"Our main position is that we should patiently maintain the monetary policy easing," said Bank of Japan Governor Katsuo Ueda last Monday, adding that "stable and sustainable achievement of 2% inflation is not yet visible."

Newly appointed Economy Minister Yoshitaka Shindo echoed this sentiment, stating that the weak yen has various effects on the economy, such as increasing import costs for consumers and enhancing exporters' competitiveness.

It is worth adding that a weak yen is critically necessary for Japan's export-oriented economy, allowing for increased competitiveness of Japanese goods in the international market.

At the same time, the Japanese government closely monitors "currency movements with a sense of urgency and immediacy," as stated by Japanese Finance Minister Shunichi Suzuki on Tuesday, not ruling out "any actions in response to disorderly currency movements."

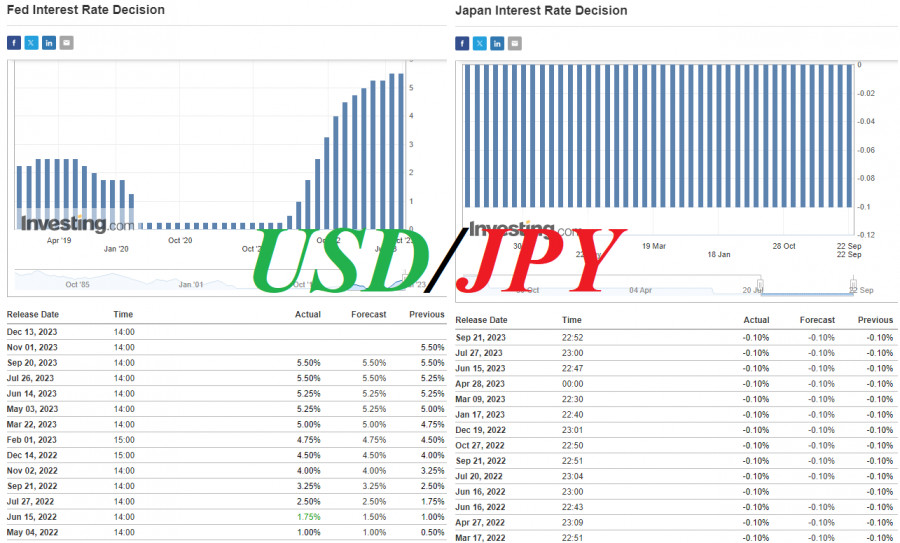

From all these and other statements made by government and Bank of Japan representatives recently, market participants have concluded that the Bank of Japan will continue its ultra-loose monetary policy in the near future. At most, yen buyers can expect currency interventions by the Bank of Japan (yen purchases).

However, typically, the effects of such actions are short-lived, only temporarily easing tension in the currency market while providing new opportunities for yen sellers.

Until the Bank of Japan clearly signals an imminent change in its policy direction, the yen will remain under selling pressure.

In other words, in practically all currency pairs involving the Japanese yen, especially USD/JPY, given the Federal Reserve's tight monetary policy, it is advisable to maintain long positions. The question here largely boils down to anticipation—at what level should one expect the Bank of Japan's intervention in the currency market with yen purchases.

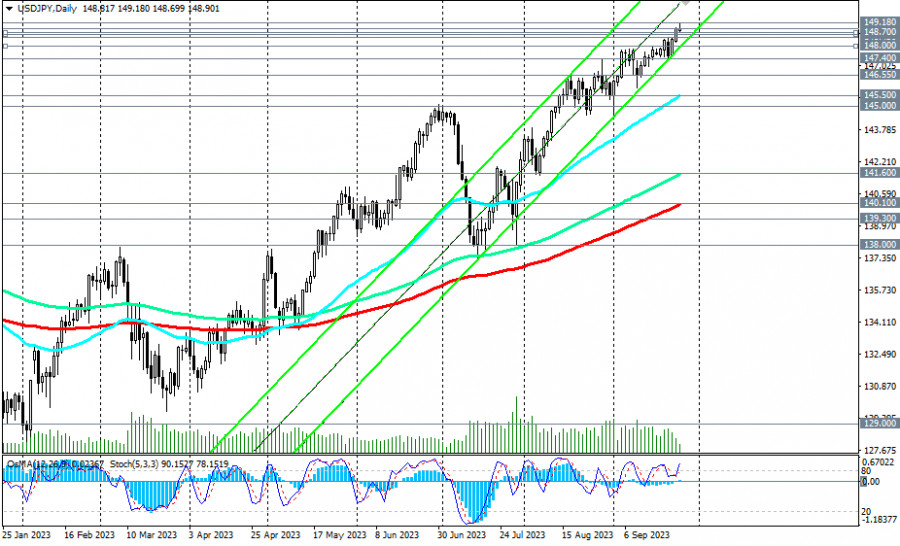

The USD/JPY pair continues to rise. While market participants previously considered the 145.00 level as the "protective" level at which the Bank of Japan would intervene in the currency market, USD/JPY is currently trading close to the 149.00 level, having reached a high of 149.18 at the beginning of the European trading session. Now, investors' new assumption is that the Bank of Japan will "defend" the 150.00 level. We must now simply observe the unfolding events, manage risks, and stay informed about the news.

Currently, long positions remain the preference. It is not excluded that the 150.00 level will also be easily surpassed. It's worth noting that in October last year, USD/JPY almost reached a record multi-year level of 152.00.

Today (at 23:50 GMT), the minutes of the Bank of Japan's September meeting will be published. As we recall, it concluded with an acknowledgment of the need to continue the current course of the Bank of Japan's credit and monetary policy. As the former head, Haruhiko Kuroda, repeatedly stated earlier, "it is appropriate for Japan to patiently continue its current accommodative monetary policy." The current head of the Bank of Japan, Kazuo Ueda, maintains a similar rhetoric in his statements.

If, however, the published minutes contain unexpected or additional information regarding the Bank of Japan's monetary policy matters, volatility in JPY quotes will increase.

It is also worth paying attention to the publication on Thursday between 23:30–23:50 (GMT) of a significant block of macroeconomic statistics from Japan, which can also have a substantial impact on the yen's dynamics.

However, the yen may once again become highly sought after by investors in the event of a sharp escalation of the geopolitical situation in the world or an increase in economic uncertainty. The yen is, as known, a popular safe-haven asset.