To open long positions on EURUSD, you need:

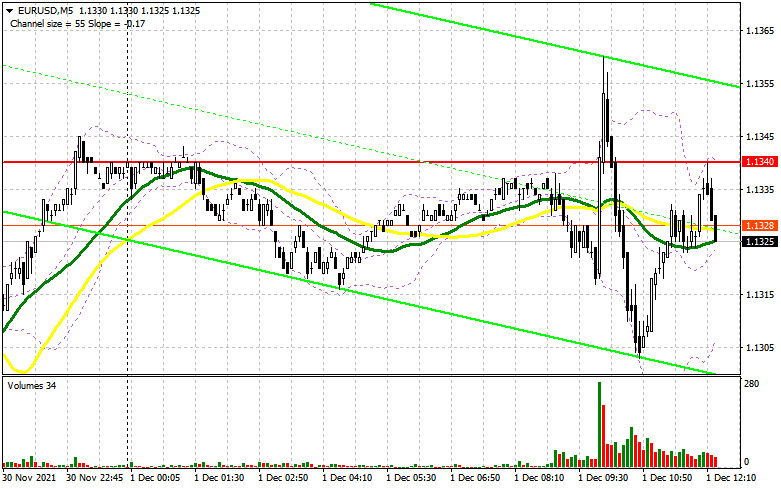

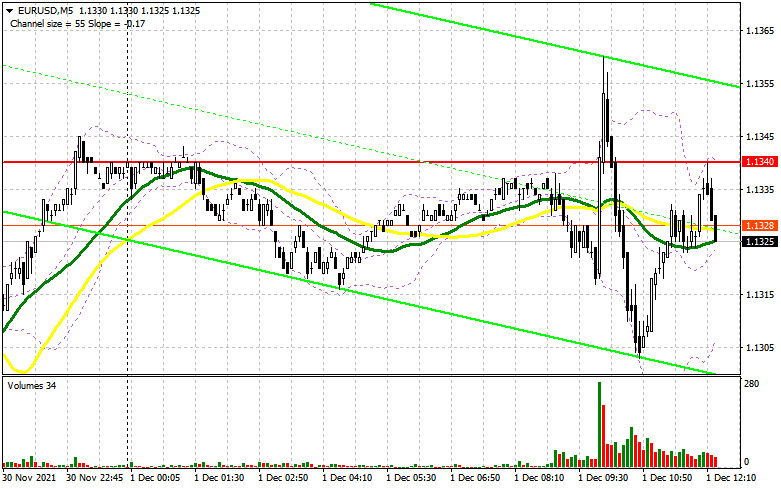

Today, in the first half of the day, no signals were formed to enter the market, although a movement above the 1.1340 level occurred. Let's look at the 5-minute chart and figure out how to act. In my morning forecast, I paid attention to 1.1340, but as you can see, after its breakdown, the reverse test from top to bottom led to the bears regaining control of the market. The bulls failed to catch on to the above level and defend it. For this reason, I did not enter long positions in the continuation of the upward correction of the pair. The pressure on the euro may continue in the afternoon, as there are several objective reasons for this – the main one is Jerome Powell. From a technical point of view, everything remained unchanged.

