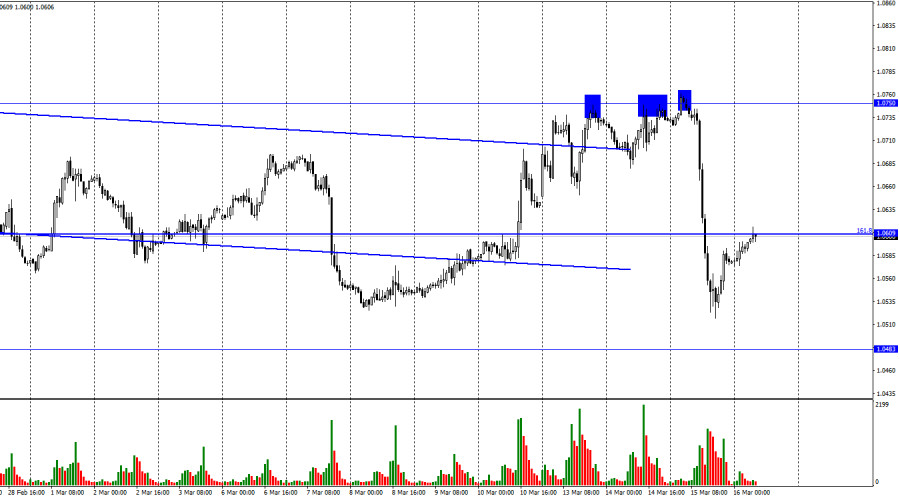

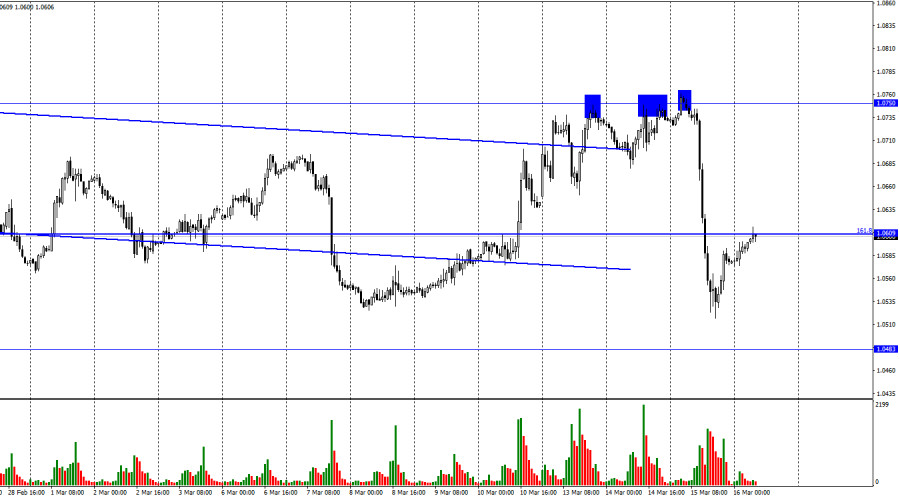

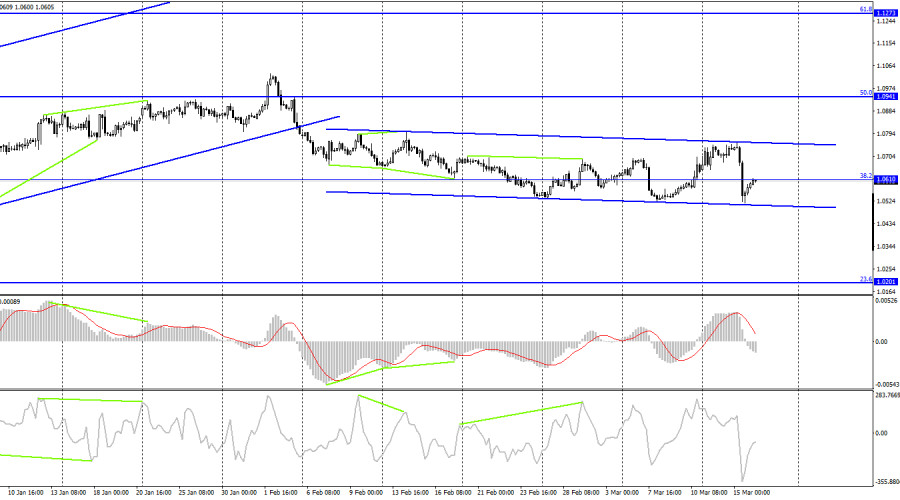

On Wednesday, the EUR/USD pair displayed a rebound from the 1.0750 level, a change of direction in favor of the US dollar, and a decline that ended with a closing under the corrective level of 161.8%. The pair's quotes performed a return to the level of 1.0609 toward the day's close. Now that the US dollar has rebounded from this level, the decline toward the level of 1.0483 will resume, and the consolidation above it will allow us to count on the continuation of the growth that has already started in the direction of the level of 1.0750.

