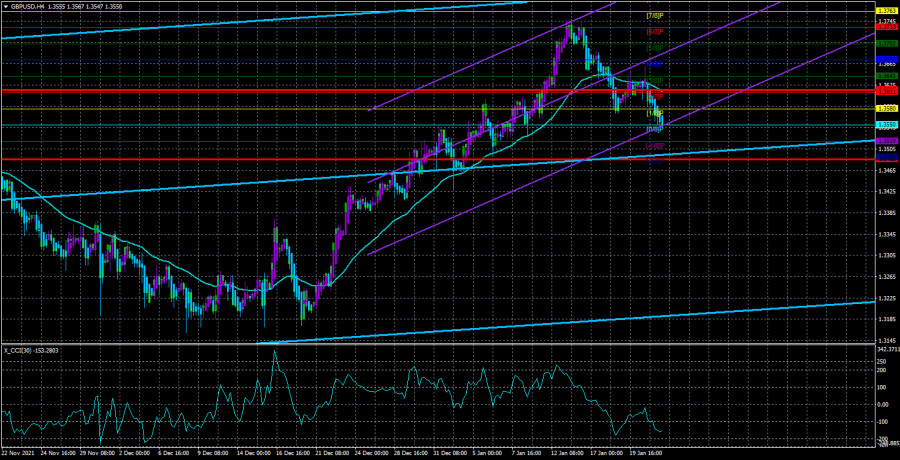

The GBP/USD pair resumed its downward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in short positions with targets of 1.3519 and 1.3489 until the Heiken Ashi indicator turns up. It is recommended to consider long positions if the pair is fixed above the moving average line with targets of 1.3672 and 1.3702, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.