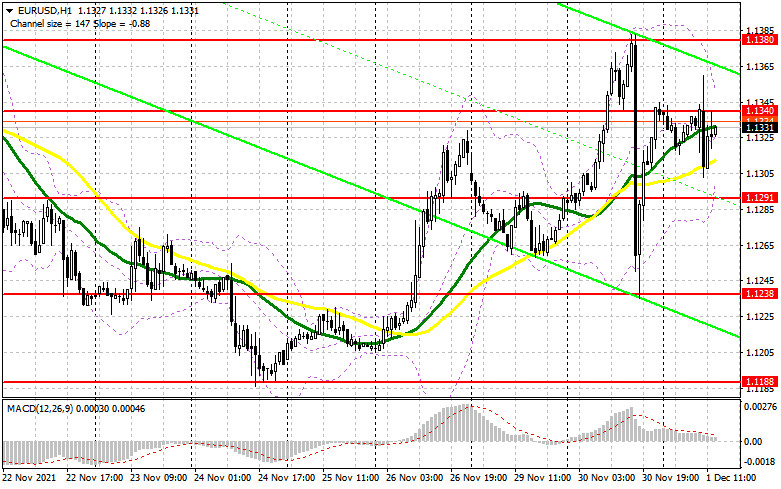

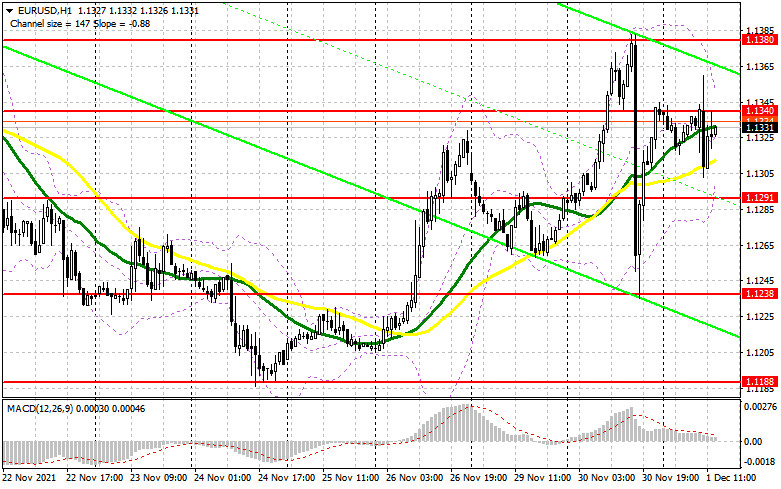

In the afternoon, we are waiting for several statistics on the US labor market in the form of changes in the number of employees from ADP, and the ISM manufacturing index will be released – the growth of indicators will lead to a strengthening of the US dollar. But more interesting will be the speech of Chairman of the Fed Board of Governors Jerome Powell and Treasury Secretary Janet Yellen. Most likely, they will repeat everything they said yesterday, but some details of their plans may be revealed, which will further strengthen the euro's position against the dollar. Bulls need to reserve the nearest support of 1.1291, as the further upward correction of the pair depends on it. Only the formation of a false breakdown there, together with weak statistics on the US manufacturing sector, will lead to the formation of the first entry point into the market. The calculation will be on the continuation of the pair's growth and the breakthrough of the resistance of 1.1340 formed by the results of yesterday. A breakout and a top-down test of 1.1340, by analogy with what I discussed above, will give an excellent entry point with the prospect of updating the maximum of 1.1380 and with an exit to 1.1420. However, the bulls should hold the 1.1340 level after it is updated from top to bottom. A more distant goal will be 1.1462, where I recommend fixing the profits. In the scenario of a decline in EUR/USD to 1.1291 and strong fundamental statistics on the United States, as well as hawkish statements by representatives of the Federal Reserve System, it is best not to rush into purchases. I advise you to wait for the next fall of the pair and the formation of a false breakdown at the minimum of 1.1238. You can open long positions on EUR/USD immediately for a rebound from 1.1188, or even lower - from 1.1155, counting on a correction of 15-20 points within a day.

To open short positions on EURUSD, you need:

The bears have made it clear that they are not going anywhere today. Having collected stops above 1.1340, they quickly returned the market to balance. The main task of sellers today for the second half of the day remains to protect the resistance of 1.1340, above which it is impossible to issue the European currency. The formation of a false breakdown there, together with strong data on the US manufacturing sector for November this year, will give an excellent entry point into short positions in continuation of yesterday's bearish momentum formed after the speech of Federal Reserve Chairman Jerome Powell. Do not forget about the new strain of coronavirus, which will also keep the pair from a rapid recovery. Any news about its next rapid spread will return pressure on the euro. An equally important task for EUR/USD sellers is to regain control over the 1.1291 support, just above which the moving averages are now playing on the buyers' side. Its breakdown and bottom-up test, together with a clear change in the course of monetary policy in the United States, as the chairman of the central bank will tell us again today, will lead to the formation of a signal to open short positions with the prospect of a decline in the area of 1.1238. A more distant goal will be the support of 1.1188, where I recommend fixing the profits. If the euro rises and bears are inactive at 1.1340, it is better to wait for sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1380. It is possible to open short positions immediately for a rebound from the highs: 1.1420 and 1.1462 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for November 23 recorded an increase in both short and long positions. However, there are still more of the former, which led to an increase in the negative delta. Data on manufacturing activity in the eurozone countries provided significant support to the euro last week, but pressure on risky assets remained. A strong report on US GDP and the minutes of the Federal Reserve System from its last meeting supported the dollar, as many traders expect more active changes in monetary policy in December this year. However, all this can be prevented by a new strain of the Omicron coronavirus, the spread of which is actively observed in the eurozone and African countries. In the USA, this strain has not yet been registered, but it's only a matter of time. Euro buyers can only wait for hawkish statements from European politicians, which were actively voiced last week, which also supported the euro. The latest November COT report indicated that long non-profit positions rose from the level of 198,181 to the level of 204,214, while short non-profit positions also jumped from the level of 202,007 to the level of 220,666. At the end of the week, the total non-commercial net position increased to -16,452 against -3,826. The weekly closing price dropped to 1.1241 against 1.1367.

Signals of indicators:

Moving Averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by the bulls to continue the growth of the euro.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decline in the euro, the average border of the indicator around 1.12391 will act as support. If the euro rises, the upper limit of the indicator in the area of 1.1350 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.