The European Central Bank's rate decision will be known to us in a few hours. In recent weeks, traders have been utterly certain that the interest rate will increase by 0.50%, as the ECB members have frequently warned. As a result, there is no curiosity at first glance. Buyers of the euro currency will be surprised if the ECB does not meet its pledge to raise the rate by half a point. Yet, as they have often stated in recent weeks, there are now specific circumstances in which the regulator could make an incorrect decision. If the shares of Credit Suisse, one of the main banks in the European Union, had not fallen this week, everything would have been great. Although the bank has not declared bankruptcy, it is having financial difficulties, as evidenced by the fact that it even asked one of its major shareholders for financial support, which was turned down. As a result, the bank may start to lose a lot of deposits, and its stock price may continue to decline. Yet given the issues in the banking industry, the European regulator might not make such a difficult choice as previously suggested.

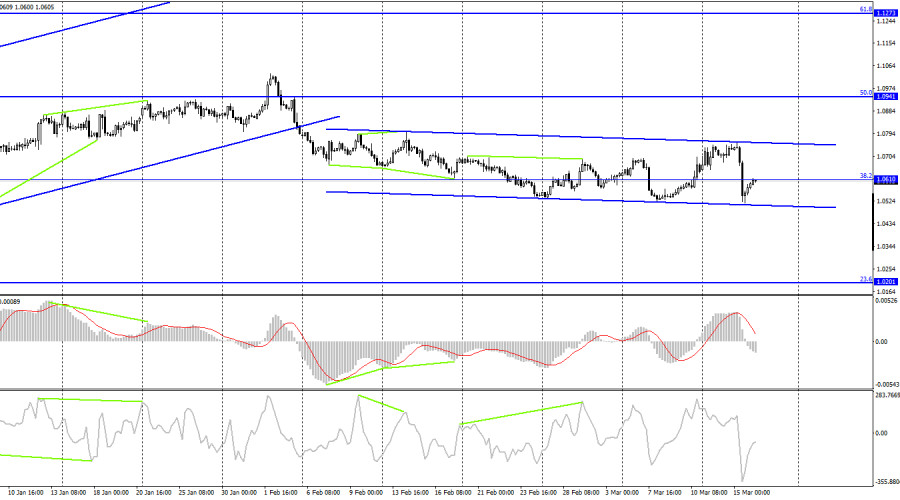

While it is more likely that the ECB will raise the rate as stated, I think it can only do so by 0.25% today. The euro may continue to decline in the first scenario, while traders are betting on the second scenario, which calls for a cautious response. The pair has stabilized under the upward trend corridor on the 4-hour chart, allowing us to continue to anticipate additional declines. The new downward trend corridor, which verges on the idea of "sideways," is confirmed by the traders' "bearish" attitude. There have been more horizontal movement recently.

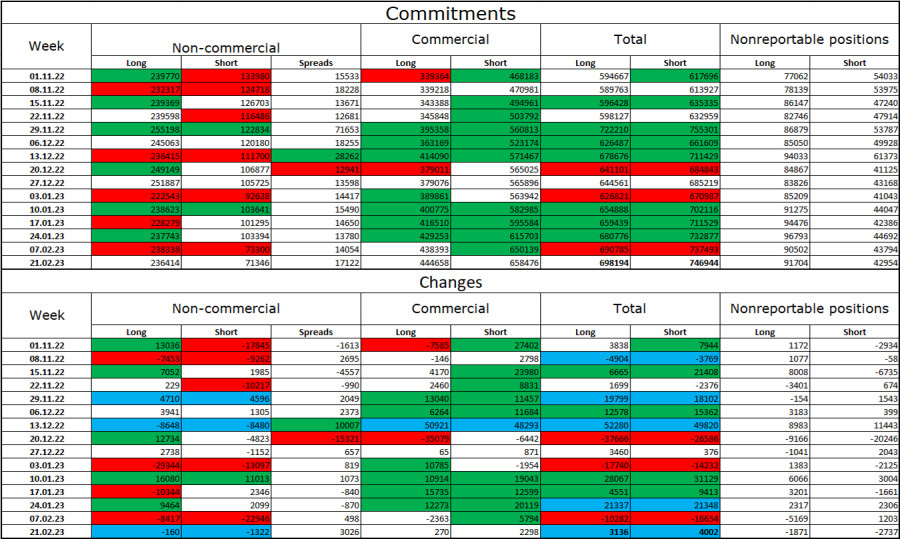

Report on Commitments of Traders (COT):

Speculators concluded 1,322 short contracts and 160 long contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. I want to call your attention to the fact that the most recent report we have is from February 21. The "bullish" sentiment may have grown stronger in February, but how are things now? Speculators now have 236 thousand long contracts, while just 71 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

US – number of construction permits issued (12:30 UTC).

US – index of manufacturing activity from the Philadelphia Federal Reserve (12:30 UTC).

US – number of initial applications for unemployment benefits (12:30 UTC).

EU – decision on the interest rate (13:15 UTC).

EU – ECB press conference (13:15 UTC).

EU – ECB monetary policy statement (13:15 UTC).

EU – ECB President Lagarde will deliver a speech (15:15 UTC).

Many significant events are scheduled on March 16 on the economic calendars of the European Union and the United States, but the ECB meeting will take precedence. The information backdrop might have a significant impact on how traders feel today.

Forecast for EUR/USD and trading advice:

On the hourly chart, new sales of the pair can be initiated when it rises over the level of 1.0609, with targets of 1.0526 and 1.0483. On the hourly chart, purchases of the euro are possible if the price closes above the level of 1.0609 with a target of 1.0750.