The dollar has strengthened since the beginning of this week, and during today's Asian trading session, the dollar index (DXY) reached a local 4-day high of 105.80. At the beginning of the European trading session, dollar sellers again decided to take control of the situation, which is, so far, not convincing.

Market participants are still evaluating the statistical data on the US labor market and the non-manufacturing PMI published the day before. As we recall, the report of the US Department of Labor, published last Friday, showed a more considerable growth of the number of new jobs created outside the agricultural sector at 263,000 (against the forecast of 200,000, and the previous figure of 284,000); unemployment remained at pre-pandemic lows at 3.7% in November (vs. 3.7% in October, 3.5% in September, 3.7% in August, 3.5% in July, 3.6% in June, May, April and March, 3.8% in February, 4.0% in January 2022). Meanwhile, average hourly earnings rose 0.6% instead of 0.3% (forecast), and year over year, it rose 5.1% (vs. 4.6% forecast).

The data suggests that the labor market remains strong, and the tightening of monetary conditions did not significantly affect its growth.

On Tuesday, the ISM reported that business activity in the US services sector grew at an accelerated pace in November: services PMI rose to 56.5 (against the forecast of growth to 53.1 and the value of 54.4 in October). Other components of the ISM report showed that the employment index rose to 51.1 from 49.1, while the inflation price index fell in November to 70 from 70.7, stronger than the forecast of 73.6.

These data also confirm the resilience of the US economy in the face of tightening monetary policy and despite a serious and prolonged increase in interest rates.

All this means that, despite the doubts among members of the Fed leadership, expressed by its head Jerome Powell last week, regarding the advisability of high rates of monetary tightening, the interest rate can be raised again by 0.75% at the Fed meeting on December 13–14.

At the same time, arguments in favor of a less tight Fed monetary policy and a slight increase in interest rates also remain.

Now the Fed interest rate is at 4.0%, while the level of 5.0%–5.25% is considered to be the peak, and Powell, speaking earlier at the Brookings Institution in Washington, said that the US central bank could reduce the pace of interest rate hikes as early as December, expressing the opinion that the final rate is likely to be "slightly above 4.6%."

In other words, the intrigue about the further actions of the Fed remains, shaking the markets and not allowing its participants to decide on the direction of movement. Probably, these doubts will remain until December 14, when the Fed's decision on the interest rate will be announced.

By the end of this week, the weekly report of the US Department of Labor will be released with data on jobless claims, November statistics on manufacturing inflation, as well as a preliminary consumer confidence index from the University of Michigan.

And today, the focus of market participants will be on the meeting of the Bank of Canada, as well as the publication (at 13:30 GMT) of the final data from the US Bureau of Labor Statistics on labor productivity (non-agricultural) and unit labor costs (for the 3rd quarter). Productivity and inflation are interrelated—a decrease in the productivity of a worker is equivalent to an increase in his wages. At the same time, when businesses pay more for labor, the higher costs tend to be passed on to the consumer, thus pushing up inflation.

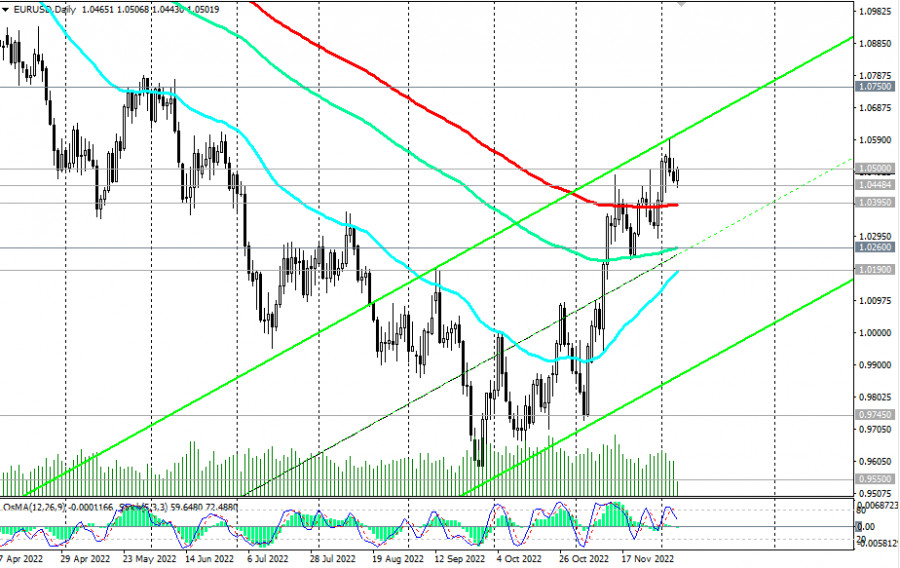

EUR/USD is trying to develop an upward trend, bouncing off the 1.0448 short-term support level and break again into the zone above the 1.0500 key resistance level. Above long-term support at 1.0395, EUR/USD retains further upside potential, and a break above 1.0500 would confirm bulls' intention to push the pair higher to key resistance levels 1.1035, 1.1155.