The dollar is falling again at the beginning of the week after a strong fall last Wednesday, when the dollar index (DXY) lost more than 1%, and further decline on Thursday.

Today, at the time of this writing, DXY futures are trading near 111.93, 280 pips below a new local 20-year high reached last week.

It seems that buyers of the dollar have not yet decided on active actions. Perhaps this is in anticipation of the Institute for Supply Management (ISM) report on business activity and employment in the manufacturing sector of the US economy.

The PMI index for September is predicted at 52.3, slightly lower than the previous value of 52.8. A result above 50 is seen as positive and strengthens the USD. However, the expected relative decline is likely to alarm investors. The indicator has been gradually falling since May of this year (previous values of the indicator: 52.8, 53.0, 56.1, 55.4, 57.1, 58.6, 57.6).

It is possible that its decline may be more than expected, and this, one way or another, indicates a slowdown in the growth rate of activity in this most important sector of the American economy, which cannot be ignored by the central bank's leadership when conducting a cycle of tightening monetary policy. Although, as has been repeatedly stated by various representatives of the Fed leadership, a recession is most likely unavoidable. However, the Federal Reserve still intends to tighten monetary policy further, actively raising the interest rate in order to curb high inflation, which is not declining in any way.

A number of speeches from the Federal Reserve representatives are scheduled for today (at 13:05, 18:15, 19:10, 22:45 GMT). Their speeches are assumed to focus on the need for further interest rate hikes, and this will most likely not have a strong impact on markets that are already ready for this. But if they talk about the possibility of a pause or a slowdown in this cycle, the decline in the dollar, observed last week, may continue this week, especially on weak macro data from the US.

The focus of market participants will be on the publication of key data from the US labor market on Friday—the US Department of Labor will present its monthly report for September.

Positive indicators are expected, while unemployment remains at minimal levels.

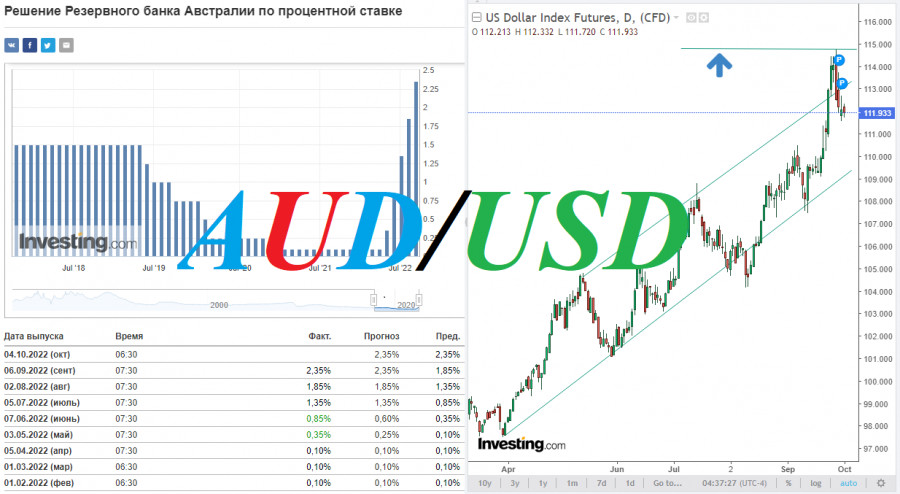

Market participants who follow the dynamics of commodity currencies and, in particular, the Australian dollar will be waiting for the publication tomorrow (at 03:30 GMT) of Reserve Bank of Australia's decision on the interest rate, which is predicted to be raised again by 0.50% to 2.85%. Actually, this is a bullish factor for the national currency. AUD may also receive support amid a decrease in supply on the natural gas market due to the undermining of the Nord Stream gas pipelines. Australia is known to be a major supplier of raw materials, including coal and liquefied natural gas.

However, the market's reaction to tomorrow's interest rate hike may not be very positive, and the rate hike may not become a growth driver for the AUD, given the growing recession risks for the Australian economy.

The RBA, like other major world central banks, is in the same difficult situation—high and rising inflation, on the one hand, and a slowdown in the economy, on the other. In other words: "rates cannot be raised or lowered."

At the same time, the US dollar continues to receive support as a safe-haven asset, especially given the high geopolitical risks in Europe and the world.

As of writing, the AUD/USD pair is trading near the 0.6450 mark, resting on the resistance level of 0.6455. In case of its breakdown, further corrective growth is not ruled out. In general, the downward dynamics of AUD/USD remains, making short positions preferable.