Bitcoin had a productive weekend and hit $28k. This was influenced by a large number of fundamental and internal factors, but the situation may change dramatically in the near term.

The main cryptocurrency is building bullish sentiment due to fundamental events, which are reflected in the actions of investors. The events of March 22 could drastically affect the movement of the BTC price and send the asset above $30k or drop it to $20k–$22k.

Fundamental factors

The Fed will hold its next meeting on March 22, and the outcome is unpredictable. On the one hand, inflation is down and aggressive monetary policy is in effect, giving the regulator a window of opportunity to loosen its grip.

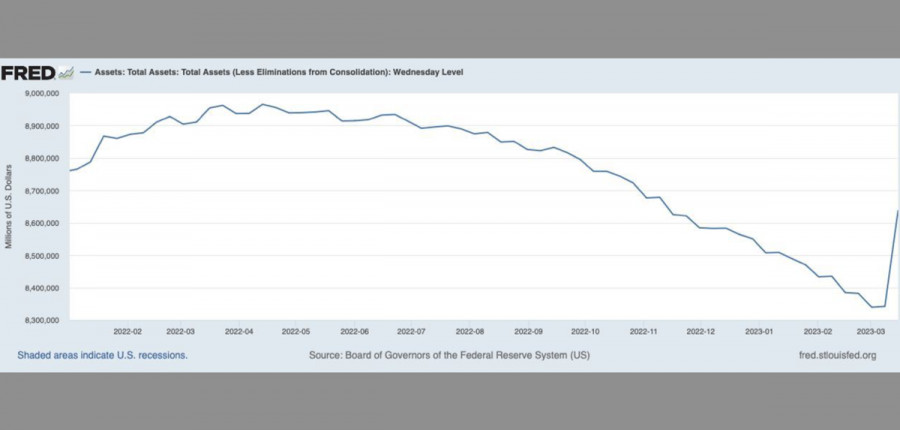

At the same time, the labor market remains abnormally strong, and the crisis in the U.S. banking system and bank failures are forcing the Fed to run the printing press. As of March 18, the regulator has injected about $300 billion of the planned $2 trillion into the banking system to stabilize the situation.

This news was received with enthusiasm in the crypto space, as the growth of liquidity in the global economy directly correlates with the movement of Bitcoin to $28k. Many experts believe that BTC at $30k is a matter of a few days, and this can really happen.

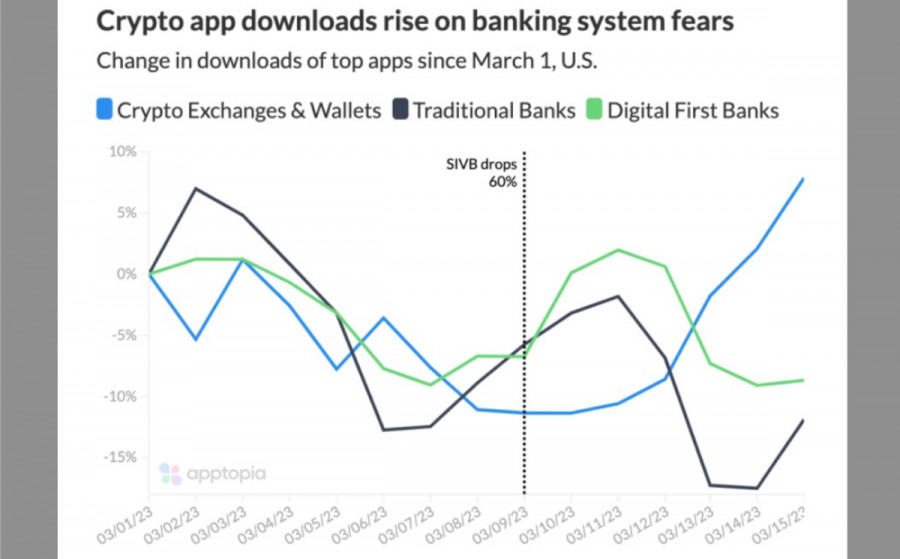

Although the markets are actively preparing for a rate hike of 0.25%, this may not happen due to the growing panic of investors. Since SVB filed for bankruptcy, downloads of the top 15 crypto applications have increased significantly. App downloads for the top 10 banks fell 5% over the same period.

The U.S. banking system is experiencing one of the largest outflows in its history, and this may force the Fed to leave the key rate unchanged and lend a shoulder to the banking system. In this case, Bitcoin can update the local high and reach the $30k–$31.5k area.

Bulls vs. Bears

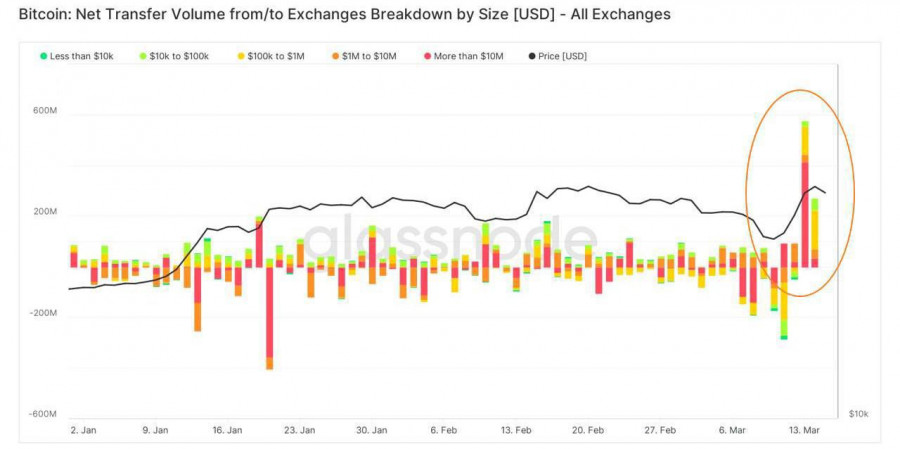

In parallel with the bullish euphoria in the market, there are signals of likely profit taking. Analysts at Santiment and Glassnode argue that BTC inflows to exchanges exceeded $1 billion during the last five days. Given the rapid rise in price, this process is most likely associated with the implementation of investors' short-term targets.

With this scenario, we should expect a long-term consolidation of the price of Bitcoin, as well as a corrective movement below $25k, followed by accumulation. However, in the short term, Bitcoin is at risk of continuing its upward movement, and the Fed meeting on March 22 could be the catalyst for this.

BTC/USD Analysis

The coming days, before the Fed meeting, will pass within the consolidation corridor of $27.2k–$28.1k. The cryptocurrency managed to set a new high near the $28.5k level, where there was a strong activation of sellers and a downward movement to $27.2k.

As of writing, Bitcoin has stabilized near the $28k mark and has added 3% to its market capitalization over the past day. Overall, the market looks bullish, and the rapid redemption of the local strait is direct evidence of that. Daily technical metrics confirm the bullish sentiment and desire to move above $28k.

In the short term, only the unexpected results of the Fed meeting can break the plans of buyers. However, even if the current bullish momentum continues, the ultimate potential of Bitcoin is close to $31.6k. Subsequently, it is worth preparing for a protracted correction and consolidation of large volumes of liquidity.

The problem is that BTC has entered a zone of massive liquidity accumulation from May 2022. Now the $30.1k–$31.6k area is a strong resistance zone, and before the asset manages to overcome it, we are in for a corrective movement, at least to $25k.

Results

In the long term, the current aggravation of the macroeconomic situation will play a cruel joke on BTC. With the stabilization of the banking system, the Fed will resume the withdrawal of liquidity, and the cryptocurrency will again face the painful process of falling inflation.