Inflation has dominated the foreign currency market's attention for the past year. Inflation used to be a key indicator, but for many years it was just above 2% in the US and the EU, drawing little attention to itself. Let me remind you that for years, central banks have been focused on raising inflation rather than lowering it. However, substantial financial rewards and low-interest rates have been effective. Although the economy has more money, the amount of real goods and services produced has remained stable. The fact that prices have begun to increase across all levels of goods and services is not shocking. And as they did, salaries started to rise.

Now that several central banks have already increased their rates to levels unseen in decades, the anticipated outcome has not yet materialized. Only in the United States is inflation continuously dropping, although there are concerns that this process may be completed soon. Many think that the Fed's decision to raise the rate to 4.75% is what has caused the consumer price index to begin to slow down. But in truth, declining energy prices may also cause inflation to slow down. The US's core inflation rate has barely decreased in recent months. And the base value just represents the shift in costs across the board, excluding those for energy and food. It turns out that if you exclude the price of gas and oil, inflation in the US does not decrease.

John Williams, the president of the Federal Reserve Bank of New York, thinks it will take a while to stop excessive inflation. In an interview with The Wall Street Journal yesterday, he stated that the Fed may need to maintain high rates for a lot longer than most economists anticipate. To preserve pricing stability, he pointed out that the regulator still has a lot of work to do. He thinks the Fed made the right decision in limiting rate increases to 25 basis points because fewer sudden changes in rates will make it possible to examine their effects on the economy more precisely. According to Williams, the rate should ultimately increase to 5.00–5.25%.

According to Williams' comments, the regulator is unsure if inflation will continue to decline gradually for a very long time. They worry that eventually the indicator will stop falling and additional time or a stronger rate increase will be needed. Williams is leaning toward the alternative that has a strict policy in place for a longer period of time. Rate increases may be possible, according to Jerome Powell, if the labor market is as healthy as it was in January. Regardless of your perspective, it reflects a more "hawkish" stance than the market had previously anticipated. The same Powell has maintained time and time again that rates may start to decrease no earlier than 2024. Let me remind you of this. High inflation, however, might necessitate adjusting this forecast.

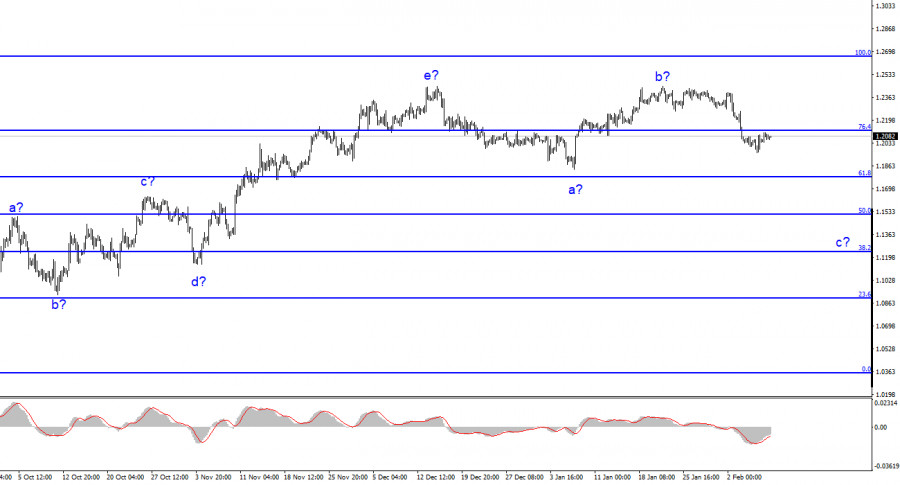

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. However, almost for the first time in recent weeks, we notice on the chart a picture that can be termed the start of a new downward trend segment. The likelihood of an even bigger complication in the upward trend segment still exists.

The development of a downward trend section is implied by the wave structure of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a stop-loss order. Wave C may be shorter in duration; everything now depends on the Fed and Bank of England's actions in March as well as economic data, particularly inflation data.