Last week, the U.S. dollar index (DXY) rose by 1.8%, returning to the levels of June 2020. However, today DXY is declining. According to the data presented last Friday by the Commerce Department's Bureau of Economic Analysis, the growth in personal income of U.S. households slowed to +0.3% in December (against the forecast and the previous value of +0.5%), and spending decreased by -0.6% against the growth of +0.4% in November. At the same time, the preliminary consumer confidence index from the University of Michigan fell to 67.2 (against the forecast of 68.7 and the value of 68.8 in December).

At the time of writing, the dollar index (DXY) was near the 97.00 mark, corresponding to the levels of July 2020, 43 points below the local maximum reached last week. At the same time, the yield of 10-year U.S. government bonds remains near the highs of 2 years ago, currently amounting to 1.780%.

Meanwhile, despite the currently observed decline, economists expect further strengthening of the dollar.

A lot of important macroeconomic news is expected this week, including data on economic growth in the Eurozone and the monthly employment report of the U.S. Department of Labor.

Also, this week there will be meetings of three of the world's largest central banks: Australia, the Eurozone, and the UK. The Reserve Bank of Australia will be the first to start. Its meeting will end on Tuesday with the publication of the interest rate decision at 03:30 (GMT).

Australia's Q4 inflation data released last week far exceeded forecasts. Taking into account the fact that the Australian labor market continues to strengthen, creating conditions for accelerating wage growth, this allows many economists to predict the beginning of the tightening of the RBA policy earlier. According to their new forecast, the RBA will raise the key rate in August 2022, and not in the fourth quarter, as previously expected. If the RBA leaders confirm the possibility of such a scenario at the meeting on Tuesday, the AUD may receive good support.

Today the AUD is strengthening, including in the AUD/USD pair, having received support from the positive data on Australian producer prices published on Friday and from the positive data on private sector lending published today. Australia's private sector lending rose 0.8% in December, better than the +0.5% forecast, albeit lower than the previous +1.0%.

The producer price index is considered a leading indicator of consumer inflation, therefore, the strengthening of this indicator implies an acceleration of consumer price growth in the near future. According to the data published on Friday, the indicator for the fourth quarter of 2021 increased by +3.7% (in annual terms), which turned out to be better than the forecast of +2.7% and the previous value of +2.9%.

Since the Fed and, as is now expected, the RBA will begin to tighten their monetary policies this year, we have yet to see sharp fluctuations in AUD/USD quotes. The growth of AUD/USD in the zone above the 0.7100 mark can strengthen the corrective upward dynamics. However, all this is still just a possible correction. In general, the downward dynamics of this currency pair remain, leaving the advantage for short positions on it. If the rhetoric of the accompanying statement of the RBA leaders is soft, then the AUD is likely to weaken, and the AUD/USD pair will decline.

Technical analysis and trading recommendations

In response to the publication last Friday and today of a fresh batch of positive macro statistics from Australia and against the background of the weakening of the U.S. dollar, the AUD/USD pair has been growing since the beginning of today's trading day.

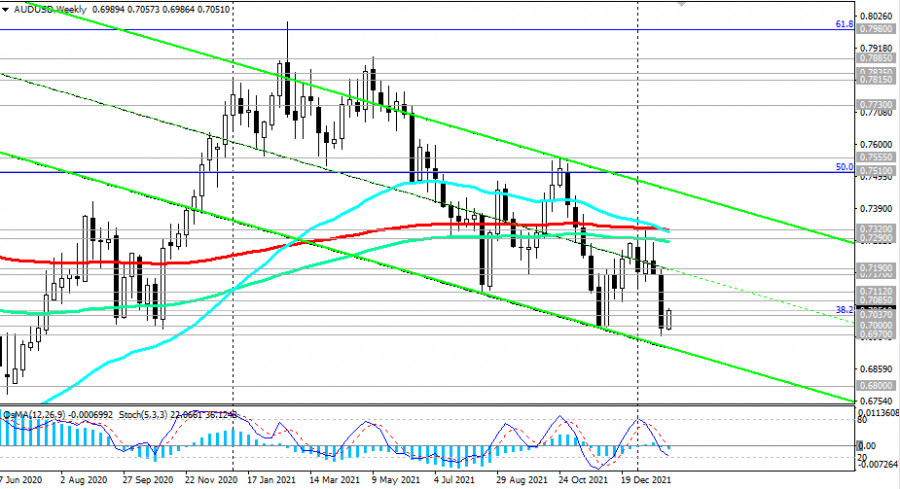

At the time of writing, AUD/USD is trading above the resistance level of 0.7037 (38.2% Fibonacci retracement to the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), near the 0.7050 mark.

However, despite the current upward correction, the pair is in a steady downward trend, below the key resistance level of 0.7320 (200 EMA on the daily and weekly charts).

The breakdown of the support level 0.7037 and the short-term support level 0.7032 (200 EMA on the 15-minute chart) will be a signal for the resumption of sales, and the breakdown of the local support level 0.7000 will be a confirmation. Downside targets are local support at 0.6970 (18-month lows and January lows), 0.6800, 0.6455 (23.6% Fibonacci). The further downside target is at the multi-year lows near 0.5500, reached in March 2020 at the start of the coronavirus pandemic.

Alternatively, the upward correction will continue with targets at the resistance levels 0.7112 (200 EMA on the 1-hour chart), 0.7170, 0.7190 (50 EMA on the daily chart), 0.7290 (144 EMA on the daily chart), and 0.7320.

A breakdown of the resistance level of 0.7320 can turn the tide and bring AUD/USD into the bull market zone.

In the meantime, AUD/USD remains in the zone of the global bearish trend. Therefore, you should give preference to short positions, finding suitable entry points into the market.

Support levels: 0.7037, 0.7032, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Resistance levels: 0.7085, 0.7112, 0.7170, 0.7190, 0.7290, 0.7320

Trading Recommendations

Sell Stop 0.7020. Stop-Loss 0.7065. Take-Profit 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Buy Stop 0.7065. Stop-Loss 0.7020. Take-Profit 0.7085, 0.7112, 0.7170, 0.7190, 0.7290, 0.7320