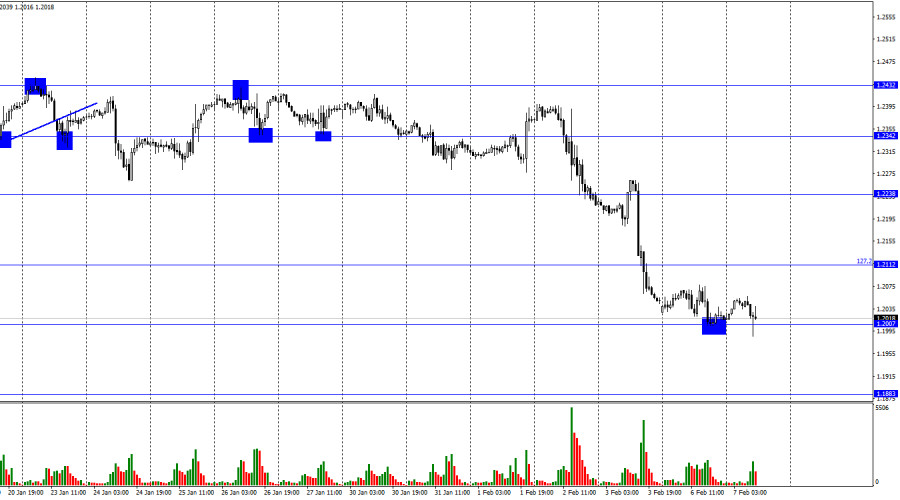

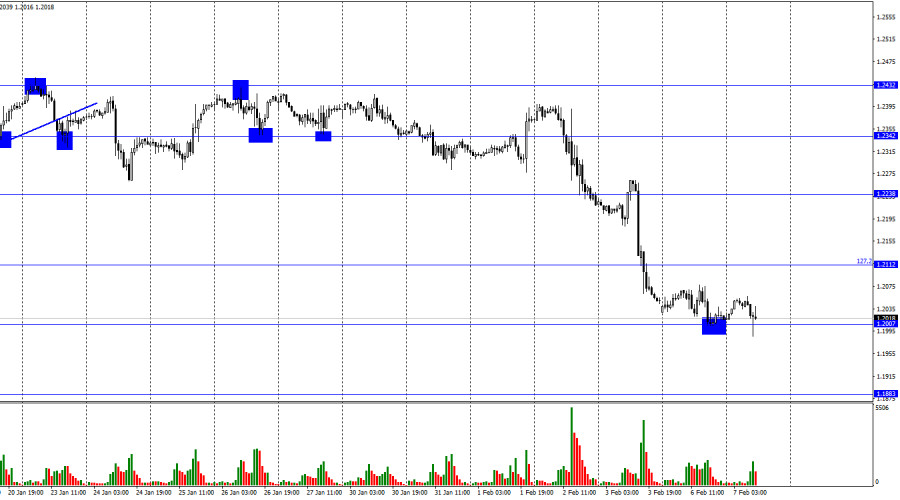

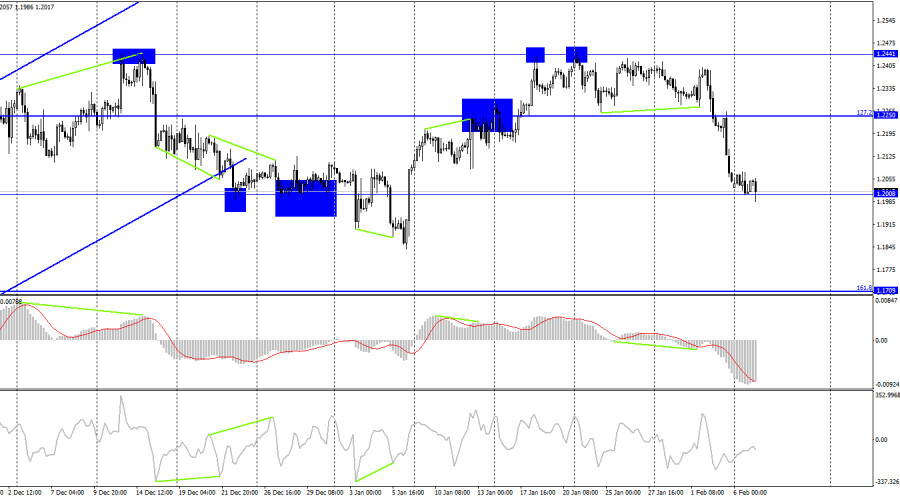

The GBP/USD pair continued to decline on Monday, as it was discovered close to the 1.2007 level, according to the hourly chart. The British pound gained little as the quotes recovered from this level. The pair has now returned to this level, and a new increase could enable the British pound to move somewhat closer to the corrective level of 1.2112. The risk of a further decline towards the next level of 1.1883 will increase if the exchange rate of the pair is fixed below the 1.2007 level.

