For a long time, EURUSD bulls took advantage of the rally in US stock indices and the associated improvement in global risk appetite and a decrease in demand for safe-haven assets, however, in the context of a slowdown in the global economy, the upward movement of the S&P 500 is becoming more and more like an anomaly. The higher the US stock market climbs, the greater the downside risks. And the euro clearly does not have enough strength. The eurozone economy, led by Germany, is breathing its last.

Another blow to EURUSD was the release of data on investor confidence in the German economy. The ZEW Institute's expectations index collapsed to a new low of -55.3, with forecasts for a modest increase in the indicator. The current conditions index also worsened. The highest rate of inflation in the history of the currency bloc and additional costs for heating and energy lead to lower corporate profit expectations, negatively affecting business, the economy, and the euro.

Dynamics of economic sentiment in Germany

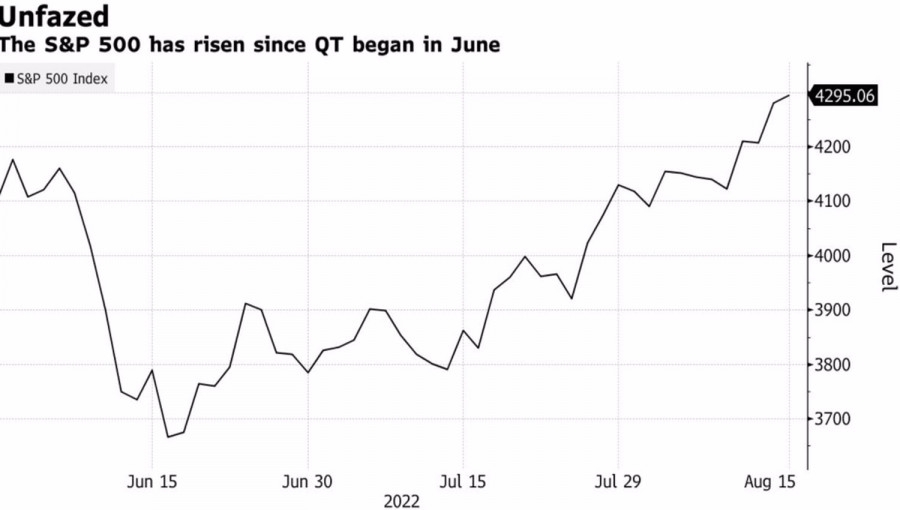

The regional currency needs its own trump cards to resist the US dollar weakened by the decline in Treasury yields and the growth of stock indices. And you won't find them in the daytime with fire. In addition, investors are beginning to understand that the S&P 500 is too tough to continue the rally. According to Bank of America research, a $1.1 trillion a year reduction in the Fed's balance sheet will trigger the broad market index to fall by 7% from current levels.

Quantitative tightening has now faded into the background amid increased investor interest in topics such as inflation and recession, but this cannot continue indefinitely. If financial conditions tighten significantly, this could make QT a more important topic.

S&P 500 performance since the beginning of the quantitative tightening program

Danske Bank also says that the US dollar still has a lot of trump cards up its sleeve. In its opinion, the weakening of the US currency will lead to an increase in commodity prices, which will ultimately affect inflation and force the Fed to act with double aggression.

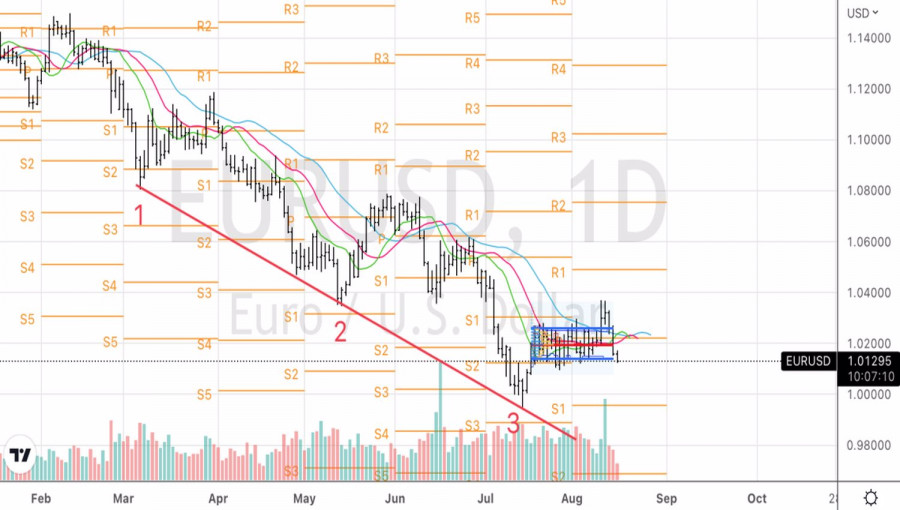

MUFG notes that the EURUSD pair shows increased sensitivity to unpleasant surprises from the CPI. Data on consumer prices, producer prices, and import prices were a pleasant surprise, but at the end of the week by August 15, euro sales were triggered by an unexpected increase in inflation expectations from the University of Michigan from 2.9% to 3%. The Fed is closely monitoring the indicator, and the company expects it to increase hawkish rhetoric in the near future, which will support the US dollar.

Thus, the main trump card of the "bulls" in EURUSD in the form of the S&P 500 rally is about to win back, and the euro does not have enough of its own strength. There is only one thing left—fall.

Technically, on the daily chart of the main currency pair, the false breakout pattern is clearly playing out. We managed to form shorts from 1.0275 and increase them on the break of the middle of the trading channel 1.01–1.03 – the level of 1.02. We continue to sell EURUSD with targets at 1.008, 1.001 and 0.995.