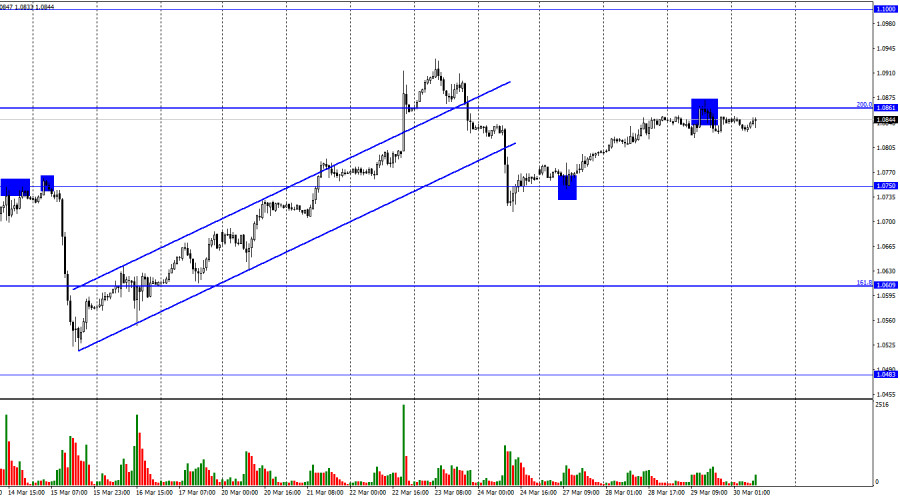

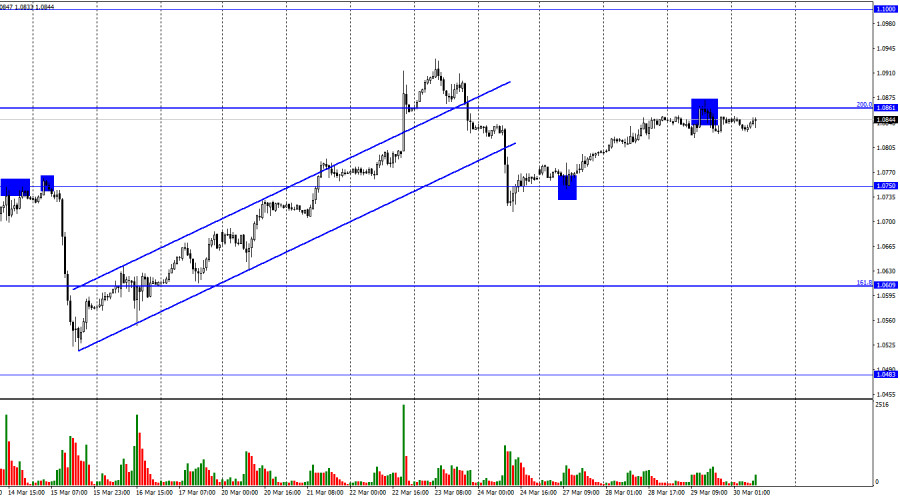

On Wednesday, the EUR/USD pair completed the growth process and reached the corrective level of 200.0% (1.0861). The US dollar recovered from this level, but the decline in the direction of the 1.0750 level has not yet started. The trader's activity has been very low in recent days. If there was an increase at the start of the week, then the pair is moving horizontally as of yesterday. The likelihood of further development toward the next level of 1.1000 will increase if consolidation occurs above the level of 1.0861.

This week, the background information is merely absent. The first significant report will be published today. It is anticipated that the German inflation report will show substantial declines, which could please bear traders who sell the pair (that is, buy the US dollar). If inflation declines noticeably after increasing a month earlier, the ECB may tone down its "hawkish" stance at the following meeting. However, the inflation estimate for Germany only covers one member state of the EU. The European consumer price index is not at all required to show a significant decline on Friday. I suspect that inflation will radically fall by more than 1% in a single month. As a result, I don't think it's worthwhile to give it a lot of importance. Of course, given the significant issues with the background information this week, traders are unlikely to disregard this data.

A report on the US GDP for the fourth quarter will be made public in the afternoon. I could make a similar statement about this report. The report is essential, but don't overestimate it. There is no denying that the American economy is growing, but traders are currently more worried about the FOMC rate, which may stop growing in May. The ECB rate will also keep rising at the same time. Thus, the euro currency still holds an important advantage over the dollar.

