Overview of trading and tips on EUR/USD

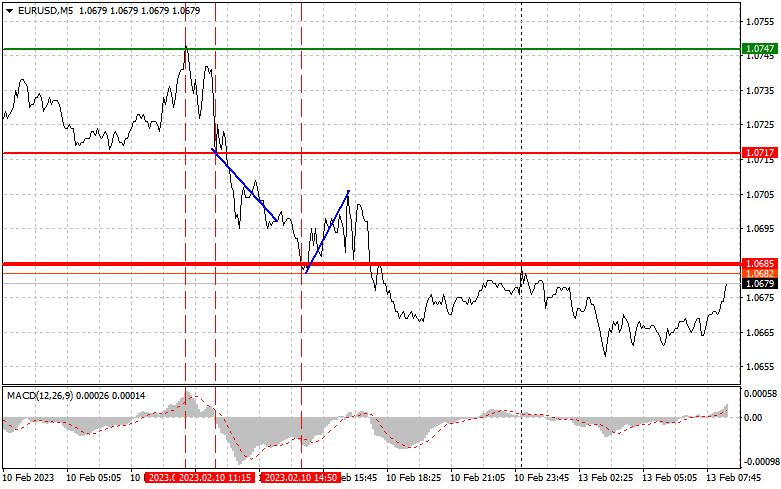

The level of 1.0747 was tested exactly at the moment when the MACD indicator had moved a lot from the zero level. In my viewpoint, this capped the upside potential. For this reason, I didn't buy the euro. Later on, after a fall in the trading instrument, there was a test of 1.0717 where MACD was just going to begin its down move. Bearing in mind market conditions a day earlier, I decided to sell the pair. Sell positions brought me nearly 20 pips of profit. In the second half of the day, I went long on EUR/USD at 1.0685 during a rebound. I also told you about it in my forecast. As a result, I also took a 20-pips profit.

The inflation data for Germany encouraged a modest growth of the instrument but the euro came under selling pressure again after the US unemployment claims. Today in the first half of the day, no important events, except the Eurogroup's summit, may lead to the euro's fall. Thus, I'm betting on the euro's upward correction amid the empty economic calendar. During the New York trade, FOMC member Michelle Bowman is due to speak. She might remind traders that the Federal Reserve would hardly lower interest rates this year. Such comments will push EUR/USD down, thus reinforcing the US dollar.

Buy signal

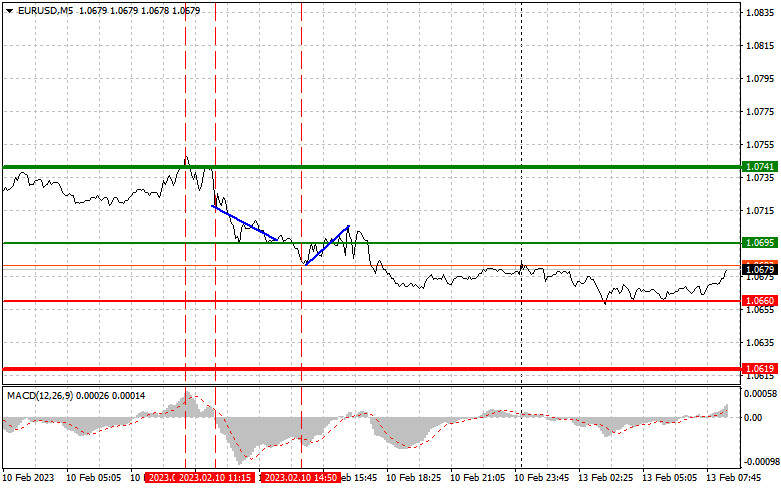

Scenario. Today we can go long on EUR/USD once the price reaches 1.0695 plotted by the green line on the chart, betting on the euro's growth to 1.0741. At this level, I would recommend leaving the market and opening short positions in the opposite direction, reckoning a 30-35-pips down move from the market entry point. We can expect EUR/USD to grow today amid the empty economic calendar. Importantly, before opening long positions, please check that MACD is above the zero mark, beginning its climb from it.

Scenario 2. We could buy the euro today also in case the price drops to 1.0660, but the MACD indicator should be in the oversold zone at that moment. This will cap the downward potential of the pair and will enable a market reversal. We can also expect the price growth to the opposite levels of 1.0695 and 1.0741.

Sell signal

Scenario 1. We can go short on EUR/USD after the price reached 1.0660 plotted by the red line on the chart. The downward target will be 1.0619 where I recommend exiting the market and buying the euro in the opposite direction, bearing in mind a 20-25-pips upward move from that level. The currency pair could come under pressure in case the buyers lack activity at around the intraday high. Importantly, before selling the pair, make sure MACD is below the zero level, starting its decline from it.

Scenario 2. Another option today is selling the euro after the EUR/USD reaches 1.0695, but MACD should be in the overbought zone at that moment which will limit the upward potential of the pair and push the trajectory down. We can predict a decline to the opposite levels of 1.0660 and 1.0619.

What's on the chart

The thin green line is the key level at which you can open long positions on the EUR/USD pair.

The thick green line is the target level since the price is unlikely to move above this level.

The thin red line is the level at which you can open short positions on the EUR/USD pair.

The thick red line is the target level since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.