On Monday, the GBP/USD currency pair attempted to adjust again to the moving average but failed. Generally speaking, the British pound has been increasing recently just as quickly and irrationally as the euro. Recall that it all began with a report on American inflation, which decreased for the sixth consecutive time and very dramatically. Traders interpreted this news as an indication that the Fed might scale down its hawkish monetary policy in early February. Although we think there is a good chance that it will happen, the right choice has not yet been made. Several members of the Fed's monetary committee called for a slowing of rate growth last week, but experts like James Bullard still think that monetary policy needs to be tightened as quickly as possible to fend off a potential new price crackdown. Therefore, if the Fed decides to increase the rate by 0.5% in a week and a half, we won't be shocked.

The British pound has now reverted to the level of 1.2451, which marked the point at which the previous phase of this currency's expansion came to an end. In theory, we can discuss how the "double" vertex pattern develops. Nevertheless, it is necessary to obtain particular technical verification, as with any fundamental hypothesis, by putting the price, at the very least, below the moving average line. Also take note of the CCI indicator's recent entry into the overbought region, which could signal a negative reversal. We are still in favor of the option with a fall, not with growth, because we have been waiting for a significant downward correction for a very long time. There were no fundamental or macroeconomic backdrops yesterday, and there won't be many significant developments this week that might significantly affect traders' sentiment. For instance, only business activity indices will be made public today.

Rates will climb more than everyone anticipates, in Jamie Dimon's opinion. The worries of Christine Lagarde, who believes that a new acceleration of inflation in the EU is very likely caused by the "opening" of the Chinese economy, were already discussed in the article on the euro/dollar exchange rate. It should be highlighted that if Lagarde's worries come true, the issue won't just affect Europe because global gas and oil prices will increase once again. As a result, American inflation, which has been declining for the past six months straight, could start to increase once more. Or at least slow the rate of decline. Jamie Dimon, CEO of JP Morgan, likewise thinks that the Fed's rates may climb more than it anticipates because the inflation problem has not yet been fully resolved. At the Davos international summit, where Christine Lagarde also spoke, she made this statement.

Because core inflation is still quite high and is not decreasing as quickly as the primary index, Dimon predicts that rates will rise above 5%. Mr. Dimon also pointed out that the Fed, which has been actively raising rates, is not the only reason for the decline in US inflation over the past six months. The reduction in price increases has also been influenced by declining energy prices and China's sluggish economic growth. But now that China is "opening up" its economy, there is a chance that oil and gas prices could start to increase once more, which will hasten global inflation. In the next ten years, energy prices "may climb," Dimon predicted. JP Morgan's CEO also mentioned that the US economy's recession would be mild and that the job market and unemployment might allow the Fed to hike rates by up to 6%.

As a result, the Fed's prediction of a high rate just above 5.1% may not materialize. We do want to caution traders, though, that any Fed expectations come with a "double-edged sword." The monetary committee's representatives have promised to take action on the matter time and time again. The pace of the fall in inflation is the current "condition." Few individuals now believe that the percentage could increase to 6% if they are frail or don't show up. Although this alternative still seemed "unnecessarily hawkish" at the beginning of the year, it was about a 3.5% increase.

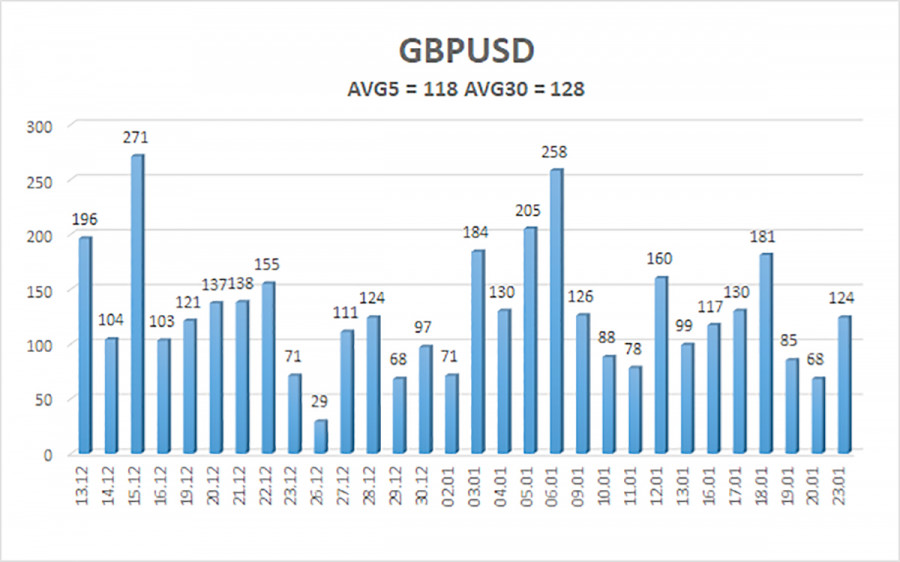

Over the previous five trading days, the GBP/USD pair has averaged 118 points of volatility. This figure is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Tuesday, January 24, with movement being constrained by levels of 1.2271 and 1.2507. A new phase of the corrective movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest levels of resistance

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still rising. Therefore, until the Heiken Ashi indicator swings down, it is still possible to hold long positions with goals of 1.2451 and 1.2512. If the price is locked below the moving average, short trades can be opened with targets of 1.2268 and 1.2207.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.