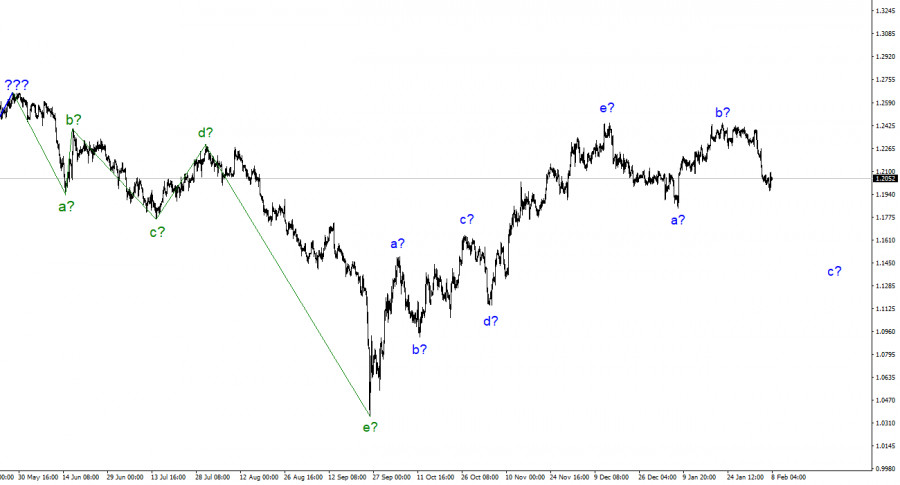

The wave pattern for the pound/dollar pair now appears very confusing but does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I anticipate that the downward section of the trend has started to take shape; it will at least have three waves. Wave B appeared to be unnecessarily long, but it did not cancel. As a result, last week, a wave could have started to form with a downward section of the trend, the targets of which are situated below wave a's low. The price would be at least 200–300 points less than it is at the moment. The entire downward section of the trend may even take a five-wave structure, in my opinion, and wave c may prove to be deeper than expected. But it's too early to discuss it at this time. The pair has been on the verge of restarting the development of an upward trend section for a while, and it wasn't until last week that it was able to start moving quotes away from the peaks reached with the help of the news background.

On Tuesday, the pound/dollar exchange rate increased by 30 basis points. Last night, the pair attempted but failed, to begin moving away from the achieved low. It is now absolutely uncertain how many additional interest rate increases will take place and how long the maximum rate period will last, which has only served to confuse the markets as a result of Jerome Powell's actions. Jerome Powell's speech is now in the past, therefore it's unlikely that any other FOMC members will provide any more detailed comments. The answer to the question "why?" is simple enough. The Fed itself cannot determine what kind of tightening of monetary policy may still be required because they do not yet fully understand how inflation will shift in 2023. Therefore, since this question has no purpose, there is no need to find a solution. It is preferable to respond to inflation directly.

The GDP data on Friday this week is the only thing the British pound, which has been rapidly dropping lately, can rely on. Powell tried everything in his power to support the pound after yesterday's market confusion, but the support was insufficient. There is no assurance that the fourth quarter's GDP would surpass what the markets are currently anticipating. The Bank of England may opt to cut the rate of rate hikes again at its upcoming meeting if the British economy declines in the fourth quarter. All three central banks now generally use the same language. All three banks predict that rates will rise further as long as inflation remains much below the common target level of 2%. The only uncertainty is how much a specific bank's rate will rise. And right now, it's impossible to find an answer to this query. Only when it comes to the Fed is the situation reasonably clear. There could be one or two more 25 basis point increases.

Conclusions in general

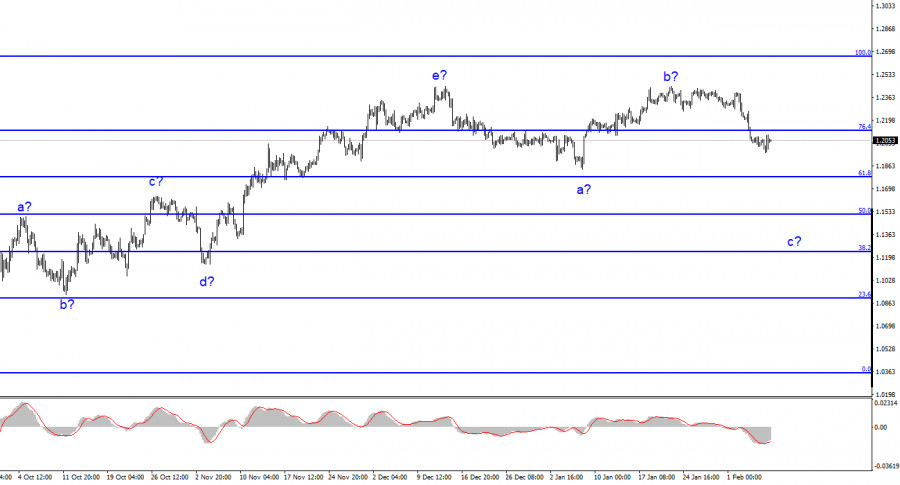

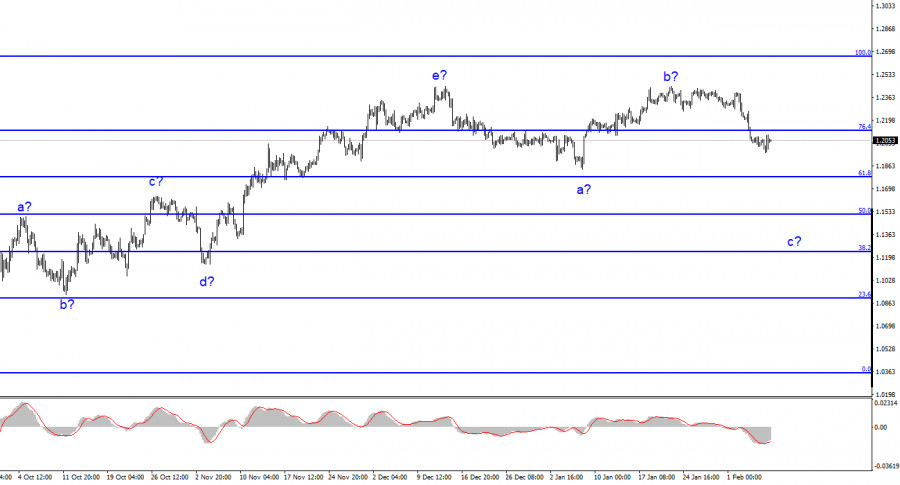

The development of a downward trend section is implied by the wave structure of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave C may be shorter in duration; everything now depends on the Fed and Bank of England's actions in March as well as economic data, particularly inflation data.

The image resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.