Today, traders can become interested in simply one event. This is Jerome Powell's speech. Last week, he spoke immediately following the conclusion of the Fed meeting. Although his speech was "hawkish," several traders and experts still detected "dovish" tones. Following the Fed meeting, the US dollar declined. Some analysts claim that Jerome Powell's speech is more "tough" now, but I disagree with this statement. There is a belief that the most recent set of American statistics should make FOMC members' "hawkish" positions more rigid. But in my view, given that the FOMC's positions do not require tightening, this should not be anticipated. The US labor market is still quite strong, and unemployment is at its lowest point in the past 50 years. Inflation has been falling in the US for six consecutive months and has been doing so at a good pace. When everything is working well, why change it? If everything is going as planned, why bring up future interest rate increases? Jerome Powell should be more aggressive tonight than he was last week for these reasons. The Fed can increase the rate more than before in response to reports on payrolls and unemployment. But why is it required right now? If there is no particular need for it right now, why is Powell talking about it? Therefore, I don't think the Fed president's tone will alter from last Wednesday. The Fed will still anticipate another 1-2 0.25% rate increases.

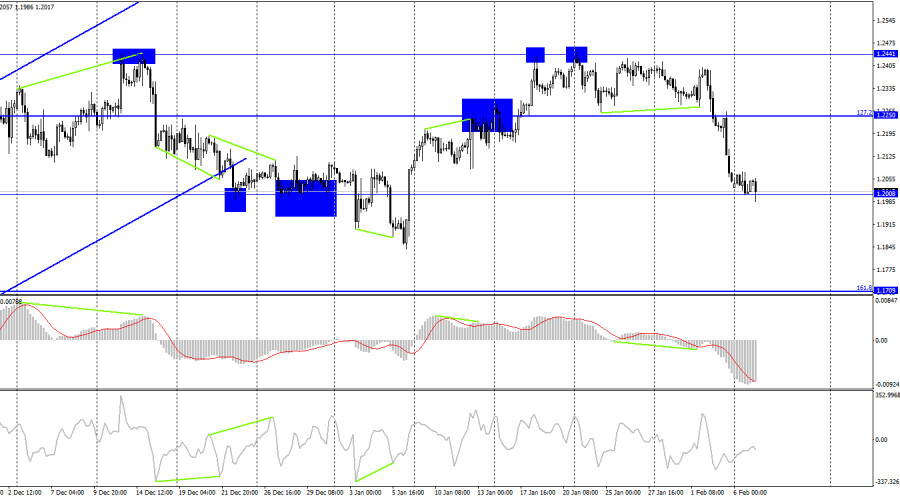

The pair carried out a decrease to the level of 1.2008 on the 4-hour chart. The British pound will benefit from the rebound in prices from this level and some growth, but it is unlikely to be significant. The likelihood of a further decline in the direction of the next corrective level of 161.8% (1.1709) will rise if the pair's rate is closed at 1.2008. Emerging divergences are currently undetectable by any indication.

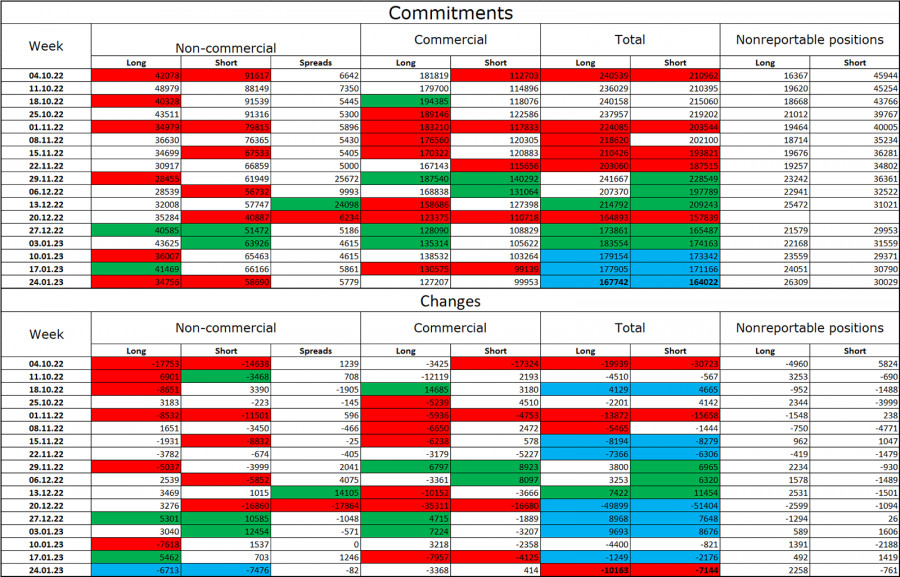

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British over the last few months, but today the number of long and short positions in the hands of speculators has nearly doubled once more. As a result, the outlook for the pound has once again declined, but the British pound is not eager to decline and is instead concentrating on the euro.

An exit from the three-month upward corridor was visible on the 4-hour chart, and this development may have stopped the pound's growth.

The following is the UK and US news calendar:

US – Speech by the head of the Fed, Mr. Powell (17:40 UTC).

Powell's address will take place in the US on Tuesday, while the UK's calendar of economic events is devoid of any intriguing events. The mood of the traders may be affected by the background information, but only in the evening.

Forecast for GBP/USD and trading advice:

When quotes on the hourly chart were fixed below the level of 1.2238, I suggested selling the pound with targets of 1.2112 and 1.2007. Both targets have been met. With a target of 1.1883, new sales closed at a lower rate than 1.2007. On the hourly chart, the pair may be bought when it recovers from the 1.2007 level with a target price of 1.2112.