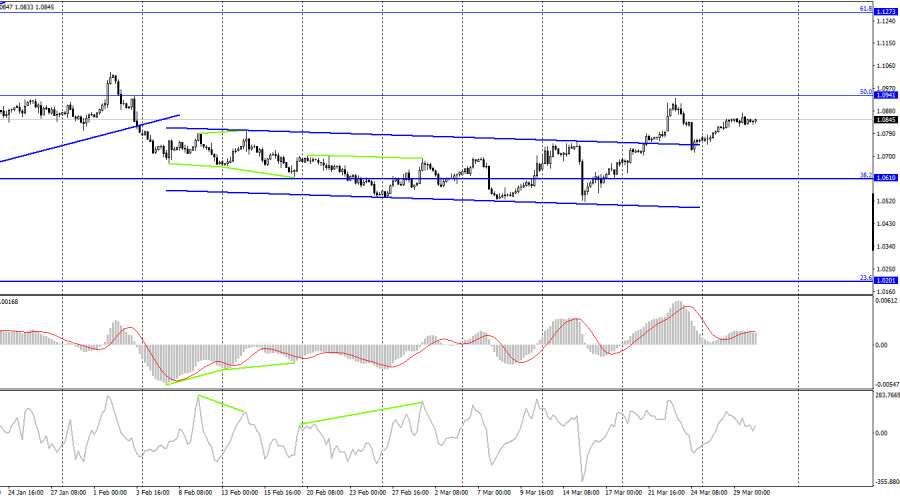

The 4-hour chart shows that the pair has stabilized above the side corridor, allowing us to predict further growth. However, consolidation was not possible above the corrective level of 50% (1.0941). However, there was no rebound from it. As a result, the decline in quotes can always be restarted in the direction of the corrective level of 38.2% (1.0610). Emerging divergences are currently undetectable by any indication.

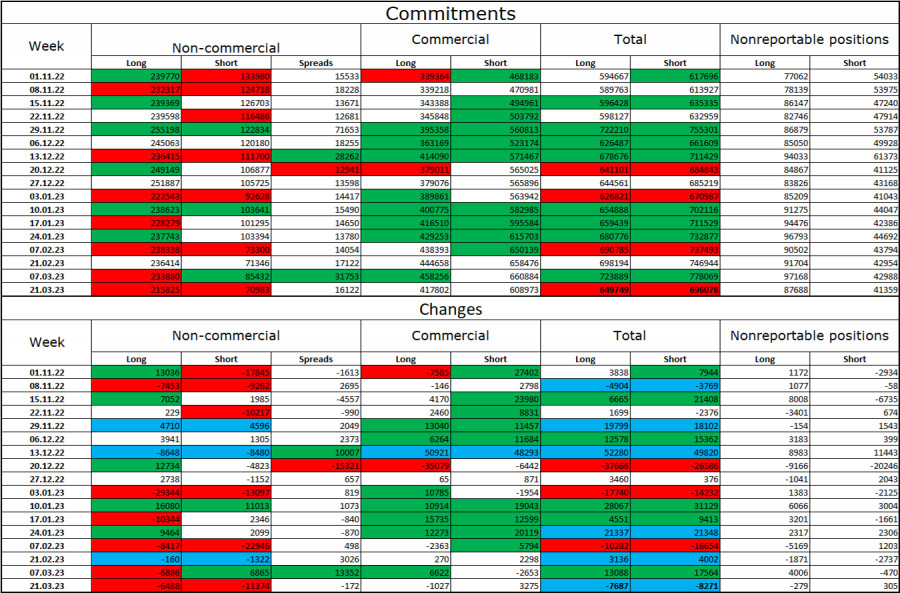

Report on Commitments of Traders (COT):

Speculators closed 6,488 long contracts and 11,374 short contracts during the most recent reporting week. Major traders' overall attitude is still "bullish" and getting better. Speculators now have 215 thousand long contracts, while just 71 thousand short contracts are concentrated in their hands. Although the value of the euro has been rising for several months in a row, professional traders have not raised the number of long contracts in recent weeks. After a protracted "black period," the situation is still in favor of the euro, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least. I would like to point out that the market could become "bearish" soon since the ECB won't be able to keep raising interest rates by half a percent.

News calendar for the USA and the European Union:

EU – German consumer price index (CPI) (12:00 UTC).

US – GDP for the fourth quarter (12:30 UTC).

US – number of initial applications for unemployment benefits (12:30 UTC).

The calendars of economic events in the European Union and the United States both have a few less significant listings for March 30. The prior information's impact on today's traders' attitudes will be minimal.

Forecast for EUR/USD and trading advice:

On the hourly chart, the pair's sales can be initiated at its rebound from the 1.0861 level with a target of 1.0750. On the hourly chart, buying the pair with a target of 1.1000 will be possible if it closes above the level of 1.0861.